Bitcoin: A Strong Resurgence as a Safe-Haven Asset

In a dramatic twist within the cryptocurrency landscape, Bitcoin (BTC/USD) is re-establishing itself as a robust macro hedge, showcasing a revitalized correlation with gold. As of April 25, this 30-day Pearson correlation reached an impressive 0.54, a stark contrast to its previous dip to -0.67 in February. This resurgence underscores a growing unity between Bitcoin and gold, two key assets sought after during turbulent economic times.

Back in February, Bitcoin faced a significant setback, plummeting by 17% from $102,000 to $84,000, while gold experienced a modest increase from $2,800 to $2,850. This stark divergence, though unusual, was fleeting. Recent data suggest that the two assets are finding their way back to one another amidst an environment rife with global uncertainty.

📈 Why This Matters

Understanding the dynamics between Bitcoin and gold is crucial for investors looking for alternative stores of value. With recent geopolitical tensions and economic challenges, many are shifting their portfolios towards assets that can withstand inflation. Bitcoin’s recovery not only highlights its potential as a safe haven but also reflects broader trends in the financial market. As traditional investments wobble, Bitcoin is proving it can hold its ground.

📊 Bitcoin’s Recent Performance: A Comparison

Since March, Bitcoin has bounced back with an impressive rally of over 10%, while gold has also seen a 5% increase—both indicators of renewed interest in alternative investments. Notably, the U.S. Dollar Index has dipped by 4%, suggesting a growing appeal for assets that resist inflationary pressures.

Historically, Bitcoin’s correlation with gold has fluctuated. Since 2020, there have been 18 instances when its correlation fell below -0.50. In 17 of those episodes, it quickly rebounded above the 0.5 mark within just one week. This historical trend gives weight to the current “recoupling” of these two assets.

🔥 Expert Opinions: Insights from Analysts

Macro analyst Ted (@TedPillows) recently emphasized Bitcoin’s accelerating performance in a tweet, stating, “$BTC is catching up really fast now. Since the bottom, BTC is nearly 25% and is outpacing both Gold and SPX.” His commentary suggests a significant liquidity rotation from gold to Bitcoin, indicating that institutional investors may now view Bitcoin as a more attractive venue for capital.

“When Gold pumps, BTC pumps even harder,” Ted asserted, highlighting a broader trend of capital migrating from traditional safe havens into higher-risk, higher-return assets as global economic conditions evolve.

🌍 The Macro Landscape: Trade Policies and Digital Gold

Recent macroeconomic developments, including President Trump’s new tariff announcements dubbed “Liberation Day,” have also played a role in driving Bitcoin’s upward trajectory. Following the announcement, Bitcoin surged more than 10%, while gold appreciated by 5%, and the U.S. Dollar Index experienced a notable decline.

This environment, marked by trade policy uncertainties and impending economic reports, is rekindling interest in scarcity-based assets like Bitcoin. The unique narrative around Bitcoin’s finite supply resonates strongly with investors looking to mitigate the risks associated with economic instability.

🚀 Technical Analysis: Bitcoin on the Brink of Breakout

From a technical standpoint, Bitcoin is currently consolidating just below $95,000, firmly above its rising trendline and the 50 EMA at $94,015. Recent support near $93,760 has been established twice, while resistance lies at $95,850. A confirmed breakout could pave the way toward targets of $97,500 and $98,800.

For traders, the following strategy is suggested:

- Entry Point: Look for action above $96,000 on high volume.

- Stop-loss: Set below $94,000.

- Upside Targets: Aim for $97,500 and $98,800.

The current MACD momentum remains neutral. However, a surge in bullish volume could trigger an aggressive upward move. The prevailing trend suggests that this may just be the beginning of Bitcoin’s impressive journey.

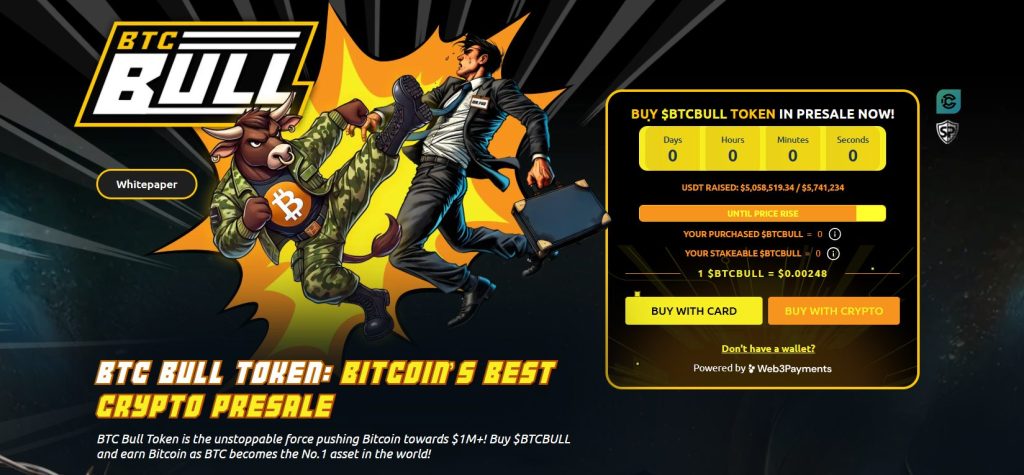

🌟 BTC Bull Token Shines: Surpassing $5 Million in Presale

Amidst Bitcoin’s renaissance, the interest in BTC Bull Token ($BTCBULL) is rapidly growing. Having raised over $5 million out of a $5.8 million target, this token offers a competitive entry point with a current price of $0.002485 as its presale approaches its next price hike.

What sets BTCBULL apart from typical meme coins is its focus on sustainable utility. Offering an estimated 80% annual yield through its staking program, investors can enjoy profitable returns while maintaining full liquidity—withdrawals without penalties are permitted at any time.

💎 The Road Ahead: BTCBULL’s Promise

As BTCBULL’s presale enters its final phase with only $742,500 left before the next milestone, early investors are taking their positions in anticipation of significant gains. With no lock-up periods, the high-yield, flexible structure appeals to both yield-seeking investors and those looking to leverage Bitcoin’s positive momentum.

💬 Conclusion: What Lies Ahead for Bitcoin and BTCBULL

The latest developments in Bitcoin’s market performance signal a promising future for both Bitcoin and the BTC Bull Token. As capital shifts towards assets viewed as inflation-resistant amidst global economic uncertainties, Bitcoin’s robust bond with gold could bolster its position as a leading alternative investment. With BTCBULL leading the charge with its unique offerings, the cryptocurrency landscape is looking vibrant and full of potential. What are your thoughts on Bitcoin’s resurgence? Join the discussion below!