Bitcoin’s Current Stance: A Subtle Shift in the Market

The world of Bitcoin (BTC/USD) is abuzz as the cryptocurrency hovers at an impressive $104,322, reflecting a modest increase of 0.14% over the past 24 hours. However, savvy traders are more focused on an upcoming regulatory shift that could significantly influence their trading strategies. Buckle up, because starting January 1, 2026, the IRS is mandating rigorous wallet-by-wallet cost basis tracking for all crypto assets, including Bitcoin. This is not just a minor adjustment; it promises to reshape how assets are traded within the U.S. market.

Starting in January 2026, the IRS will require platforms like @coinbase and @krakenfx to issue 1099-DA forms for all digital asset disposals. These new tax forms will report: → Type of asset → Date of sale → Proceeds from the transaction But there’s a catch: For assets… pic.twitter.com/Tjhid56MrQ— CoinTracker (@CoinTracker) May 27, 2025

Previously, traders relied on a pooled basis for tax reporting, simplifying the process. Now, with the introduction of IRS Form 1099-DA, the need for meticulous recordkeeping for each individual wallet will be mandatory, echoing the complexities found in traditional stock trading. While this push for transparency could enhance clarity in transactions, it also raises concerns about increased compliance costs and potential slowdowns in trading activity, particularly for retail and institutional investors managing multiple wallets.

📌 Why This Matters

The impact of these regulatory changes extends far beyond compliance. As traders adapt to this new landscape, we may witness a transformation in trading strategies, with a shift towards more cautious plays and heightened risk management. Investors need to prepare for a future where the costs of compliance could eat into profits, fundamentally altering the trading ecosystem.

Texas: Setting the Pace for Bitcoin Reserves

In the midst of these national changes, Texas is making headlines for taking a bold step in cryptocurrency legislation. The Texas Senate has overwhelmingly passed SB21, the Strategic Bitcoin Reserve (SBR) bill, marking a significant moment in the state’s approach to digital assets. This pivotal legislation is poised to land on Governor Greg Abbott’s desk shortly, and if signed, Texas will join New Hampshire and Arizona as a state with dedicated Bitcoin reserve laws.

🇺🇸 TEXAS Bitcoin Reserve Update: The Senate has voted to adopt the Conference Committee report (24-7) on Bitcoin Reserve bill SB 21. Both chambers have now adopted the report, meaning the bill can (finally) go to the Governor’s desk for signing. Texas SBR incoming. https://t.co/0LlkqNHntC pic.twitter.com/MNOTWCMC6D— Bitcoin Laws (@Bitcoin_Laws) May 31, 2025

Under the SB21 bill, the Texas Comptroller will have the authority to establish a Bitcoin reserve utilizing state funds, all under the guidance of a specialized advisory committee. The legislation includes crucial amendments, including a $500 billion market cap threshold for eligible assets and an exclusion of staking options. This proactive stance cements Texas’s position as a leading hub for Bitcoin mining, boasting the highest hash rate in the country.

🔥 Expert Opinions

Leading analysts are watching these developments closely. “The IRS regulation changes and Texas’s acceptance of Bitcoin reserves are directly linked,” notes a cryptocurrency market expert. “As compliance costs rise, regions that embrace Bitcoin with favorable regulations will likely attract more investors. Texas is ahead of the curve, and that could spark a wave of similar legislation across the U.S.”

🚀 Future Outlook: What Lies Ahead?

Looking ahead, the implications of these regulatory moves will shape the cryptocurrency market for years. Bitcoin’s price is currently in a narrow band between $105,000 and $103,500, showing clear signs of indecision within traders as they assess the landscape. Should the IRS rules and Texas’s groundwork inspire other states to follow suit, we could see a more favorable environment for Bitcoin, potentially buoying prices long-term.

Bitcoin Price Analysis: Key Levels to Watch

In today’s analysis, Bitcoin is caught in a tug-of-war, currently evaluating a resistance level approached by the falling trendline on a 4-hour chart. Currently, the 50-period EMA sits at $106,331, acting as a formidable barrier against upward momentum.

As market indicators show mixed signals—a Doji candle formation at $104,894 suggests hesitation, while patterns of lower highs hint at a possible continuation of the downtrend—traders must stay vigilant. The MACD is bearish, with a widening gap indicating downward momentum. Here are the essential levels to keep in mind:

- Support: $103,501, $102,141

- Resistance: $106,331, $107,914

A reversal at the support level of $103,501 could potentially signal a turnaround, ushering Bitcoin back toward $106,331 or beyond. Until that happens, traders are advised to approach the market cautiously, keeping an eye out for definitive breakout or reversal indicators.

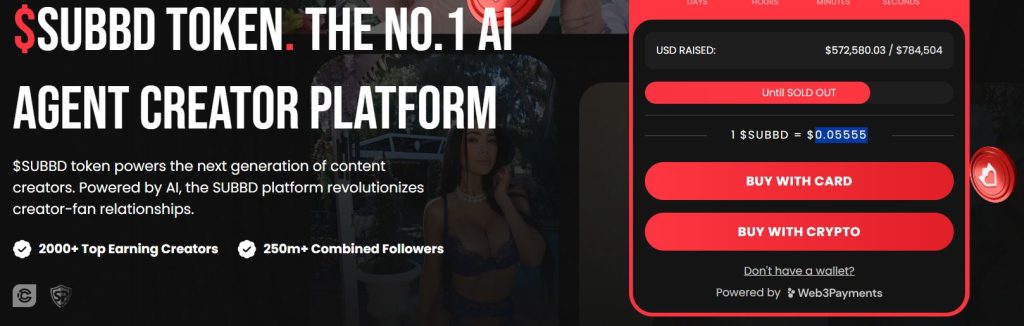

🌟 SUBBD Presale: The Future of Content Creation

Shifting gears to a different narrative, SUBBD is redefining the landscape of content creation with an innovative Web3 platform. This initiative is rapidly gaining traction, with over 2,000 creators and a collective audience of 250 million joining the movement. At its core, SUBBD aims to eliminate intermediaries, fostering a direct connection between creators and fans.

Leveraging AI-driven tools, token-gated rewards, and an interactive ecosystem, fans obtain access to exclusive drops and creators can monetize without barriers. Currently, the presale has amassed an impressive $572,580 towards its target of $784,504, with $SUBBD tokens available at just $0.05555 each.

Stake your tokens to unlock rewards such as XP boosts, premium content access, exclusive raffles, and more. Fans earn credits that can be redeemed for various perks, while token holders have a say in governance decisions. The momentum is palpable, and with limited allocations remaining, now is the time to connect your wallet and join the future of decentralized content creation.

Conclusion: A New Era for Crypto Trading

The landscape of cryptocurrency trading is on the cusp of transformation. As traders prepare to adapt to stringent IRS regulations and Texas’s innovative Bitcoin reserve legislation, we are witnessing a pivotal moment that could influence not just trading strategies, but the very fabric of the cryptocurrency market itself. What are your thoughts on these regulatory changes? How do you see them affecting your trading strategies? Join the conversation and share your insights!