In the dynamic world of cryptocurrency, Bitcoin is once again at a crossroads. Fresh off a peak of $123,200 reached just a week ago, the pioneer cryptocurrency is currently caught in a sideways trading pattern. While this plateau has slightly impacted Bitcoin’s dominance in the market, sharp interventions from smart money and institutional investors have strategically nudged BTC back above the critical $119,000 resistance level. This intriguing market development has sparked speculation among analysts about the potential for a new all-time high in the near future. In fact, many insiders argue that this current dip might represent the last opportunity for savvy investors to secure their Bitcoin holdings before prices soar towards $150,000.

🚀 Experts tell Cryptonews that Bitcoin still has plenty of room to run — but not everyone’s convinced #BTC #ATH https://t.co/IcWwb580o3— Cryptonews.com (@cryptonews) July 11, 2025

As we dive deeper into the mechanics driving Bitcoin’s recent movements, it’s essential to highlight the complex interplay between retail and institutional investors. According to data from CryptoQuant, retail accumulation has taken a noticeable downturn, yet a distinct accumulation pattern has surfaced led by larger investors, including institutional players and investment funds. These entities, notably ETFs, have begun to ramp up their Bitcoin purchases aggressively, positioning themselves for potential gains as market conditions evolve.

The Source of the Bitcoin Rally is not Retail “While retail investors are selling, institutional and large investors continue to accumulate.” – By @burak_kesmeci pic.twitter.com/SeFTl26p0Z— CryptoQuant.com (@cryptoquant_com) July 24, 2025

Fadi Aboualfa, Copper’s head of research, reflects this sentiment, emphasizing that the recent resurgence of BTC can largely be attributed to institutional inflows. He states, “Leverage-driven retail mania is fading into history,” indicating a significant shift in market dynamics. Aboualfa is convinced that Bitcoin is set for another ascendant move, targeting a price range between $140,000 and $200,000 in the months to come. However, a note of caution comes from the on-chain analytics firm Glassnode, which warns of an impending “froth” across the Bitcoin and broader cryptocurrency markets. Elevated open interest in derivatives could pose a risk, potentially undermining Bitcoin’s upward momentum.

As of July 24, Bitcoin is trading around $119,100, reflecting the cooling off from its previous all-time high of $123,218. This price action suggests a consolidation phase, with the cryptocurrency hovering just beneath the $120,000 resistance zone. A bearish divergence appears on the Relative Strength Index (RSI), hinting at weakening bullish momentum and raising the likelihood of a short-term pullback.

One area of particular interest is the unfilled liquidity gap near $116,000, a fair value zone that could act as a magnet for price movements before any significant upward trajectory. If this support level falters, we could see BTC slide to the $112,000–$108,000 range, although this scenario seems improbable without a drastic shift in market sentiment. On the other hand, a decisive breakout above the $120,000 mark would invalidate bearish forecasts and may lead Bitcoin to revisit $123,000, setting the stage for new highs in the $130K–$150K range.

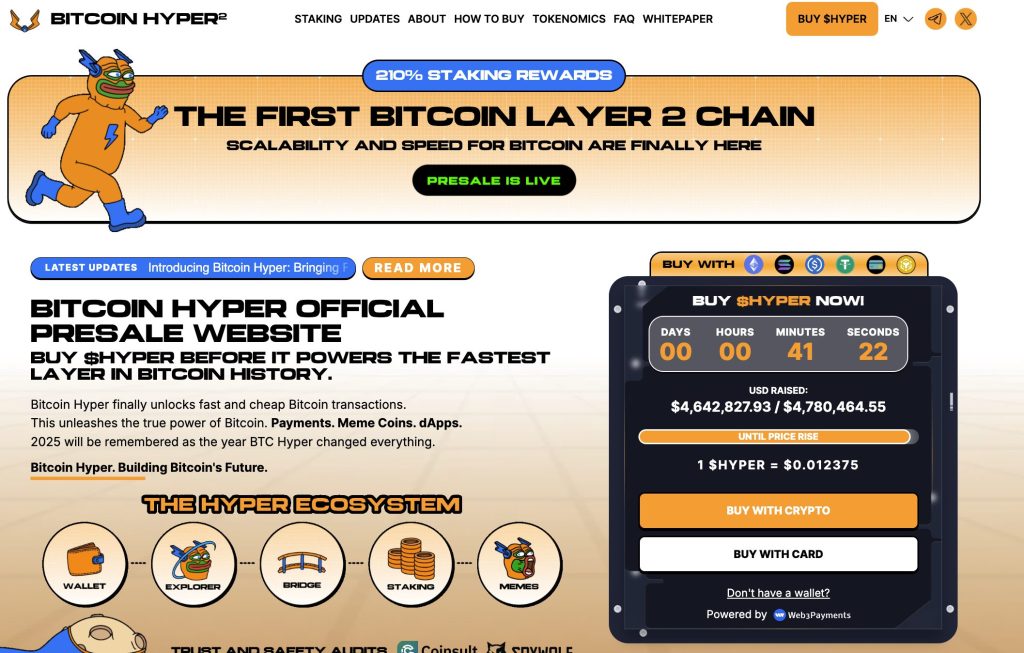

While Bitcoin prepares for potentially explosive growth, many investors are seeking opportunities in smaller, quicker-moving altcoins. One such emerging project generating buzz in the crypto community is Bitcoin Hyper ($HYPER). This innovative Layer 2 solution aims to enhance Bitcoin’s capabilities, enabling faster transactions and cheaper fees while permitting smart contracts. Impressively, it has already attracted over $4.5 million in early funding, signifying strong interest from early adoption investors.

For newcomers and seasoned investors alike, Bitcoin Hyper presents an exciting opportunity to participate in the next wave of Bitcoin innovation without sacrificing its foundational strengths. If you’re intrigued by the potential of $HYPER, you can participate in its presale by visiting the official Bitcoin Hyper website. It’s a chance to be part of an initiative that aims to supercharge Bitcoin’s impressive legacy.

As the cryptocurrency landscape continues to evolve, positioning oneself strategically in this market becomes increasingly crucial. Are you ready to seize these opportunities, or will you sit back and watch as bold investors capitalize on this thrilling phase in the crypto revolution?