The Resurgence of Bitcoin: Institutional Investors Take the Lead

Bitcoin is making headlines once again, but this time, the narrative has significantly shifted. At the Token2049 Conference in Dubai, Robert Mitchnick, Head of Digital Assets at BlackRock, announced a crucial trend: institutional investors are increasingly piling into spot Bitcoin ETFs. His insights were corroborated by notable figures from VanEck and CME Group, highlighting a significant transformation in the crypto investment landscape.

According to Mitchnick, while early investments were primarily driven by retail investors, the tide has turned. “The flows are back in a big way,” he remarked, emphasizing the gradual decline in retail client participation as institutional and wealth management clients assert their influence. This shift marks not just a financial reconsideration, but a reimagining of Bitcoin’s place in investment portfolios.

📌 Why This Matters: A New Phase in Adoption

What does this growing institutional interest signify for the cryptocurrency market? It points to a more mature investment environment where Bitcoin is increasingly recognized as a legitimate asset class. Unlike previous market phases highlighted by speculation and volatility, this newfound institutional engagement suggests a profound shift towards risk management and diversification strategies.

BlackRock executives articulate a narrative whereby Bitcoin is viewed as a macroeconomic hedge—an insurance policy against inflation and currency devaluation rather than merely a speculative tool. With concerns about global financial stability on the rise, investors are recalibrating their strategies. “Bitcoin thrives when you have more uncertainty,” noted Jay Jacobs from BlackRock, underscoring the cryptocurrency’s role as a refuge during unpredictable economic conditions.

🔥 Expert Opinions: Insights from the Cryptocurrency Frontier

Larry Fink, CEO of BlackRock, sparked considerable conversation when he suggested that Bitcoin could reach unprecedented heights of $700,000 under extreme economic conditions. While this projection may seem bold, it reflects a growing recognition of Bitcoin as a decentralized alternative to traditional fiat currencies in times of economic distress.

The factors that bolster Bitcoin’s appeal in this context are compelling:

- Institutions are reallocating their assets amidst uncertain interest rates.

- Increasing distrust in government-issued currencies is prompting a shift towards decentralized options.

- Bitcoin’s inherent scarcity aligns with an ongoing debate about sustainable monetary policy.

- Greater regulatory clarity surrounding Bitcoin ETFs enhances investor confidence.

🚀 Future Outlook: A Potential Breakout Looms

In technical terms, Bitcoin (BTC/USD) is poised for a breakout as it approaches a critical resistance level at $95,441, forming what appears to be an ascending triangle on the 2-hour chart—often a precursor for bullish continuation. The 50 EMA (Exponential Moving Average) sitting at $94,426 is providing robust support, and the MACD indicator is showing positive momentum.

Should Bitcoin close above the $95,441 mark with strong trading volume, bullish targets of $96,610 and $97,500 could be within reach. Conversely, should buyers fail to overcome this resistance, there’s a solid support level at $94,400, which savvy traders might consider as a stop-loss.

Investment Strategy: A Textbook Setup

For those looking to capitalize on this potential breakout, here’s a strategic overview:

- Entry Point: Break and close above $95,441.

- Target 1: $96,610.

- Target 2: $97,500.

- Stop-Loss: Below $94,400.

This structure exemplifies a classic breakout opportunity. Traders are encouraged to exercise patience and await confirmations to sidestep potential false breakouts, as the momentum does currently favor the bullish side so long as BTC remains above the critical 50 EMA.

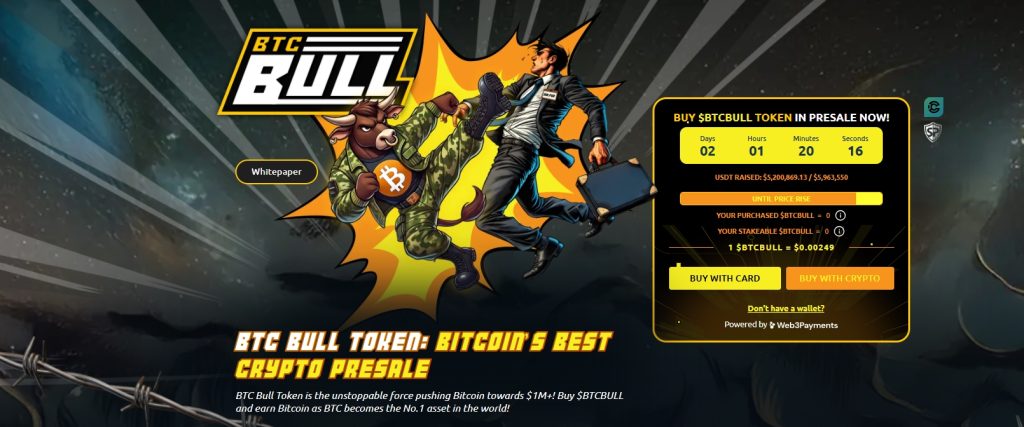

BTC Bull Token: Staking Gains Traction

In related news, the BTC Bull Token ($BTCBULL) has garnered significant investor interest, raising $5.2 million towards its $5.9 million goal in its presale phase. Priced currently at $0.00249, BTCBULL distinguishes itself from typical meme-based tokens by offering utility-driven staking rewards, resulting in an impressive estimated annual yield of 80%.

This project is particularly appealing as it allows investors to maintain full liquidity—the ability to unstake without penalties at any time makes it a flexible option for yield hunters. With an annual yield of 80% and full access to funds, BTCBULL sets a new standard in crypto asset allocation, especially for those eyeing strong returns amidst evolving market conditions.

Conclusion: Where Do We Go From Here?

The convergence of institutional interest in Bitcoin has never been more pronounced, reshaping the landscape of digital currency investment. As the tensions in the broader financial markets persist, the ongoing dialogues among financial leaders underscore a pivotal moment for Bitcoin as an investment vehicle. Are you ready to engage with this evolving story? Join the conversation and share your insights on the future trajectory of Bitcoin!