Bitcoin Holds Steady Amid Economic Uncertainties

In the early hours of the Asian trading session, Bitcoin is maintaining its position around $104,800, exhibiting a promising gain of nearly 2.50% in the past 24 hours. This uptick comes even as surprising U.S. job data has cast a shadow over expectations for imminent interest rate cuts. With the U.S. economy adding 139,000 jobs in May—surpassing the anticipated 125,000—it’s evident that the economic landscape is proving more resilient than many had predicted. This robust job growth significantly lessens the Federal Reserve’s incentive to alter its current monetary policy.

Yet, former President Donald Trump has made headlines once again by advocating for a dramatic 1% rate cut, suggesting that such a measure could serve as the “rocket fuel” needed for the economy’s further expansion. While his calls grow louder, it appears that the Fed is unlikely to take action before September, leaving the market in a waiting game.

🚨 BREAKING: Trump Demands Immediate 1% Rate Cut from Fed”Despite the obstruction by Powell, our country is doing great. Just cut the rate by one percentage point — rocket fuel!”The crypto market isn’t pricing in a rate cut — But if it comes this month, BTC could explode past… pic.twitter.com/8xY6SpKxZC— Crypto Decode (@TheCryptoDecode) June 6, 2025

Altcoins React with Mixed Signals

In the altcoin arena, the market presents a varied picture. Ethereum has seen a decline of 5.5%, while Dogecoin is down by 6.4%, illustrating a period of uncertainty for these alternative cryptocurrencies. In contrast, XRP and Solana have only experienced modest decreases, hinting at selective resilience in the altcoin market.

Traders are also voicing caution regarding Bitcoin’s current trajectory. There’s talk of a potential “liquidity trap,” as many long positions cluster between $99,000 and $102,000. Should buying momentum fail to materialize, a sharp pullback could ensue, catching investors off guard.

📈 Strong jobs report lifts markets, but Trump-Musk drama still simmers…—The economy added 139K jobs in May, beating forecasts.—Bitcoin popped above $105K before retreating slightly.—Trump vs. Musk beef rocked Tesla yesterday (14% decline), but the stock is now up 5%. Will…— Bitcoin.com News (@BTCTN) June 6, 2025

Strategic Moves by Metaplanet: A Bold Bitcoin Acquisition Plan

On a strategic front, Japan’s Metaplanet, recognized as the “Bitcoin strategy arm” of the nation, is ramping up its ambitions significantly. The company announced a revised goal to amass 100,000 BTC by the end of 2026, soaring from its earlier target of 21,000 BTC. To facilitate this ambitious expansion, the firm plans to issue as many as 555 million new shares, aiming to raise a staggering $5.4 billion.

JAPANESE MICROSTRATEGY RAISING $5.4 BILLION TO BUY $BTCMetaplanet have stated they want to own 210,000 Bitcoin by 2027. That’s 1% of Bitcoin’s maximum supply.They currently hold 8,888 BTC ($932M) pic.twitter.com/pb43vGOvkb— Arkham (@arkham) June 6, 2025

CEO Simon Gerovich asserts that the growing uncertainties in global markets are directing investors away from bonds and toward traditionally inflation-resistant assets like gold and Bitcoin. Their ultimate goal? To capture 210,000 BTC by 2027, which would symbolize a full 1% of Bitcoin’s entire supply. Such a long-term strategy could lead to tighter supply dynamics and potentially trigger significant institutional interest, further pushing Bitcoin prices higher.

Market Momentum: Bitcoin’s Chart Signals Potential Breakout

Recent price activity indicates that Bitcoin is on the cusp of a breakout. After bouncing back from its dip at $100,519, Bitcoin has established higher lows and is now closing in on a crucial descending trendline. Currently positioned above the 50-period EMA on the 2-hour chart, the MACD indicator is showing a bullish crossover, signaling that positive momentum may be building.

Bitcoin Price Chart – Source: Tradingview

Bitcoin Price Chart – Source: Tradingview

A significant resistance level is identified between $105,000 and $106,300, where horizontal resistance aligns with the trendline. Surpassing this range may unlock the potential for a bullish price prediction, aiming for new targets at $107,600.

Moreover, Michael Saylor, founder of MicroStrategy, is back in the spotlight as his firm pushes forward with a $1 billion stock offering to expand its Bitcoin acquisitions. Given BTC’s current price near $104K, this new capital injection could allow MicroStrategy to amass an additional nearly 9,600 BTC, boosting confidence in Bitcoin’s upward trajectory.

Entering the Market: Strategic Trade Ideas

Traders should be considering the following strategic ideas:

- Entry Point: Above $105,200

- Target Price: Between $106,750 and $107,600

- Stop-Loss: At $103,900

- Confirmation: Look for bullish engulfing candles or a breakout of the trendline

Should Bitcoin break through these barriers, it could signal the beginning of another upward leg, driven not just by speculative fervor but also by significant institutional investments and strategic purchases.

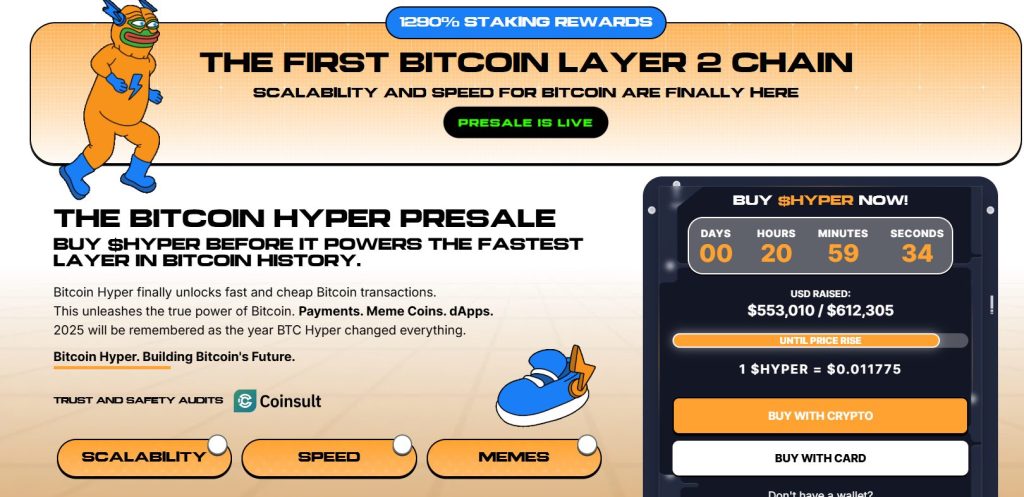

Bitcoin Hyper: A New Layer 2 Solution Taking the Market by Storm

In other developments, Bitcoin Hyper ($HYPER) is making waves as the first Bitcoin-native Layer 2 solution. This innovative platform aims to address Bitcoin’s key challenges, such as slow transaction times and high fees, by leveraging the speed and scalability of the Solana Virtual Machine (SVM) to create an efficient ecosystem for smart contracts.

What Sets Bitcoin Hyper Apart?

- First Bitcoin-native Layer 2 solution

- Utilizes Solana’s speed alongside Bitcoin’s security

- Seamless BTC transfers through the Canonical Bridge

- Low-cost gas fees for efficient transactions

Bitcoin Hyper also offers staking rewards, allowing users to earn high APY rates post-launch, while using the token for gas fees and accessing decentralized applications (dApps). With over $552,000 already raised in its presale, early investors are capitalizing on this innovation that mixes technical enhancements with meme culture to create significant potential.

Presale Now Live: A Call to Action for Investors

Don’t miss the opportunity to get in on the ground floor of the Bitcoin Hyper presale. Each $HYPER token is available for just $0.011775, with over 90% of the funding goal already met. This is a crucial moment for early adopters, as prices are expected to rise once the next tier launches. Whether you prefer crypto or card payment, the Web3Payments integration provides an easy, user-friendly path to participate in this exciting venture.

As the cryptocurrency landscape evolves, these movements may shape the future of Bitcoin. What do you think? Will we see a breakout soon, or are we in for more volatility? Share your thoughts and predictions below!