Bitcoin Rises Amid Market Turmoil: What You Need to Know

In a striking turn of events, Bitcoin’s dominance has surged following one of the most tumultuous days in the cryptocurrency world, marked by an astonishing $1 billion in leveraged liquidations. Currently stabilizing around $104,957—a minor dip of just 0.17% in the past 24 hours—Bitcoin is becoming a beacon of reliability as traders reassess their appetite for risk in a volatile market.

Recent data reveals that over 247,000 traders were liquidated within a single day, with significant repercussions, particularly on leading exchanges like Binance and Bybit. The most notable casualty? A mammoth $200 million Bitcoin long liquidation on Binance, the largest of its kind for the year. Together, these exchanges accounted for approximately $834 million in liquidated positions, reflecting a brutal day for those betting on Bitcoin’s upward momentum.

🚨UPDATE: Over $1 billion were liquidated in the last 24 hours, with $943.31M from long positions. pic.twitter.com/VllxE4f3KM— Cointelegraph (@Cointelegraph) June 13, 2025

Why This Matters: The Impact of Forced Liquidations

Understanding the dynamics of these forced liquidations is crucial. When traders overleverage their positions—particularly those fueled by bullish outlooks surrounding events like Circle’s IPO—they put themselves at risk of automatic margin calls. Should they fail to meet collateral requirements, exchanges are compelled to close these positions to safeguard the overall market. In periods of aggressive volatility, these cascading liquidations can snowball, rapidly driving prices down and leading to widespread capitulation.

Bitcoin Gains Traction as Altcoins Stumble

While altcoins have suffered significant losses, Bitcoin has found itself back in favor among investors seeking a safe haven. The current metrics illustrate a stark shift; Bitcoin’s share of the total cryptocurrency market cap, or “Bitcoin dominance,” has risen dramatically. This change implies that many traders are pivoting away from risk-laden assets, seeking the relative stability that Bitcoin offers.

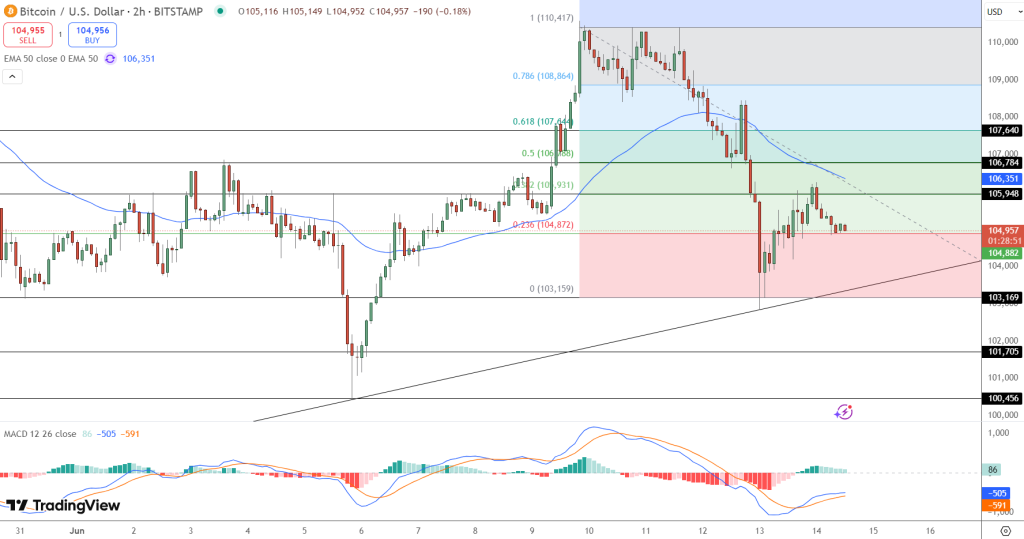

Current Bitcoin Price Chart – Source: Tradingview

Analyzing the Technical Landscape

From a technical perspective, Bitcoin finds itself hovering just above the 0.236 Fibonacci retracement level at $104,872. Encouragingly, it sits on an ascending trendline that has been supportive since early June. The MACD histogram suggests that bearish momentum may be dissipating, which could pave the way for a bullish reversal. If Bitcoin bulls can reclaim the 50-period EMA situated near $106,351 and break through the 0.5 Fibonacci level at $106,788, we could see a trajectory toward $108,864.

Short-Term Predictions: Can Bitcoin Reach $108K?

Despite the market’s turbulence, Bitcoin’s current chart structure reveals a constructively bullish sentiment. A rise above the $106,350 threshold would signal a potential breakout, validating a reversal and possibly propelling BTC toward price targets of $107,640 and $108,864.

- Entry Point: Above $106,350 with sufficient volume

- Stop Loss: Below $104,000

- Profit Targets: Initial target at $107,640; extended target at $108,864

With major altcoins facing significant pressure and overall risk sentiment remaining fragile, Bitcoin’s resilience could draw in sidelined investors. As long as it stays above $103,169, the broader uptrend appears to remain intact. In this environment, Bitcoin is more than just a cryptocurrency—it has become a defensive asset in the crypto landscape.

Spotlight on BTC Bull Token: A Rising Star

As Bitcoin hovers near the $105,000 mark, attention is shifting toward BTC Bull Token ($BTCBULL), which is nearing its fundraising cap of $8.2 million. The project has successfully raised $7,141,005.09, leaving less than $1 million until the next price increase. Presently priced at $0.00256, the token is poised for a bump once the fundraising goal is met.

BTC Bull Token is ingeniously tied to Bitcoin through two core mechanisms:

- BTC Airdrops: Holders receive rewards, with presale participants prioritized.

- Supply Burns: Activated automatically every time Bitcoin increases by $50,000, effectively diminishing the circulating supply of $BTCBULL.

Moreover, a 58% APY staking pool with over 1.81 billion tokens offers attractive opportunities for both seasoned DeFi enthusiasts and newcomers looking for passive income.

BTC Bull Token Staking Overview

Conclusion: What Lies Ahead for Bitcoin and Beyond

As the cryptocurrency landscape continues to evolve, Bitcoin stands strong, serving as a refuge for traders amidst market chaos. With pending price movements and innovative projects like BTC Bull Token on the rise, the future remains dynamic and promising. What do you think? Will Bitcoin maintain its dominance, or will altcoins regain their footing? Share your thoughts and insights in the comments below!