Bitcoin’s Growing Appeal: Evertz Pharma Makes a Bold Move

The world of cryptocurrency is not just confined to tech enthusiasts and speculative traders anymore; it’s steadily infiltrating corporate balance sheets. This week, Evertz Pharma GmbH, a leading natural cosmetics brand based in Germany, made waves in the financial landscape by announcing their strategic acquisition of an additional 100 Bitcoin (BTC) valued at approximately $10.8 million (€10 million) set for May 2025. This makes them the first company in Germany to adopt Bitcoin formally as part of a reserve strategy, reflecting a substantial shift in how businesses view cryptocurrencies.

Setting a Trend: The Significance of Evertz Pharma’s Purchase

At the heart of Evertz’s decision is a long-term vision for resilience in an unpredictable financial environment. Managing Director Dominik Evertz articulated that this step aligns perfectly with the company’s future-focused ethos. Meanwhile, CFO Tobias Evertz underscored their commitment to channel profits into Bitcoin, thus reinforcing the notion of BTC as a strategic asset rather than just a speculative investment.

This strategic pivot isn’t just about financial numbers; it represents a broader trend where companies are increasingly looking to Bitcoin as a hedge against inflation, dubbing it “digital gold.” By locking in long-term BTC holdings, Evertz Pharma not only adds robustness to its financial strategy but also sends a clear signal of confidence in cryptocurrency as a viable asset class. Could this be the beginning of a corporate revolution in cryptocurrency? Only time will tell.

A Boost from Geopolitical Developments: Bitcoin’s Fortuitous Timing

But Evertz Pharma is not the only one taking bold steps in the crypto space. Bitcoin has received a significant boost from recent geopolitical events, particularly a trade agreement proposed by former U.S. President Donald Trump with China. This announcement, made via Truth Social, has the potential to reduce trade tensions significantly. With tariffs expected to be rolled back, market sentiment soared, and Bitcoin’s value reacted favorably, hitting an intraday high of $110,300 before stabilizing around $109,560.

💥BREAKING: TRUMP SAYS TRADE DEAL WITH CHINA IS DONE ✅MARKETS LIKELY TO REACT STRONGLY! pic.twitter.com/awVibnj3xS— DustyBC Crypto (@TheDustyBC) June 11, 2025

The easing of macro risk has reignited investor optimism across both equity and cryptocurrency markets, prompting analysts to predict that reduced friction in global trade could be a catalyst for Bitcoin to not only revisit but potentially surpass its previous all-time highs. Could this be the turning point Bitcoin enthusiasts have been waiting for?

Bitcoin: A Precious Asset Amid Inflation Fears

Even as Bitcoin experienced a slight dip of 1.4% recently, it remains technically supported. Trading close to $108,610, the cryptocurrency is currently perched atop critical support levels, including the 50-EMA ($108,123), an ascending trendline, and a significant Fibonacci retracement level at $108,595. The technical indicators paint a picture of ambiguity, yet hold onto the belief that Bitcoin’s bullish potential remains intact.

As we analyze Bitcoin’s recent performance, candlestick formations indicate hesitation in the market, with resistance levels around $109,355 and $110,574 proving challenging. Despite some bearish indicators, market bulls maintain a case for a comeback as long as Bitcoin keeps above $108,100, potentially setting the stage for a rebound.

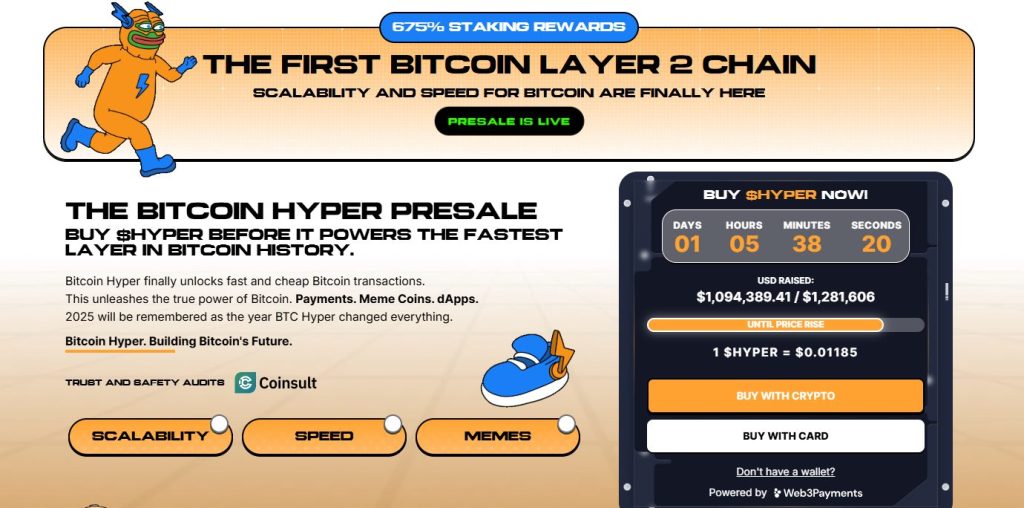

Bitcoin Hyper: A New Player on the Scene

In more exciting cryptocurrency news, Bitcoin Hyper ($HYPER), a new layer-two solution designed to enhance Bitcoin functionality, has successfully raised over $1 million in its ongoing presale, surpassing its initial target and drawing significant interest from investors. This innovative project aims to bring fast, low-cost smart contracts into the Bitcoin ecosystem, powered by the Solana Virtual Machine (SVM).

What makes Bitcoin Hyper particularly appealing is its promise of security coupled with scalability, which facilitates the creation of high-speed decentralized applications (dApps), meme coins, and efficient payment systems—all while keeping gas fees low. With over 77.7 million $HYPER already staked, participants can expect attractive returns post-launch. The presale accommodates both cryptocurrency and card payments, making it accessible to a broader audience without the need for a crypto wallet. Could Bitcoin Hyper be the breakout star of 2025 in the layer-two domain?

Conclusion: The Future of Bitcoin Looks Bright

In summary, Evertz Pharma’s foray into Bitcoin as a treasury reserve not only showcases a growing corporate confidence in cryptocurrencies but also aligns with a broader financial trend of seeking alternatives to traditional assets. Coupled with positive geopolitical developments influencing market sentiment, Bitcoin’s position continues to evolve. Furthermore, new initiatives like Bitcoin Hyper show promise for the cryptocurrency to scale and adapt creatively. As our financial landscape shifts, one has to ask—are we witnessing the dawn of a new era for cryptocurrencies? Join the conversation and share your thoughts below!