Bitcoin’s Ascent: A Catalyst for Decentralized Finance

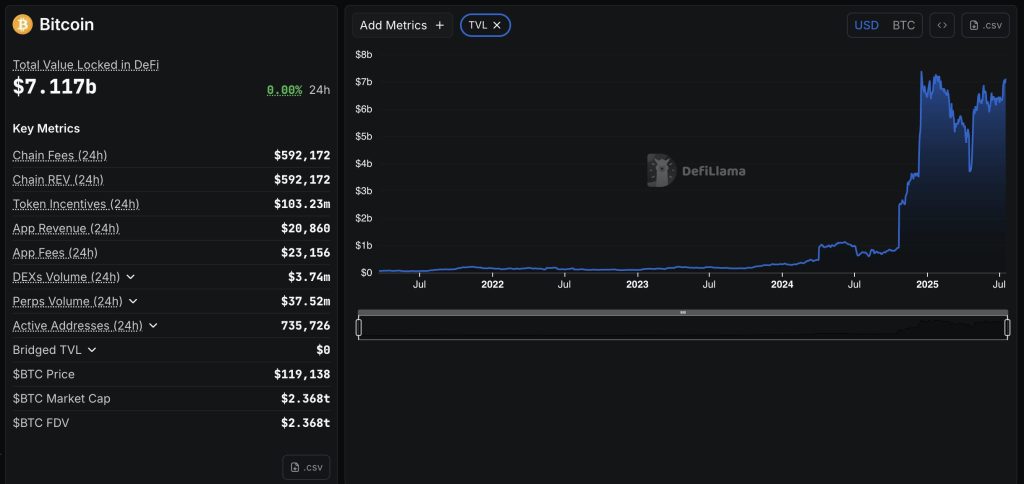

As Bitcoin (BTC) experiences a remarkable surge in value, it’s not just traders who are taking notice; the world of decentralized finance (DeFi) is undergoing a seismic shift. Recent data from DefiLlama reveals that the total value locked (TVL) in Bitcoin-centric DeFi protocols skyrocketed from a mere $304.66 million at the start of 2024 to an astonishing $7.117 billion today.

📌 Why This Matters: Understanding the Shift

The meteoric rise in Bitcoin DeFi—often dubbed BTCFi—signifies more than just increasing numbers. It highlights a growing inclination among institutions to leverage Bitcoin beyond traditional holding strategies. As Bitcoin gains traction as a collateral asset, institutional players are eagerly exploring how to deploy their holdings into DeFi, unlocking fresh avenues for growth and profitability.

🔥 Institutions Are Taking Notice

In an interview with Cryptonews, Rena Shah, Chief Operating Officer of Trust Machines, emphasized that institutions are just beginning to realize Bitcoin’s potential for accelerated growth. The recent activity on the Stacks protocol is telling—5,000 sBTC bridged in less than three hours, signaling intense institutional interest and engagement.

sBTC Cap-3: Full.We reached the 5,000 sBTC cap in less than 2.5 hours.BTCFI is inevitable. pic.twitter.com/iz08KX4ltA— stacks.btc (@Stacks) May 22, 2025

Shah noted that as Bitcoin’s price climbs, so does the total loan volume within the Stacks ecosystem. This trend indicates that institutions will increasingly develop BTCFi strategies, capitalizing on what she describes as “the best opportunity to introduce new users to untapping the full potential of their Bitcoin.”

🔗 The Role of Stablecoins in Bitcoin-DeFi Integration

Rich Evans, Managing Director at CEX.IO, elaborated on another vital facet of the BTCFi boom: the integral role of stablecoins. He mentioned that the launch of USDT on the Lightning Network and UST0 on Rootstock are crucial developments for enhancing Bitcoin’s DeFi ecosystem. “Stablecoins are the backbone of DeFi activity in other blockchains; thus, their emergence in Bitcoin could catalyze its DeFi success,” Evans asserted.

Ben Sanders, Chief Growth Officer at Rootstock Labs, echoed these sentiments, revealing that Rootstock has seen an uptick in activity, reflected in its TVL and user interactions. He highlighted that existing platforms like UST0, Solv, Midas, and others have integrated support for Rootstock, driving the BTCFi momentum further.

It’s go time. BTCFi, for real. https://t.co/MGazo28xme— Rootstock (@rootstock_io) July 16, 2025

🚀 Future Outlook: What’s Next for Bitcoin DeFi?

The BTCFi landscape is not just growing; it’s evolving. Shah believes cross-chain opportunities may be the next frontier, enabling users to interact with DeFi innovations without needing to liquidate their Bitcoin. “Stacks is creating bridging opportunities that transcend traditional barriers,” she explained.

Furthermore, the emergence of technical solutions such as BitVM2 and BitVM3 may revolutionize smart contracts on Bitcoin, improving scalability and functionality. These innovations could pave the way for the development of Ethereum-like applications on Bitcoin’s architecture, without sacrificing the network’s core values.

Challenges Ahead: A Cautious but Necessary Adoption

Although the prospects of BTCFi are bright, they are not without hurdles. Evans pointed out that despite Bitcoin hitting an all-time high with about a 28% year-to-date increase, Bitcoin DeFi has only managed an 8% growth—remaining below its previous peak. This discrepancy raises the question: what’s holding BTCFi back?

Schroé remarked that for Bitcoin DeFi to thrive, long-term holders must adapt their mindset from ‘buy and hold’ to actively utilizing their assets. He urged that **yield opportunities can only flourish if more Bitcoin circulates within the ecosystem**. Additionally, concerns regarding security and user education need addressing, as many Bitcoin enthusiasts are understandably hesitant to explore new tools and protocols.

Sanders emphasized the importance of robust security measures for the future of BTCFi. “It is vital for Bitcoin treasury companies, infrastructure developers, and decentralized protocol teams to implement safeguards to protect users,” he stated.

Conclusion: A Turning Point for Bitcoin’s Future in DeFi

As Bitcoin continues its upward trajectory, the wave of institutional interest and the growth of Bitcoin-native DeFi are set to fundamentally reshape the crypto landscape. The intrigue around BTCFi is palpable, but for it to truly flourish, collaborative efforts on securing the ecosystem and educating the community are essential. What do you think about Bitcoin’s booming DeFi sector? Are you optimistic about its future? Let’s discuss!