Bitcoin Soars as Institutional Interest Peaks: A New Dawn for BTC?

In a riveting development for cryptocurrency enthusiasts and investors alike, Bitcoin (BTC) has confidently stabilized around the $94,767 mark, riding high on a remarkable 11% surge from recent lows. This impressive uptick has been primarily fueled by a remarkable influx of institutional capital directed into spot Bitcoin Exchange-Traded Funds (ETFs). The spotlight is particularly on BlackRock’s IBIT ETF, which dominated headlines by collecting more than $240 million in just a single day. Fidelity is also making waves, contributing an eye-catching $108 million to the ETF mix. Cumulatively, institutional flows into Bitcoin ETFs have skyrocketed to over $41.2 billion, signaling a potent resurgence of institutional confidence in the crypto space.

💥BREAKING BLACKROCK JUST BOUGHT $240 MILLION WORTH OF BITCOIN pic.twitter.com/HH4URkxSDF— DustyBC Crypto (@TheDustyBC) April 26, 2025

The Mechanics of the Market Movement

This monumental buying wave coincided beautifully with Bitcoin’s impressive leap from $85,000 to nearly $94,250, igniting fresh speculation that we might soon see Bitcoin break through the esteemed $100,000 barrier. The momentum driven by ETFs, coupled with a reduction in selling pressure from miners, creates a potential supply shortage — a historical harbinger of aggressive price increases.

- BlackRock IBIT ETF inflows: $240 million in one day

- Fidelity ETF inflows: $108 million

- Cumulative ETF flows: $41.2 billion+

Bloomberg analyst Eric Balchunas aptly captured the sentiment, stating, “It’s a Bitcoin bender out there,” perfectly encapsulating the sudden shift in market sentiment toward ETFs.

Institutional Interest Transcends Bitcoin

The broader implications of this institutional appetite extend well beyond Bitcoin. On April 24, BlackRock confirmed substantial purchases not only of Bitcoin but also $54 million worth of Ethereum. Once a self-proclaimed skeptic of cryptocurrencies, CEO Larry Fink has now evolved his stance, dubbing Bitcoin as “digital gold” and identifying Ethereum as a foundational element for the future of tokenized finance. This evolution in outlook reflects a growing acceptance of digital assets among traditional financial institutions.

💥BREAKING: BLACKROCK JUST BOUGHT $240,000,000 WORTH OF BITCOIN HERE WE GOOO pic.twitter.com/dwpShxGdFf— Crypto Rover (@rovercrc) April 26, 2025

Following this announcement, Ethereum experienced a remarkable surge of 5.2%, trading at $3,850, with an impressive trading volume increase of 120% in just an hour. Such sharp price movements underscore the powerful influence institutional players now wield in setting cryptocurrency market trends.

- BlackRock Bitcoin purchase: $240 million

- BlackRock Ethereum purchase: $54 million

- Ethereum trading volume spike: +120% in 1 hour

With clearer regulatory frameworks beginning to take shape, experts anticipate that institutional interest will only burgeon, further boosting the maturation of the digital asset landscape.

Bitcoin’s Path Ahead: The $100K Threshold

On a technical front, Bitcoin is eyeing a pivotal resistance level at $95,380, where a long-term descending trendline aligns with horizontal supply levels. The 50-day Exponential Moving Average (EMA) at $87,270 continues to serve as robust dynamic support. However, indications from the MACD indicator suggest that momentum may start to plateau, hinting that any failure to break through $95,380 decisively could lead to a period of consolidation or a correction.

Trade Plan:

- Buy breakout: Above $95,380

- Upside targets: $99,620 and $104,820

- Stop-loss: Below $88,620

For traders, this scenario presents a classic “make-or-break” opportunity. A solid daily close above the $95,380 mark could propel Bitcoin to new all-time highs, while a rejection may initiate a corrective phase towards the $88,620 support zone. This critical juncture underscores the importance of patience, as true price discovery may commence only after decisively breaching $95,380 with convincing volume.

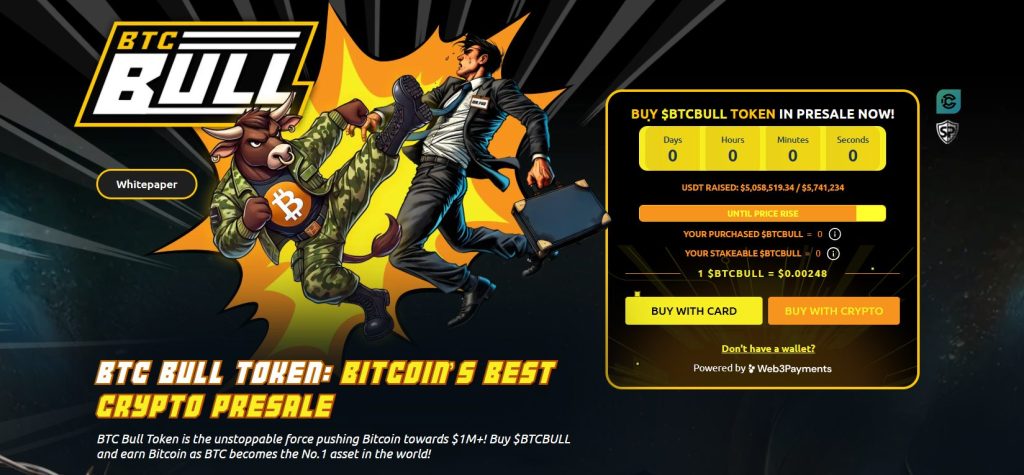

BTC Bull Token Dazzles: Surpassing $5M Milestone

In another exhilarating turn of events, the BTC Bull Token ($BTCBULL) continues to gain ground in the crypto landscape, officially surpassing the remarkable $5 million mark in its ongoing presale. As of today, the project has raised $5.05 million, edging closer to its target of $5.74 million, indicating a sense of urgency among buyers as they position themselves ahead of the next anticipated price increase. Currently, the token is priced at $0.00248, creating a limited opportunity for investors before any upcoming repricing occurs.

Staking with Unparalleled Flexibility

BTCBULL has distinguished itself from typical meme assets by emphasizing sustainable utility. The project’s staking program boasts an impressive estimated annual yield of 81%, coupled with Bitcoin-backed distribution rewards. Notably, users can maintain complete liquidity, enjoying the flexibility to unstake at any time without facing mandatory lock-up periods or penalties.

- Total Tokens Staked: 1,293,025,857 BTCBULL

- Estimated Annual Yield: 81% APY

- Unstaking: Available at any time

This unique structure is appealing to yield hunters as well as investors seeking upside potential without sacrificing liquidity. By aligning aggressive yields with the allure of meme-token expansion, BTCBULL is carving out a unique niche for astute investors in the cryptocurrency realm.

Closing Thoughts: The Time is Now to Engage

As BTCBULL’s presale approaches its final stages with less than $683,000 remaining before the next price adjustment, investors are clearly eager to take action. With the dynamic nature of the cryptocurrency markets unfolding daily and institutional interest reigniting enthusiasm across the board, there has never been a better time for investors to engage. As this thrilling narrative continues to develop, the crypto community stands poised on the edge of what could be a transformative era for digital assets. Are you ready to make your move?