Bitcoin (BTC/USD) experienced a significant downturn this week, tumbling below the $111,000 mark and deepening its losses as global investor sentiment soured. The price drop was initiated when BTC faced resistance near $124,500—a moment marked by a bearish engulfing candle on the daily chart, signaling a wave of profit-taking and a likely short-term trend reversal.

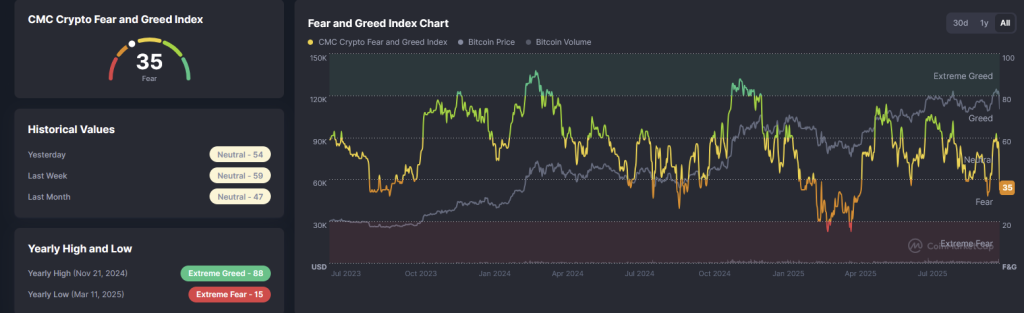

This bearish sentiment wasn’t isolated to Bitcoin; it echoed throughout the broader financial landscape as trading worries about inflation and international tensions coupled with ongoing instability in global markets. The Crypto Fear and Greed Index plunged to 35 (indicating Fear), its lowest point in over a month, reflecting the anxiety gripping crypto investors and aligning with the overall risk reset across the market. Notably, the total market capitalization for cryptocurrencies fell to $3.7 trillion, while 24-hour trading volumes nearly reached $497 billion.

As the cryptocurrency space navigates these turbulent waters, it’s essential to understand how deeply Bitcoin is interconnected with the broader market. The correlation with U.S. equities has surged, indicating that as traditional risk assets face sell-offs, Bitcoin is swept along in the tide.

To give you a clearer picture of the current landscape, let’s look at some key figures:

- Bitcoin: $110,705, down 8.59% in the last 24 hours

- Ethereum: $3,764, down 12.94%

- BNB: $1,092, down 13.6%

- Solana: $183, down 16.3%

- XRP: $2.41, down 14.0%

The Altcoin Season Index has also slipped to 37, a sign of Bitcoin’s rising dominance in the market. Meanwhile, the CoinMarketCap 20 Index, which tracks the performance of major cryptocurrencies, dropped by 10.5% to 235.1, illustrating a widespread sell-off across a range of digital assets.

Investor psychology is shifting as fear grips the market. Analyzing historical data from the Fear and Greed Index shows that sentiment has seen one of its steepest drops, plummeting from a neutral score of 54 last week to 35 now. This kind of rapid sentiment change often signals a turning point where cautious accumulation might begin.

Moreover, recent price action aligned with the completion of a bearish butterfly pattern, consistent with our previous price predictions. Bitcoin’s recent selloff followed this analysis, leading to its current test of critical support areas.

### What’s Next for Bitcoin?

From a technical standpoint, Bitcoin’s breach of its ascending trendline from April signals a potential weakening of its bullish momentum. The Relative Strength Index (RSI) has dipped into oversold territory at 38.8, while the Moving Average Convergence Divergence (MACD) indicates growing negative momentum.

The $108,000–$110,000 region emerges as a critical support zone, historically a point where long-term buyers have stepped in to stabilize prices. The formation of candles showing long lower wicks suggests that buyers are keen to defend this level.

Should a Doji or spinning top appear in this area, it could signal the start of an upward reversal, particularly if it is confirmed with a rebound above $117,000—the 50-day moving average and a previous resistance zone. A successful recovery from here could lead Bitcoin to retest levels around $124,000, possibly aiming for a medium-term target in the $126,000–$130,000 range. Conversely, failure to hold above $108,000 may push Bitcoin towards downside targets near $103,000 and $98,200, historically significant demand zones.

#Bitcoin – As noted in our previous forecast, BTC completed the bearish butterfly’s first target before tumbling 9% to $110K. Price now tests key support at $108K–$110K. A rebound above $117K could trigger recovery toward $124K–$126K, while failure risks deeper pullback to $103K. pic.twitter.com/4D4spTnEqX— Arslan Ali (@forex_arslan) October 11, 2025

The current market sentiment indicates many investors find this pullback as a healthy reset rather than the onset of a prolonged bearish trend. With the Fear and Greed Index currently at 35, it reflects phases of accumulation previously observed in market cycles.

As such, a potential “buy-the-dip” strategy could be employed near $108,000 with stop-loss orders set just below $107,500, targeting a future rebound towards $124,000–$126,000. This scenario aligns closely with Fibonacci retracement levels and moving averages, presenting an attractive risk-reward ratio for swing traders amidst ongoing market volatility.

Looking ahead, if momentum shifts positively, Bitcoin could resume its upward trajectory toward $130,000 in the fourth quarter of the year. This optimistic outlook hinges on rising institutional interest, expected demand for ETFs, and broader blockchain adoption contributing to a stabilizing market effect.

### New Innovations on the Horizon

Additionally, the launch of innovative projects like Bitcoin Hyper ($HYPER) introduces exciting possibilities. Positioned as a pioneering Bitcoin-native Layer 2 solution leveraging the Solana Virtual Machine (SVM), Bitcoin Hyper aims to enhance the Bitcoin ecosystem with rapid, cost-effective smart contracts and decentralized applications. By fusing Bitcoin’s robust security with Solana’s high performance, it facilitates new use cases while expanding accessibility.

With a focus on trust and scalability, Bitcoin Hyper has already garnered significant interest, raising over $23 million in its presale phase, with only a limited allocation remaining. Currently priced at just $0.013095, the value of HYPER tokens is expected to rise as the presale advances. For those looking to invest in this new venture, tokens can be purchased on the official Bitcoin Hyper website using either cryptocurrencies or bank cards. Join the presale here!

This week’s fluctuations in Bitcoin’s value highlight not only the inherent volatility of the cryptocurrency market but also the strategic opportunities that arise from it. Stay tuned as we continue to unravel the dynamics of these digital assets and the forces that shape their future!