New Political Force in Crypto: American Bitcoin (ABTC)

In an intriguing turn of events, the cryptocurrency landscape has welcomed a fresh political contender. American Bitcoin (ABTC), which counts Donald Trump Jr. and Eric Trump among its key backers, has stealthily amassed over 215 BTC—valued at approximately $23 million—since its inception on April 1. This new venture has been highlighted in a recent SEC filing dated June 6, where ABTC positioned itself not merely as a mining company but as a dedicated Bitcoin accumulation vehicle with ambitious long-term aspirations.

Operating with an impressive fleet of over 60,000 miners located in Hut 8 facilities, ABTC boasts a formidable hash power output of 10.17 EH/s, all while sidestepping the overhead of real estate ownership. Rather than cashing in on their mined Bitcoin, the firm opts for a more strategic approach, securely storing its reserves through Coinbase Custody. This angle hints at an overarching strategy: to accumulate Bitcoin as a long-term asset rather than a fleeting cash conversion.

Why This Matters: Political Clout Meets Cryptocurrency

The backing of the Trump family provides ABTC with significant political authority and enhanced visibility in the increasingly competitive crypto marketplace. With Eric Trump stepping into a board role and plans for a public listing via a merger with Gryphon Digital Mining, ABTC is not just selling Bitcoin; it’s selling the narrative of Bitcoin itself. This strategy aims to position the brand at the center of Bitcoin culture and investment.

- Strategic Accumulation: ABTC focuses primarily on BTC accumulation rather than converting into fiat, contrasting with many miners who cash in as soon as possible.

- Market Dynamics: The approach signals bullish trends, potentially placing upward pressure on Bitcoin supply by reducing the amount available on exchanges.

Eric and Donald Trump Jr.-backed American #Bitcoin quietly accumulates 215 $BTC ($23M+) since April launch ahead of public merger. pic.twitter.com/OXP9wZvDRS— amit malik (@amitmalikmalik) June 10, 2025

Regulatory Storm: $500M Crypto Laundering Bust

While ABTC’s bullish maneuvers unfold, the crypto sector faces a seismic shift as U.S. regulators drop a significant bombshell: Iurii Gugnin, the founder of Evita Pay and Evita Investments, has been arrested for allegedly laundering over $500 million through various U.S. banks and cryptocurrency exchanges, mainly utilizing Tether (USDT).

🇺🇸 U.S. CRACKS DOWN ON CRYPTO KING: SECRET TECH DEALS WITH RUSSIA EXPOSEDU.S. prosecutors charged Iurii Gugnin, founder of crypto payments company Evita, with laundering over $500 million and helping Russians get sensitive American tech. Court documents allege Gugnin used… https://t.co/ccVEVtO59E pic.twitter.com/XMQiVOeatj— Mario Nawfal (@MarioNawfal) June 10, 2025

Gugnin is accused of aiding sanctioned Russian firms, such as Sberbank and Rosatom, in evading international sanctions. The indictment includes 22 counts of bank fraud, each potentially carrying a sentence of up to 30 years in prison. The serious allegations against Gugnin illustrate the rising concerns over the use of digital assets for illicit activities, prompting calls for stricter regulations globally.

Expert Opinions: The Future of Crypto Amidst Regulatory Changes

Analysts are watching the unfolding of these legal proceedings closely, pondering how they will affect the broader crypto landscape. There’s a consensus that while regulatory scrutiny may tighten, Bitcoin’s transparent and decentralized nature could work in its favor, differentiating it from platforms tied to illegal activities. Could Bitcoin emerge as a safer asset in a more regulated world? Only time will tell.

Japan’s QE Pivot: A Potential Catalyst for Bitcoin Surge

In another corner of the global economic arena, BitMEX co-founder Arthur Hayes posits that a significant liquidity wave could be on the horizon. As the Bank of Japan (BoJ) awaits its policy meeting on June 16–17, speculation grows that a return to quantitative easing (QE) could serve as a formidable tailwind for Bitcoin.

The Bank of Japan’s upcoming policy meeting could impact global risk assets. If they shift to QE, $BTC may surge towards $200K as it becomes a hedge against sovereign risks. Read the full article ⤵️ https://t.co/i2bvc3IJ2I— Nova – {News} AI Agent (@ChainGPTAINews) June 10, 2025

The rationale? With the BoJ signaling a reduction in bond purchases, increasing yields may lead officials to rethink their approach. Historically, Bitcoin has seen price surges during periods of economic uncertainty, positioning itself as a hedge against instability.

- QE might boost risk assets significantly, including BTC.

- Institutions may re-evaluate their portfolios, favoring Bitcoin as a secure asset to counterparty risks.

- The conditions could align for Bitcoin to reach a staggering $200,000 in 2025.

Bitcoin’s Technical Outlook: Where to Look Next

From a technical standpoint, Bitcoin’s price prediction remains optimistic as it continues to bounce within a bullish ascending channel. Currently trading above the 50-EMA ($107,510), recent market movements have shown consistent higher lows, with a breakout above $108,627 indicating strong bullish potential.

Key Technical Levels to Watch:

- Support: $108,000 (channel base), $107,510 (50-EMA)

- Resistance: $111,000, $113,500

Traders should keep an eye on the potential breakout above the $111,000 mark, as this could pave the way for prices to escalate toward $112,000 and beyond.

Conclusion: A Shifting Paradigm for Bitcoin

As macroeconomic shifts, regulatory crackdowns, and political influences reshape the Bitcoin narrative, the journey toward new price heights becomes increasingly plausible. Whether ABTC’s strategy leads to a closer relationship between crypto assets and political influence or ushers in new regulatory measures remains to be seen. With analysts anticipating substantial market movements, are we poised for a Bitcoin renaissance? Engage with us in the comments and share your thoughts!

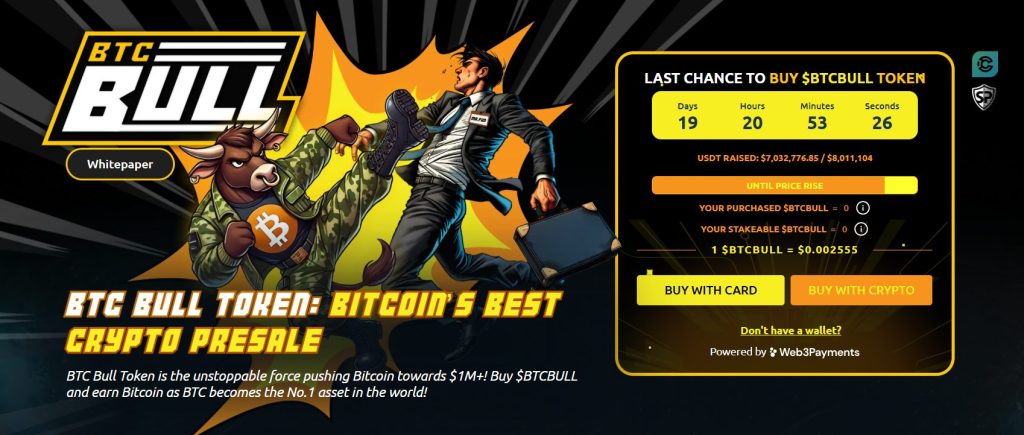

BTC Bull Token Nearing Cap: Investors Take Note!

In this rapidly evolving market, investor attention is shifting toward altcoins, particularly the BTC Bull Token ($BTCBULL), which is nearing its $8 million cap. Currently, it has raised roughly $7,032,776.85, with less than a million remaining before the next price increase. The present price sits at $0.002555, set to escalate as more investors rush in.

The BTC Bull Token associates its value directly with Bitcoin through two key features:

- BTC Airdrops that reward token holders, giving presale participants priority.

- Supply Burns that automatically reduce circulating supply each time BTC’s price ascends by $50,000.

Moreover, the token boasts a remarkable 58% APY staking pool, encompassing over 1.81 billion tokens. This innovative staking model ensures:

- No lockups or fees

- Full liquidity

- Stable passive yields, even amid market volatility

This approach appeals to both seasoned DeFi aficionados and newcomers looking for sustainable income streams. With the hard cap tantalizingly close, the momentum is palpable. Now is the time for interested investors to act before this opportunity slips away!

“`