Bitcoin’s Market Movements: BlackRock Expands Its European Footprint

In a dramatic turn of events, Bitcoin’s price has slipped to $85,000, a notable dip despite the significant strides made by BlackRock in the cryptocurrency landscape. On March 25, the investment giant launched its iShares Bitcoin Exchange Traded Product (ETP) across Europe, a move that has ignited fresh interest among institutional investors outside the U.S. markets. The ETP is now accessible on major platforms including Xetra, Euronext Amsterdam, and Euronext Paris, heralding a new era for Bitcoin in the European financial arena.

While analysts predict that inflows to European ETFs may initially lag behind their U.S. counterparts, the credibility associated with BlackRock’s staggering $11.6 trillion asset footprint cannot be understated. Experts from Bitfinex suggest that as regulatory clarity continues to improve, we may ultimately witness a surge in institutional adoption of Bitcoin in the region.

JUST IN: 🇺🇸 $11 TRILLION BlackRock’s Global Allocation Fund reports owning $47.4 million worth of #Bitcoin ETF. BULLISH 🚀 pic.twitter.com/kMIXso5G38— Bitcoin Magazine (@BitcoinMagazine) March 27, 2025

Key Takeaways from BlackRock’s Launch

- BlackRock’s European Bitcoin ETP is operational on three prominent exchanges.

- Analysts suggest a gradual adoption process due to ongoing regulatory uncertainties.

- The firm’s vast global footprint might create pathways for a wider adoption of ETFs.

This latest development reinforces Bitcoin’s narrative as a legitimate institutional asset, even if the immediate price reaction seems tepid. The market’s focus is rapidly shifting as we monitor how institutional players evolve in their strategies.

Corporate Movements: GameStop’s Bold Bitcoin Strategy

In a surprising pivot, GameStop has modified its investment policy to allow for Bitcoin holdings. Not only that, the company is contemplating a massive $1.3 billion convertible bond issuance potentially aimed at financing Bitcoin acquisitions. This news has generated palpable excitement in the community, especially after MicroStrategy co-founder Michael Saylor conducted a poll asking his followers for their opinion on how much Bitcoin GameStop should buy. A staggering 47% of nearly 69,000 participants recommended a jaw-dropping $3 billion allocation, dubbing it a “King Move.”

Michael Saylor just threw down a challenge—and it’s turning heads 👀In a poll, he asked how much bitcoin Gamestop 🇺🇸 needs to buy to earn true BTC street cred. The top pick? A jaw-dropping $3B+—what Saylor calls the “King Move.”— Bitcoin.com News (@BTCTN) March 28, 2025

Despite a significant drop in GameStop shares—over 20% following these announcements—the enthusiasm for Bitcoin within corporate strategies continues to soar. MicroStrategy also remains bullish, recently acquiring an additional 6,911 BTC, bringing its total holdings to an impressive 506,137 BTC.

🪙 GameStop plans to raise $1.3 Billion to purchase Bitcoin!Following Michael Saylor’s strategy of massive BTC acquisitions, GameStop and others are now joining in.📈 $GME has surged 15% after they announced it will buy Bitcoin as a treasury reserve asset. pic.twitter.com/W04cjREV5L— Cryptic (@Cryptic_Web3) March 27, 2025

Why This Matters

The increasing trend of companies like GameStop and MicroStrategy embracing Bitcoin as part of their financial strategies signifies a profound shift in corporate treasury management. Organizations are beginning to see Bitcoin not just as a speculative asset, but as a legitimate tool for wealth preservation and financial growth. As institutional interest heats up, expect the narrative around Bitcoin to evolve significantly.

Regulatory Landscape: Crypto.com’s Relief from SEC Scrutiny

In a noteworthy development, the U.S. Securities and Exchange Commission (SEC) has wrapped up its investigation into Crypto.com without pursuing further enforcement action. CEO Kris Marszalek confirmed this pivotal shift, which follows a Wells notice issued in August 2023. This recent closure marks a broader trend, as other exchanges, including Coinbase and Uniswap, have also seen their regulatory challenges dissipate, suggesting the SEC may be adapting its approach under new leadership.

🚨 BREAKING: Crypto.com has announced that the SEC has agreed to close its investigation against the cryptocurrency exchange with no enforcement action taken. pic.twitter.com/0uGRrSaDDE— Cointelegraph (@Cointelegraph) March 27, 2025

This shift could be a turning point for Bitcoin, as reduced regulatory pressure may create a more favorable environment for institutional investments and boost confidence in the cryptocurrency market overall.

Bitcoin Price Analysis: Navigating Current Trends

Currently, Bitcoin is trading at about $85,040, having breached crucial support at $86,500 and dropping below the 50-period Exponential Moving Average (EMA). As market sentiment shifts, the rejection of $88,800 as a significant resistance level signals caution among traders. With the Relative Strength Index (RSI) nearing the oversold territory at 32, many are keeping an eye on potential downside targets, including $84,800, $83,200, and $81,100.

With the current sentiment skewing bearish, the market remains in flux. While the present landscape poses challenges, any unexpected macro catalysts from entities such as the Federal Reserve, the SEC, or significant institutional inflows could dramatically shift momentum in favor of bullish traders.

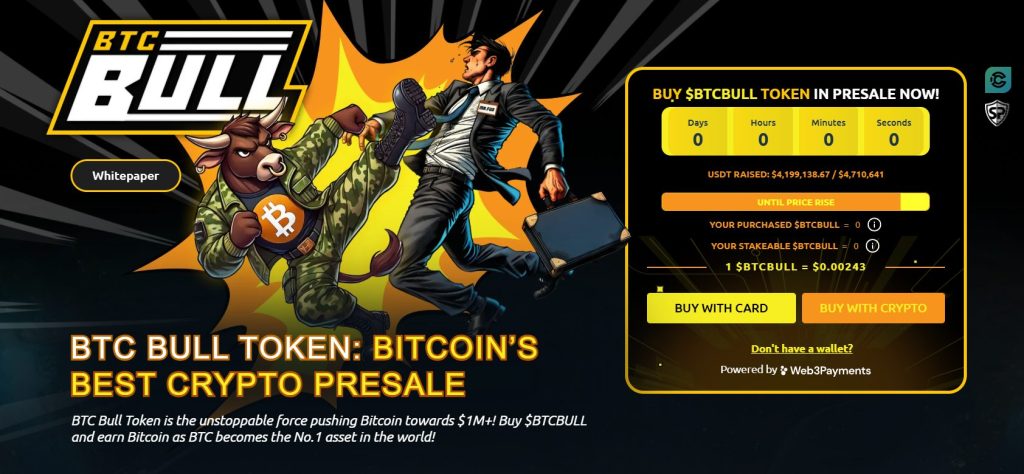

Introducing BTC Bull: Rewarding the Community

Amidst the volatility, BTC Bull ($BTCBULL) is capturing attention as a unique community-driven token. This innovative project rewards its holders with actual Bitcoin each time BTC reaches key price milestones, distinguishing it from typical meme tokens. BTCBULL promotes long-term investment perspectives, providing real rewards through both airdropped BTC and staking opportunities that yield an impressive 119% annual percentage yield (APY).

Latest Presale Details:

- Current Presale Price: $0.00243 per BTCBULL

- Total Raised: $4.1M out of a $4.5M target

This presale offers a rare chance to buy BTCBULL at an early-stage price before the anticipated price increase, capturing both growth potential and community engagement.

Conclusion: The Bitcoin Journey Ahead

As Bitcoin continues to navigate the complexities of institutional adoption and regulatory landscapes, the landscape appears ripe with opportunity. Each new development—from BlackRock’s strategic moves to GameStop’s bold investments—reflects a growing acceptance of Bitcoin as a foundational asset in modern corporate finance. What are your thoughts on these developments? Will Bitcoin reclaim its strength in this evolving market? Join the conversation and share your insights!