Bitcoin’s Rocky Start to June: What Sparked the Shift?

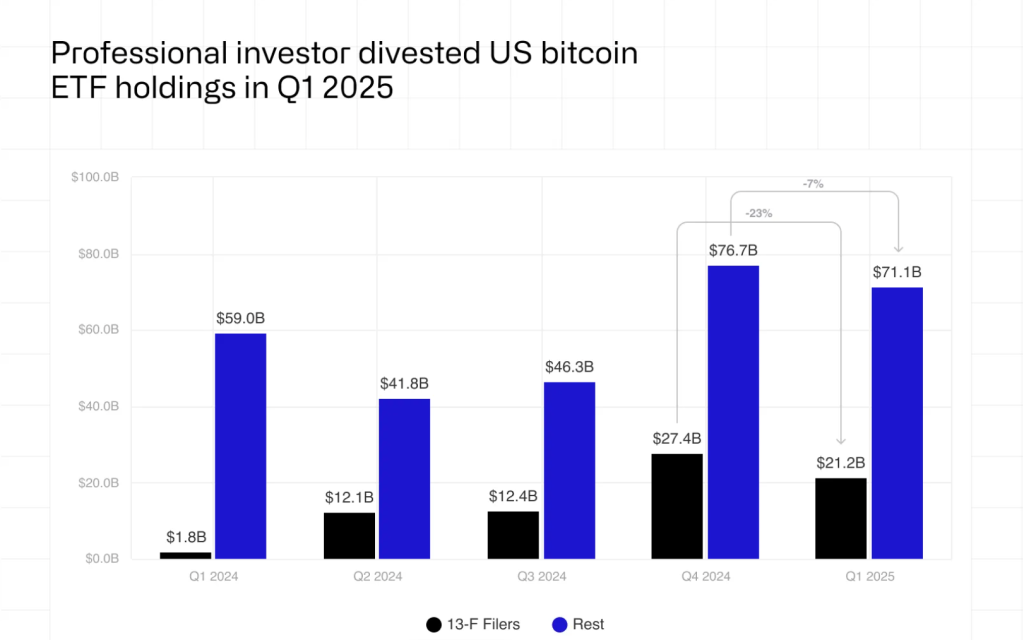

As June unfolded, Bitcoin found itself navigating turbulent waters, marking a noticeable shift in institutional sentiment towards Bitcoin ETFs. For the first time since the U.S. launched spot products, institutional interest waned, with assets under management plummeting from $27.4 billion in Q4 2024 to $21.2 billion in Q1 2025—a staggering 23% decline. This alarming downturn can largely be attributed to an 11% dip in Bitcoin’s price, paired with aggressive selling strategies by financial professionals unearthing a deeper layer of market anxiety.

Interestingly, while most institutional players retreated, a group of financial advisors slightly increased their Bitcoin exposure. This nuanced behavior hints at potential resilience within specific investor segments, diverging from the wider trend of retreating from speculative plays towards more treasury-style holdings, especially within corporate portfolios.

The Inevitable Outflows: BlackRock’s Bitcoin Trust Faces Major Setbacks

Contributing to the overall market downturn, BlackRock’s iShares Bitcoin Trust (IBIT) experienced an unprecedented $430 million in outflows on May 30, marking the largest single-day exit since its inception. This dramatic shift not only broke a streak of inflows that lasted for over a month but also ignited apprehension regarding the potential for further selling pressure in the market.

The Trump-Musk Feud: A Catalyst for Investor Panic

Adding fuel to the fire, the very public feud between Tesla CEO Elon Musk and former President Donald Trump further soured market sentiment. Their clash, revolving around a contentious Congressional spending bill, escalated after Musk suggested Trump’s resignation and threatened impeachment. Trump countered by championing the bill as a significant tax cut, igniting a political drama that rippled through risk assets, prompting widespread caution among investors.

The Trump tariffs will cause a recession in the second half of this year https://t.co/rbBC11iynE— Elon Musk (@elonmusk) June 5, 2025

This clash not only shook investor confidence but also spurred a significant downturn in the crypto market, resulting in over $831 million in liquidation, primarily impacting long positions.

OVER $800M LIQUIDATED IN CRYPTO IN LAST 24 HOURSMore than $800 million in crypto positions were wiped out across major exchanges in a single day.The surge in liquidations reflects extreme market volatility and leverage unwinding.Source: Coinglass https://t.co/ogMh2rr4to pic.twitter.com/hMofVtR7lW— Crypto Town Hall (@Crypto_TownHall) June 5, 2025

Market Sentiment Turns: Fear and Greed Index Takes a Hit

The market’s nerve was palpable as Bitcoin’s fear and greed index dropped from 62 to 57, signaling a shift towards caution among traders. With Bitcoin dipping below the critical $102,000 level to hover around $101,500, the cryptocurrency recorded a loss of 3.16% in just 24 hours. This loss rippled through the crypto ecosystem, prompting similar declines in Ethereum and various altcoins.

Long-Term Perspectives: Is Bitcoin Poised for a Comeback?

Despite the short-term panic, some analysts advocate that the current dip might unveil opportunities for future gains. If Bitcoin adheres to its historical patterns, it could prove to be a savvy investment in times of economic recession—especially with Musk’s warning of potential repercussions from Trump’s tariffs looming over the economy.

Technical Analysis Snapshot: Key Resistance and Support Levels

Determining the next moves for Bitcoin involves navigating key technical levels:

- Resistance: $102,178 → $103,127 → $104,561

- Support: $100,766 → $99,807 → $98,772

For traders:

- Bullish Scenario: A close above $102,178 could lead to a test at $103,127.

- Bearish Scenario: A breakdown below $100,766 could open pathways to $98,772.

While volatility remains high, a potential silver lining arises from the growing adoption of Bitcoin as a treasury asset by corporations, which may help establish a more stable foundation as institutional ETF outflows continue.

BTC Bull Token Presale: Rising Interest Amid Bitcoin’s Challenges

As Bitcoin hovers near the $102,000 mark, investor attention has notably shifted towards altcoins like BTC Bull Token ($BTCBULL). This project has experienced a notable surge in interest, successfully raising approximately $6,858,262 of its $7,911,528 fundraising goal. The current presale price of $0.00255 is expected to rise as the cap nears achievement.

The BTC Bull Token integrates two main features to align with Bitcoin’s performance:

- BTC Airdrops: Participants in the presale receive airdrops, offering priority rewards.

- Supply Burns: Automatic supply burns occur for every $50,000 increase in Bitcoin, strategically decreasing $BTCBULL’s circulating supply.

The token’s features, including a staggering 61% APY staking pool, have attracted both seasoned DeFi users and newcomers seeking easy passive income opportunities without facing lock-up periods or fees.

As the presale deadline approaches, the momentum behind BTCBULL is palpable, driven by its strategic connection to Bitcoin’s value, scarcity mechanics, and investor-friendly staking model. Early buyers must act swiftly as the next price tier is set to activate soon.

Conclusion: A Time for Caution and Opportunity

This juncture in the cryptocurrency market poses significant challenges but also opens doors to potential long-term benefits for savvy investors. As market volatility continues, it’s essential to keep a watchful eye on Bitcoin’s performance and the evolving sentiment within the sector. Are we on the brink of a recovery, or should we brace for further turbulence? Join the conversation below, and let us know your thoughts!