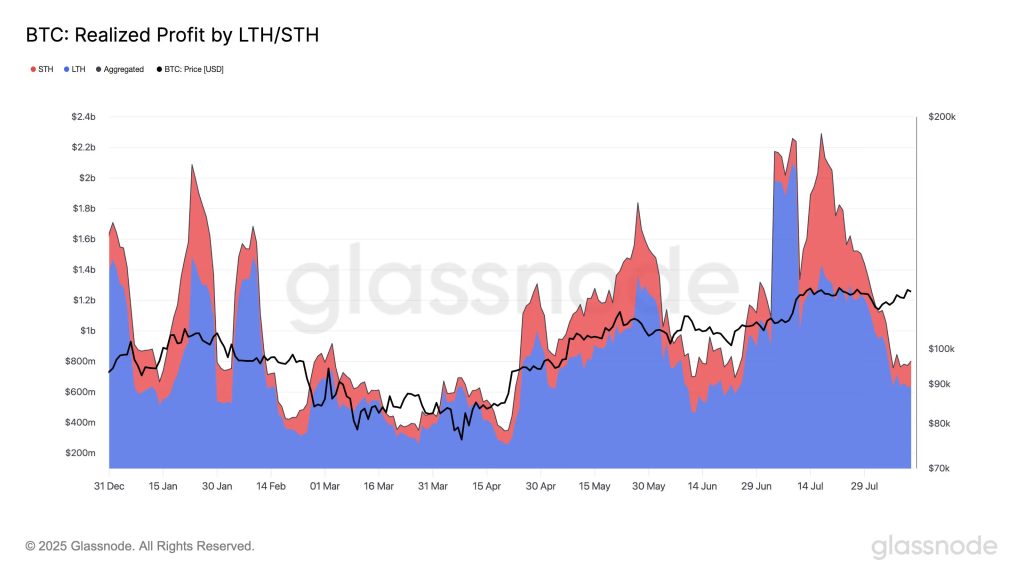

Bitcoin (BTC) has been making headlines again, currently hovering around a solid $121,930 after a recent surge from $116,000. This impressive rally might suggest a bubbling excitement in the market, but the profit-taking activity has been surprisingly calm. Dive into the numbers, and you’ll notice a noteworthy trend: data from Glassnode reveals that daily realized profits for August are averaging below $750 million, a stark contrast to the peaks we witnessed in January and July that soared to $2 billion, all while BTC dances near its all-time highs.

✦ 𝐖𝐞’𝐯𝐞 𝐨𝐟𝐟𝐢𝐜𝐢𝐚𝐥𝐥𝐲 𝐜𝐫𝐨𝐬𝐬𝐞𝐝 $𝟕𝟓𝟎,𝟎𝟎𝟎,𝟎𝟎𝟎 𝐢𝐧 𝐚𝐠𝐞𝐧𝐭𝐢𝐜 𝐯𝐨𝐥𝐮𝐦𝐞 ✦That’s three quarters of a billion dollars worth of financial decisions made by Giza agents. This is what post-human 24/7 capital optimization looks like. At scale. pic.twitter.com/6P2mv7EyYC— Giza (@gizatechxyz) August 1, 2025

So, what’s behind this curious undercurrent? It seems to stem mainly from long-term holders (LTHs) who’ve weathered the recent volatility like seasoned pros. According to Glassnode’s Realized Profit metric—an insightful measurement indicating profit from coins sold above their acquisition price—it’s clear that LTHs are reaping greater rewards than their short-term counterparts (STHs), except during significant breakout events.

The last time we saw STH profits surge was in July when Bitcoin peaked at $123,000—many of those profits originated from buyers who capitalized during the lows of March’s “tariff tantrum,” which saw prices dip to $76,000. With current realized profits sitting significantly below previous highs, it appears market sentiment is shifting towards a more committed stance rather than speculative activities. This steadfast holding behavior could be just what Bitcoin needs to fuel its next significant rally.

From a technical analysis standpoint, Bitcoin has successfully broken out from a descending channel that has shackled its price trajectory since mid-July. This bullish breakout was not just a flash in the pan; it came with a notable rise in trading volume, signaling increased confidence among traders. The daily chart reflects BTC reclaiming the 23.6% Fibonacci level at $117,335 and nudging against a resistance point at $123,236, where sellers are anticipated.

Yet, the broader trend remains optimistic; Bitcoin’s price is buoyed by a series of higher lows and supported by the 50-day simple moving average (SMA) currently at $114,724. Momentum indicators lend credence to this bullish sentiment, with the Relative Strength Index (RSI) sitting at 66.26, indicating strong buying momentum that hasn’t yet crossed into overbought territory. Meanwhile, the MACD has confirmed a bullish crossover above the zero line, and we’ve seen consecutive wide-bodied green candles revealing robust demand.

A daily close above $123,236 could pave the way for Bitcoin to reach $127,000, pushing towards that thrilling psychological milestone of $130,000. However, should sellers maintain their grip, immediate support levels lie at $117,335, followed by additional support at $113,650 and the 50-day SMA.

For traders keen on maximizing their positions, the current setup presents a variety of opportunities:

- Bullish scenario: Look to enter on a confirmed break past $123,236, with stops at $119,800. Initial targets would be $127,000 and then $130,000.

- Conservative entry: Wait for a retest at $117,335 and enter on signs of a bounce back.

- Bearish play: Consider shorting on rejections at $123,000–$123,500, with tight stops just above $123,500, targeting a retracement towards $117,000.

As long-term holders continue to keep their coins off the market, we might see increased upward pressure should the resistance levels break cleanly. It’s advisable for traders to watch for strong volume signals before positioning themselves for a sustained upward move.

In an exciting development, the cryptocurrency landscape is also witnessing the launch of Bitcoin Hyper ($HYPER), a promising new project that integrates Bitcoin’s security with the speed of Solana. This innovative Bitcoin-native Layer 2 solution is designed to enhance the Bitcoin ecosystem with rapid, cost-effective smart contracts, decentralized applications (dApps), and meme coin creation. This union of Bitcoin’s robust security and Solana’s efficiency could redefine the landscape of blockchain technology.

Currently, investor interest is skyrocketing, with the presale already surpassing $9 million in funds raised. The HYPER tokens are available at the attractive price of $0.012675, but with demand surging, that price will soon rise. Don’t miss the opportunity to join this promising venture—tokens can be purchased via the official Bitcoin Hyper website with either crypto or bank card options available. Click Here to Participate in the Presale.

As the cryptocurrency landscape continues to evolve, engaging with these trends and opportunities can help you stay ahead. Whether you’re a seasoned trader or a newcomer, the current momentum in Bitcoin presents a fascinating environment full of potential. What strategies will you adopt to navigate this dynamic space?