As Bitcoin (BTC/USD) inches closer to the $114,770 mark—up 0.66% as of Tuesday—there’s a palpable buzz in the air. Institutional investors are re-entering the arena, igniting renewed enthusiasm for the world’s largest cryptocurrency. After facing a notable selloff last week, Bitcoin is making a comeback, primarily driven by increased corporate purchases and a thaw in geopolitical tensions between the U.S. and China.

One significant player in this resurgence is Strategy, currently the largest corporate Bitcoin holder on the planet. Just before prices dipped to $110,000, Strategy discreetly acquired 220 BTC for a substantial $27 million. This move nudged their total holdings to an impressive 640,250 BTC, valued at approximately $73 billion. This purchase was funded through preferred share sales, bringing their average acquisition price to around $74,000. Market analysts view this as a major show of confidence, with one strategist noting, “Large holders like Strategy don’t flinch during market swings; they act as a stabilizing force for Bitcoin over the long haul.”

Such steady positioning by institutional giants not only signals resilience but also maintains the broader market’s structural integrity. This sets the stage for potential rallies in the weeks ahead.

In a powerful reinforcing statement, Larry Fink, CEO of BlackRock, recently drew a parallel between Bitcoin and gold during a CBS interview—a significant shift from his earlier skepticism. “Crypto has a role, just like gold does,” he asserted, further cementing Bitcoin’s status as a viable asset in turbulent times. BlackRock’s iShares Bitcoin Trust currently manages about $94 billion, with an astonishing half of its investors being new to the crypto market. This blend of institutional and retail interest is helping Bitcoin solidify its identity as “digital gold,” especially amidst rising inflation concerns. Fink’s backing has sparked a revival of investor confidence, driving retail interest to new heights.

JUST IN: $12 trillion BlackRock CEO Larry Fink says, “There is a role for crypto the same way there is a role for gold.” “This is not a bad asset.” @BitcoinMagazine pic.twitter.com/PeTORJ3PHB

Meanwhile, in a surprising turn of events, former President Donald Trump has emerged as one of Bitcoin’s largest individual stakeholders. His company, Trump Media, made headlines by acquiring $2 billion in Bitcoin earlier this year, giving Trump an indirect stake of around $870 million due to his 41% ownership. This bold move appears to mimic the strategy of MicroStrategy’s Michael Saylor, effectively transforming Trump Media into a Bitcoin-centric company. In the wake of this acquisition, Bitcoin’s price has increased by almost 6%, reflecting the growing optimism surrounding the confluence of political influence and cryptocurrency adoption. Analysts are now interpreting the combined weight of Wall Street, corporate America, and political endorsements as one of the strongest indicators of Bitcoin’s legitimization in the mainstream financial landscape.

JUST IN: 🇺🇸 Forbes says President Donald Trump “is now one of the largest #bitcoin investors on the planet,” owning an estimated $870 million in BTC 👀 @BitcoinMagazine pic.twitter.com/uvCtkvDdv4

Shifting gears to technical analysis, Bitcoin is currently experiencing a period of consolidation between the $112,700 and $117,600 range. A breakout above the crucial $116,100 mark—aligned with the 50% Fibonacci retracement—could trigger renewed bullish momentum, targeting price levels between $119,800 and $122,500. The Relative Strength Index (RSI) is positioned at 56, indicating an uptick in buying strength, while lower candle wicks suggest consistent accumulation during dips. Should resistance remain intact, BTC might test the $111,200 mark, where robust support coincides with the 23.6% Fibonacci retracement.

The ongoing wave of institutional inflows, coupled with improving sentiment and easing macroeconomic tensions, suggests the path towards the coveted $122,000 might only just be beginning. Meanwhile, as Bitcoin continues its evolution, impactful developments like the Bitcoin Hyper project are making headlines.

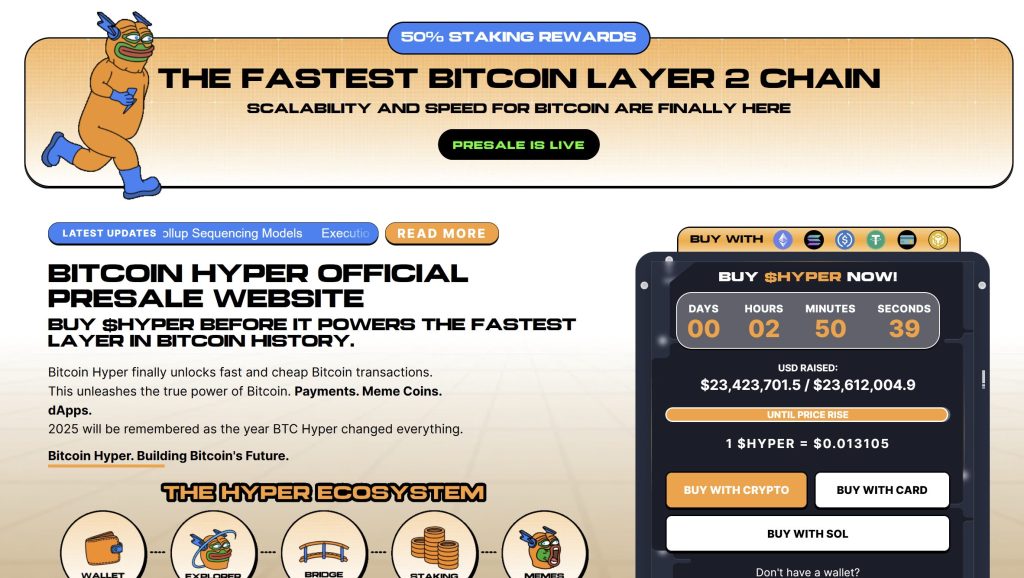

Bitcoin Hyper ($HYPER) is poised to introduce fresh dynamics to the Bitcoin ecosystem, addressing the slow transaction speeds often associated with the original blockchain. This innovative project, the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), aims to combine Bitcoin’s unparalleled security with the high-speed framework of Solana. The result? Lightning-fast smart contracts, decentralized applications, and even meme coin creations—all underpinned by Bitcoin’s proven reliability. With its presale crossing an impressive $23.4 million and tokens starting at just $0.013105, Bitcoin Hyper is crafting a bridge between two powerhouse blockchain ecosystems.

As Bitcoin activity ramps up and the appetite for efficient BTC-based applications grows, Bitcoin Hyper represents a promising evolution that could revitalize engagement within the community. If Bitcoin laid the groundwork, Bitcoin Hyper could elevate the experience, making it not just fast but also fun.

For those eager to get involved, don’t miss your chance to participate in the presale. The future of Bitcoin and its ecosystem seems not just bright but full of limitless possibilities.