Bitcoin has seen some turbulence recently, currently trading at approximately $111,580 after a 2.25% dip in the past 24 hours. However, this doesn’t seem to dampen the optimism brewing beneath the surface. Large investors are starting to accumulate again, hinting at a possible shift in momentum following weeks riddled with heavy liquidations. Market sentiment is beginning to stabilize, marking a critical point where institutional interest is reigniting.

In an exciting development, BitMine Immersion Technologies (NYSE: BMNR) has publicly updated its financial standing—revealing its total crypto and cash reserves have soared to an impressive $13.4 billion. This treasury includes a staggering 3.03 million ETH and 192 BTC. Under the leadership of Tom Lee from Fundstrat, BitMine is strategically positioning itself to expand its Ethereum holdings from the current 2.5% of the total supply to a formidable 5%. Analysts have started referring to this ambitious target as the “Alchemy of 5%.” Remarkably, BitMine now holds the title for the largest Ethereum treasury globally and stands as the second-largest corporate crypto holder, trailing only behind Strategy Inc. (MSTR), which boasts a hefty 640,031 BTC valued at around $73 billion.

🧵 BitMine provided its latest holdings update for Oct 13, 2025: $12.9 billion in total crypto + “moonshots”:– 3,032,188 ETH at $4,154 per ETH (Bloomberg)– 192 Bitcoin (BTC)– $135 million stake in Eightco Holdings (NASDAQ: ORBS) (“moonshots”) and – unencumbered…— Bitmine (NYSE-BMNR) $ETH (@BitMNR) October 13, 2025

This surge in accumulation follows a season of forced liquidations that cleared out excess leverage in the market, creating fertile ground for long-term investors. “Volatility causes deleveraging, often pushing assets below fair value and opening strategic entry points,” Lee noted, highlighting the challenge and opportunity intrinsic to trading in crypto.

As Bitcoin battles to establish a steady support level, it’s worth noting that it is forming a classic triple-bottom pattern around $109,600. This reversal signal indicates a potential waning in selling pressure. However, Bitcoin remains capped beneath the key resistance area between $114,500 and $116,000, which aligns closely with the 0.5 Fibonacci retracement level. A decisive close above this range could validate a bullish reversal, paving the way for a potential recovery.

In recent sessions, observing the price charts reveals a series of spinning tops and narrow-bodied candles, indicative of a period of consolidation before a possible upward movement. Should Bitcoin maintain its support above $109,600, we could be looking at a bounce back towards $114,600. A powerful breakthrough above $119,800 may significantly bolster bullish sentiments, and if it closes beyond $120,000, we could witness a solid confirmation of a reversal trend, unleashing a bullish trajectory aiming for targets between $125,000 and $130,000.

Amidst all this, the institutional landscape continues to tighten its grip on cryptocurrency markets. BitMine’s assertive accumulation underscores a resurging interest from institutions, further reinforced by heavyweights like Cathie Wood’s ARK Invest, Pantera Capital, and Galaxy Digital. Currently, BitMine ranks among the top 25 most traded U.S. stocks with an astounding average daily volume of $3.5 billion.

Tom Lee has dubbed Ethereum’s current rally as part of a “Supercycle,” fueled by the integration of artificial intelligence and a noticeable uptick in traditional finance’s participation in digital assets. This resurgence is ushering in renewed optimism as Bitcoin stabilizes above $111,000, with major holders returning to the fray.

If the triple-bottom structure proves robust, Bitcoin could very well lead the charge for the next bullish cycle, potentially rekindling the institutional confidence that was dimmed amidst recent market volatility.

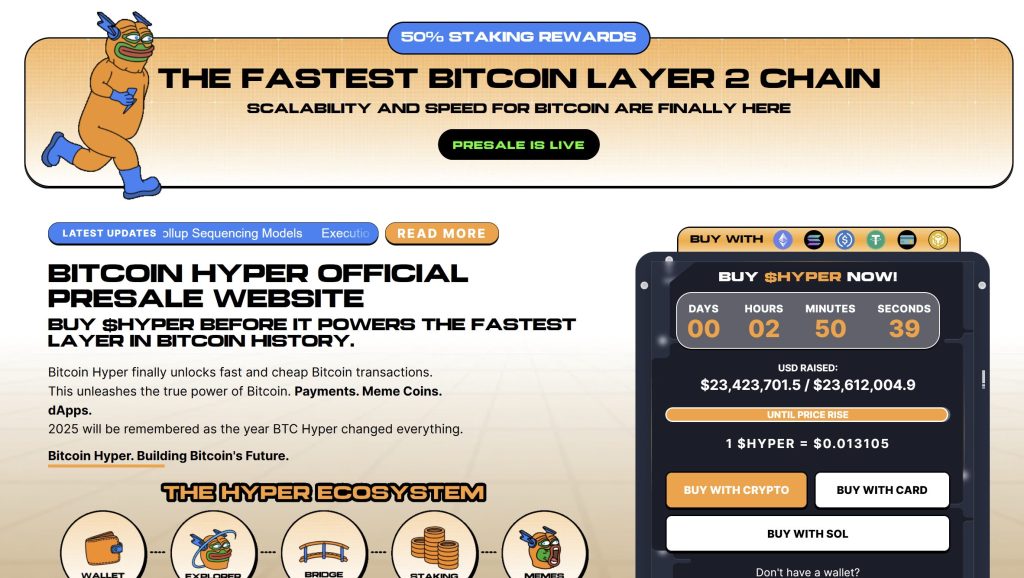

On a different note, let’s discuss an exciting innovation within the Bitcoin ecosystem: Bitcoin Hyper ($HYPER). While Bitcoin is often revered as the gold standard for security, Bitcoin Hyper seeks to introduce a fresh dynamic by integrating Solana’s lightning-speed capabilities. Designed as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), this project merges the stability of Bitcoin with the high-performance features of Solana, facilitating fast, low-cost smart contracts, decentralized applications, and even meme coin creation—all secured by Bitcoin’s robust network.

As interest in efficient BTC-based solutions rises along with Bitcoin activity, Bitcoin Hyper shines bright as a bridge intertwining the two significant ecosystems in cryptocurrency. If Bitcoin laid the groundwork, Bitcoin Hyper could transform it into a platform that’s not only secure but also swift, flexible, and exciting once again. Interested participants can join the presale that has already garnered over $23.4 million, with token prices currently set at a mere $0.013105 before the next price surge.

In a rapidly evolving market, staying informed and engaged is crucial. Whether you’re a seasoned investor or just stepping into the exciting world of crypto, now’s the time to delve deeper into these developments and consider how they might affect your investment strategy.