Bitcoin Thrives Amidst New XRP ETF Launch: A Win for the Crypto Landscape

While Bitcoin may not have seen an immediate surge following the approval of 3iQ’s XRP ETF on the Toronto Stock Exchange, the significance of this event cannot be understated. This landmark development is being viewed as a major victory not just for XRP, but for the entire cryptocurrency ecosystem. The ETF, supported by Ripple, offers a zero-management fee structure, making it more approachable for both institutional and retail investors. Such accessibility represents a pivotal shift in the acceptance of cryptocurrency ETFs beyond the usual suspects like BTC and ETH.

As XRP gains traction and institutional backing, it signals a broader acceptance of alternative cryptocurrency ETFs. This influx of new investment vehicles can bolster trust in Bitcoin, potentially leading to an expansion of infrastructure and broader market participation.

🇨🇦 Another XRP ETF dropped in Canada!Crypto asset manager 3iQ just launched an #XRP ETF, under the ticker XRPQ, on the Toronto Stock Exchange.#Ripple is backing it as an early investor.💰XRP is getting the institutional treatment.🚀 pic.twitter.com/iUcK8vdZ18— Coin Bureau (@coinbureau) June 18, 2025

Why This Matters: A Step Toward Mainstream Acceptance

The launch of the XRPQ ETF suggests a maturing market for digital assets. By integrating offerings that appeal to both new and seasoned investors, the crypto landscape is becoming increasingly sophisticated. This development encourages an environment where Bitcoin can flourish, supported by institutional confidence in a diversified ETF market. As competition and choice increase, so does the likely long-term inflow of capital into legacy cryptocurrencies like Bitcoin.

Security Breach at Nobitex: A Wake-Up Call for Crypto Safety

In another vein of cryptocurrency news, Iran’s leading digital asset exchange, Nobitex, was recently targeted in a politically charged cyberattack, losing over $90 million. The orchestrated exploitation was executed by the pro-Israel group Predatory Sparrow, which leveraged internal vulnerabilities to drain assets and even burned cryptocurrencies like $2 million in BTC and over $49 million in TRX.

‘Pro-Israel Hacker Group’ Drains, Burns $90 Million From Iranian Bitcoin Exchange► https://t.co/CgaRgPzJfL https://t.co/CgaRgPzJfL— Decrypt (@DecryptMedia) June 18, 2025

Despite Nobitex reassuring its users that their losses would be covered and that services would be reinstated soon, this breach underscores a troubling dynamic in the volatile world of crypto. Even with cold storage measures in place, the incident exposes vulnerabilities that could affect investor sentiment and trust within the broader market.

Expert Opinions: Insights on Ethereum and Institutional Moves

Industry analysts have differing views on the implications of these events. Some note that while the Nobitex hack raises red flags about security, it hasn’t severely impacted BTC’s market behavior. Others emphasize that institutional buys, like Prenetics investing $20 million into Bitcoin, continue to demonstrate a strong appetite among corporate entities for crypto assets.

Prenetics: Expanding Bitcoin Horizons

In a notable development that adds bullish momentum to Bitcoin’s narrative, Prenetics, a Hong Kong-based healthcare entity, has made headlines by investing $20 million into Bitcoin, acquiring over 187 coins at an average price of $106,712. This strategic move includes bringing on board notable crypto advisors such as Tracy Hoyos Lopez and former OKEx COO Andy Cheung, as Prenetics positions itself for deeper integration into the crypto world.

JUST IN: 🇺🇸 Healthcare firm Prenetics buys $20 million worth of BTC and adopts #Bitcoin treasury strategy. pic.twitter.com/sDfWeO7Ev7— Bitcoin Magazine (@BitcoinMagazine) June 18, 2025

Future Outlook: What Lies Ahead for Bitcoin

With Bitcoin hovering around $104,773, technical analysis reveals a crucial decision zone marked by a convergence of market signals. Recent movements indicate a potential breakout if prices exceed $105,530—catalyzing an upward trajectory toward $106,650 and $107,750. Conversely, a slip below $103,500 could redirect focus toward $102,180 and $100,450. As traders watch for crucial confirmations, the Bitcoin market remains resilient despite mixed signals.

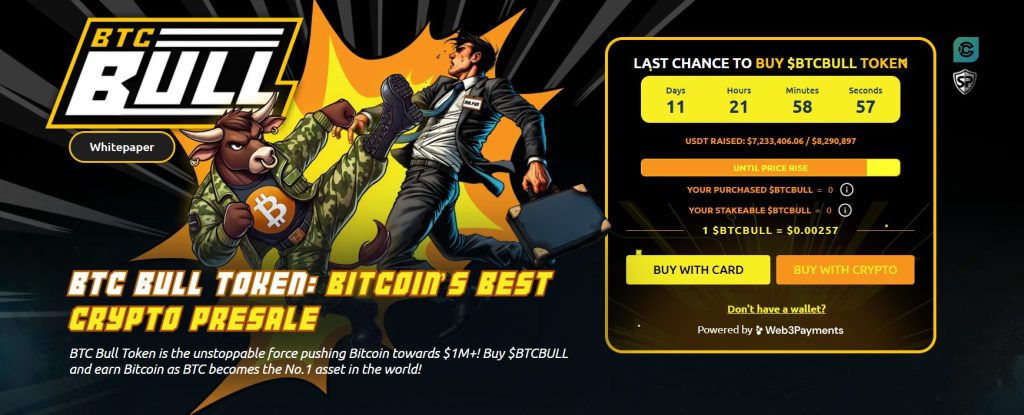

BTC Bull Token: Driving New Opportunities

Investor interest is also turning towards altcoins, particularly the BTC Bull Token ($BTCBULL). With nearly $7.2 million raised out of an $8.29 million cap, this project is garnering attention as it approaches its closing window. Currently priced at $0.00257, the BTC Bull Token offers an intriguing proposition with mechanisms tied directly to Bitcoin’s performance, including BTC airdrops for holders and automatic supply burns when Bitcoin hits certain price thresholds.

Conclusion: The Crypto Landscape is Evolving

The cryptocurrency space is witnessing remarkable transformations, evidenced by the launch of new ETFs, significant institutional investments, and ongoing cybersecurity challenges. As analysts weigh in on the potential for growth, the developments around Bitcoin and its surrounding ecosystem continue to signal a robust future. Are you ready to dive into the dynamic world of cryptocurrency? Engage with us and share your thoughts on these exciting shifts!