Bitcoin Stands Strong Above $107,000 Amid Mixed Macro Signals

As the cryptocurrency market faces a whirlwind of macroeconomic indicators, Bitcoin has managed to maintain its footing, trading above the $107,000 mark. Traders are carefully evaluating the latest data from the U.S., particularly the core Personal Consumption Expenditures (PCE) index, which the Federal Reserve uses as a critical measure for inflation. The recent report showed a 2.7% year-over-year rise in core PCE for May, slightly exceeding the anticipated 2.6%. On a month-over-month basis, core PCE increased by 0.2%, while the overall PCE saw a mere 0.1% bump. This persistent inflation signals to the Fed that they need to proceed cautiously with potential rate cuts.

Federal Reserve Chairman Jerome Powell has urged patience in upcoming policy decisions, especially considering inflationary pressures that may be exacerbated by potential tariffs from previous administrations. Despite mounting concerns in traditional markets, Bitcoin shows impressive resilience, trading firmly above $106,000 while other high-risk assets exhibit signs of stress. Interestingly, the lack of significant selling pressure following inflation reports indicates that traders are currently in a “wait-and-see” mode, perhaps anticipating more macro developments or a definitive technical breakout.

Institutional Confidence: Metaplanet’s Bold Bet on Bitcoin

In a show of unwavering confidence in Bitcoin, Japanese firm Metaplanet is ramping up its commitment by raising $300 million through zero-coupon bonds. This substantial capital infusion is aimed at accelerating their Bitcoin-centric acquisition strategy, reinforcing a visionary approach led by CEO Simon Gerovich. Recent disclosures reveal that Metaplanet has purchased 1,111 BTC during a recent market dip, bringing its total Bitcoin assets to 21,000 BTC by 2026 and a staggering 210,000 BTC by 2027—a bold ambition that mirrors yet extends beyond MicroStrategy’s model. What sets Metaplanet apart is its exclusive focus on Bitcoin as its treasury asset, indicating a potential shift in corporate investment strategies.

Such a unique single-asset approach could signal the dawn of a new wave of corporate adoption of Bitcoin, particularly within Japan and the global marketplace. Could this inspire more companies to follow suit in betting heavily on digital assets?

Bitcoin’s Technical Outlook: Is a Breakout on the Horizon?

Technically speaking, Bitcoin (BTC/USD) has been flirting with a breakout after a week-long period of consolidation. Currently priced at around $108,215, Bitcoin is challenging the upper range of its current trading pattern, which spans from $106,450 to $108,980. A recent bullish engulfing candle indicates underlying strength, while Bitcoin’s price holding above the 50-day Exponential Moving Average (EMA) adds to the optimism among traders. Analysts note that a breakout above $108,980 could trigger a surge towards targets of $110,448 and $111,944.

BTC/USD is nearing a breakout after a week-long range. Price is testing the $108,980 ceiling with a bullish engulfing candle and support from the 50-EMA. 🟢 Entry: Long above $109,000 🎯 Targets: $110,448 / $111,944 ❌ Stop: Below $106,450 Still range-bound pic.twitter.com/rX5K1QHqbc— Arslan Ali (@forex_arslan) June 29, 2025

Traders are keenly aware of the possibility of rejection at resistance, which could lead to a strategic re-entry around the $106,450 mark, should buyers hold the mid-range. For now, the overall Bitcoin price prediction remains neutral in the short term; however, a bullish structure appears intact.

Bitcoin Hyper: A New Layer in the Crypto Landscape

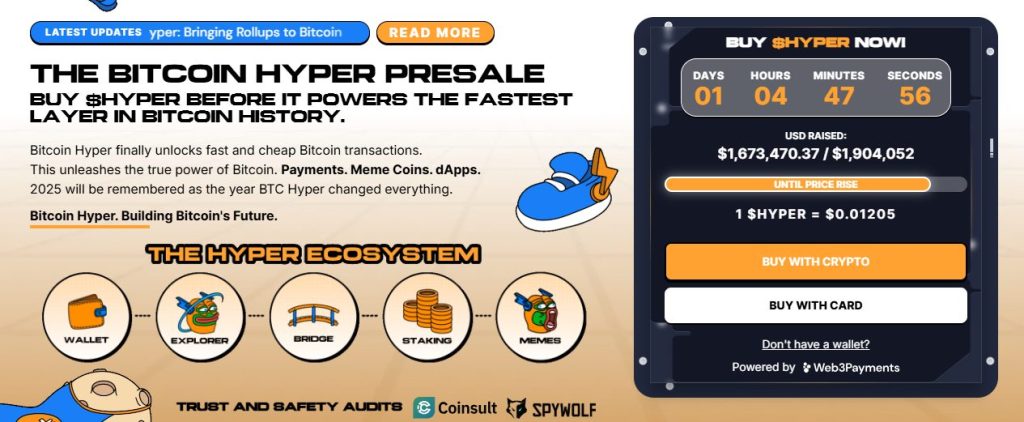

On another front, Bitcoin Hyper ($HYPER), an innovative Bitcoin-native Layer 2 solution powered by the Solana Virtual Machine (SVM), is generating buzz by surpassing $1.74 million in its public presale. With funds raised reaching $1,748,091.98 against a target of $1,974,249, the token is currently priced at $0.012075, with the next price tier poised to launch shortly.

Designed to blend the robust security of Bitcoin with the rapid speed of Solana, Bitcoin Hyper aims to facilitate fast, cost-effective smart contracts, decentralized applications (dApps), and even meme coin creation—all while maintaining seamless bridging with BTC. With an impressive audit from Consult and a clear focus on scalability and usability, Bitcoin Hyper is one to watch as it gears up for a full rollout expected in Q1 of the coming year.

Why This Matters: Understanding Bitcoin’s Current Landscape

The resilience of Bitcoin in the face of changing macroeconomic conditions and inflationary pressures is a testament to its growing strength as a digital asset. Institutional investments, like Metaplanet’s bold strategies, reflect a shift in perception towards Bitcoin, signaling that more entities might soon prioritize crypto as a core component of their financial ecosystems.

For traders and investors, these developments provide crucial insights into market strategies and help gauge when to make informed decisions. With Bitcoin’s price dynamics closely entwined with broader economic signals, how will this interplay shape the future of cryptocurrency investments?

Future Outlook: Navigating the Bitcoin Terrain

As we look ahead, the positive sentiment surrounding Bitcoin appears poised to grow, especially if institutional players continue to increase their stakes. Anticipation is building around Bitcoin’s technical breakout, which could catalyze a renewed surge in value. Furthermore, the rise of projects like Bitcoin Hyper reveals an appetite for innovative solutions within the crypto space, hinting at a vibrant future for Bitcoin and its role in the evolving digital economy. Will Bitcoin solidify its position as a dominant asset in 2025 and beyond?

Conclusion: Join the Discussion!

The ongoing developments in Bitcoin and the broader cryptocurrency market present exciting opportunities and challenges for investors and traders alike. As the landscape continues to evolve, what are your thoughts on the future of Bitcoin? Are you optimistic about institutional investors’ growing confidence, or do you see hurdles ahead? Join the conversation below!

“`