Bitcoin Surge: A Market Resurgence and Future Prospects

Bitcoin (BTC) is currently enjoying a trading value of $109,690, reflecting a robust rise of 3.81% within the last 24 hours. This bullish momentum has traders keenly observing global macroeconomic conditions, as well as technical indicators that could steer future price movements. Recent weeks have seen Bitcoin sharply recover from a dip below $100,400, largely spurred by a high-profile spat between Donald Trump and Elon Musk, coupled with encouraging U.S. jobs data and a renewed appetite for riskier assets. As the market stabilizes, the focus shifts to critical U.S.–China trade negotiations taking place in London—events that could influence risk assets significantly. Remarkably, Bitcoin has managed to maintain its footing above the $109,000 mark, reflecting a growing sense of confidence among investors.

What’s Keeping Bitcoin Strong? A Closer Look

The pink elephant in the room: why is Bitcoin showing such resilience? Several factors are contributing to its current stability, particularly a noticeable increase in institutional investment. Consider the following:

- Over 80 publicly traded companies, including heavyweight players like MicroStrategy and GameStop, have added BTC to their portfolios.

- The U.S. government is reported to hold nearly 200,000 BTC, showcasing a significant state-backed interest.

- Gemini’s recent IPO filing indicates sustained enthusiasm for cryptocurrency firms, which bodes well for the ecosystem.

Together, these elements lend not only legitimacy to Bitcoin but also suggest a robust long-term demand, thereby strengthening bullish price predictions.

Technical Analysis: Where Is Bitcoin Heading Next?

From a technical standpoint, the forecast for Bitcoin appears promising as it approaches vital resistance levels. Currently testing the upper trendline of its ascending channel near $111,848, a breakout past this point could signal a decisive bullish continuation. If successful, Bitcoin could target even higher resistance levels at $115,103 and $118,358. The daily Relative Strength Index (RSI) currently sits at 61, indicating positive momentum while leaving room for further upward movement before entering overbought territory.

Short-Term Trading Strategy for Bitcoin Enthusiasts

For traders looking to capitalize on Bitcoin’s current price dynamics, here’s a succinct setup:

- Entry Point: Confirmed daily close above $111,848

- Stop-Loss: Below $107,616

- Target 1: $115,103

- Target 2: $118,358

- Key Watch: Look out for RSI divergence or any rejection at the $111.8K level.

This bullish trading configuration will remain intact as long as Bitcoin stays above the lower channel trendline near $107,000.

Bitcoin’s Maturation: Structural Developments to Note

Beyond price action, several structural advancements are shaping Bitcoin’s maturation and reputation. In Australia, law enforcement has charged four money laundering organizations involved in $123 million worth of cryptocurrency transactions. This incident underscores the transparency of blockchain technology, fostering greater trust among investors.

“$NCPL acquires Mixie, a blockchain-based platform focused on tools for Web3 games and decentralized community engagement.” — via @JoeyRattlesnake

Additionally, Netcapital (NCPL) has successfully acquired the crypto-native platform Mixie, which is indicative of a growing trend in crypto mergers and acquisitions (M&A). This acquisition signifies a strategic enhancement of Netcapital’s capabilities within the Web3 ecosystem, mirroring increasing institutional interest in cryptocurrency.

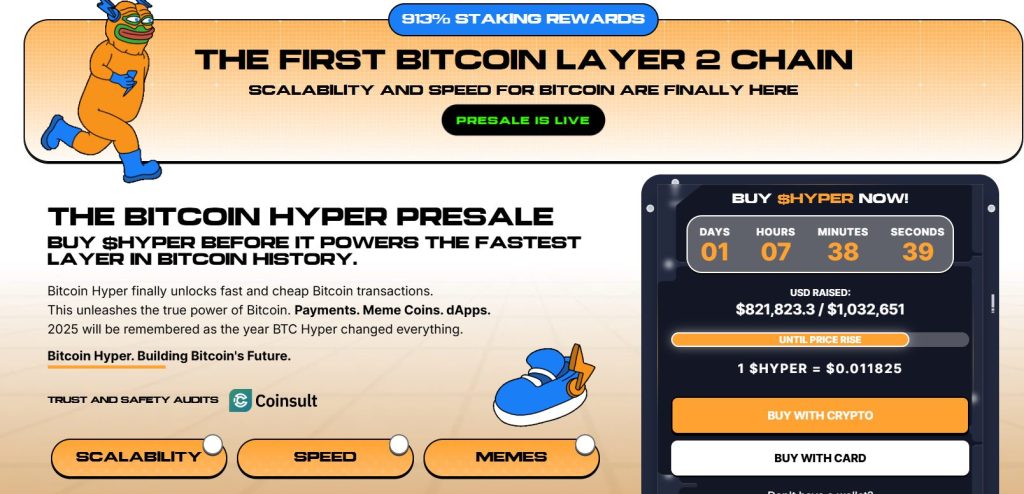

What’s New in the Crypto Scene? Introducing Bitcoin Hyper

In the realm of innovation, Bitcoin Hyper ($HYPER) is making waves as the first Bitcoin-native Layer 2 solution aimed at resolving some of Bitcoin’s most significant challenges—namely, slow transactions and high fees. By leveraging the Solana Virtual Machine (SVM), Bitcoin Hyper promises enhanced speed and scalability, along with low-cost smart contracts integrated into the BTC ecosystem. Early adopters have shown enthusiasm, with $821,823 already raised through its presale, indicating a bright future ahead for this transformative project.

Key Features and Why They Matter

What sets Bitcoin Hyper apart? Here are its standout features:

- Combines the speed of SVM with Bitcoin’s underlying security.

- Provides a Canonical Bridge for seamless BTC transactions.

- Low-cost gas fees and rapid execution capabilities for decentralized applications (dApps), meme coins, and more.

Additionally, users can stake $HYPER for post-launch rewards, further enhancing its utility and value in the rapidly evolving crypto landscape.

Act Fast! Join the Bitcoin Hyper Presale

The Bitcoin Hyper public presale is live now, with each $HYPER token priced at $0.011825. Early buyers are strongly encouraged to take advantage of this opportunity, as over 90% of the funding goal has already been achieved. Plus, participants can purchase using crypto or traditional payment methods without the hassle of a wallet, thanks to Web3Payments integration.

Conclusion: The Path Ahead for Bitcoin and Crypto

As Bitcoin navigates this volatile yet promising landscape, various factors—including institutional investments, market resilience, and technological advancements—are shaping its future. What does the future hold for Bitcoin? With ongoing shifts in macroeconomic dynamics and the maturation of the cryptocurrency market, one thing is certain: the conversation surrounding Bitcoin and its place in the financial ecosystem is far from over. Join us as we continue to track these developments and discuss what they mean for investors and enthusiasts alike. What are your thoughts on Bitcoin’s price trajectory? Share your insights in the comments below!