Binance Takes the Lead in Stablecoin Reserves: A Closer Look

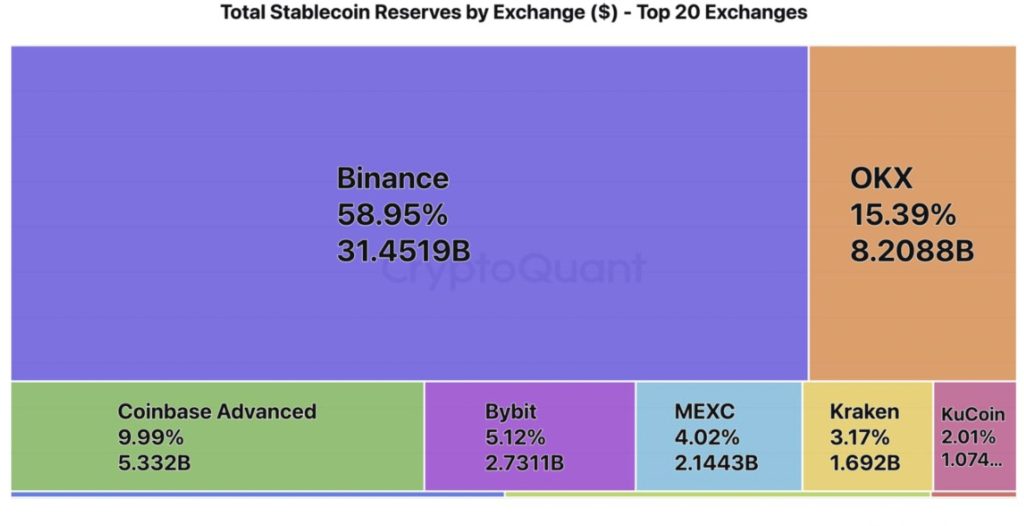

In a striking demonstration of its dominance, Binance has emerged as the powerhouse in the cryptocurrency exchange arena, boasting the largest stash of stablecoins among its competitors. The latest data from CryptoQuant unveils that Binance holds a staggering 59% of the total stablecoin reserves across the industry, translating into an impressive $31 billion in USDT and USDC. This significant liquidity gives Binance a competitive edge, attracting traders who utilize stablecoins as a form of ready cash for swift and seamless transactions.

Why This Matters: The Implications of Binance’s Dominance

Having such a significant share of stablecoin reserves is not just a number on a balance sheet; it has profound implications for the entire cryptocurrency market. Stablecoins act like cash reserves, allowing traders to maneuver swiftly between various assets without needing to convert back to fiat currencies. Binance’s robust position means it can provide excellent liquidity, making it more attractive for both retail and institutional traders.

With $31 billion in deposits recorded in May alone, Binance outpaced Coinbase, which attracted $30 billion during the same month. This trend reaffirms Binance’s strong appeal as a trading platform, especially in an environment where traders are keenly focused on liquidity and transaction efficiency.

Expert Opinions: Insights from Industry Analysts

Cryptocurrency analysts perceive Binance’s success as a result of both its strategic positioning and transparency efforts. As one analyst noted, “The sheer volume of stablecoins held by Binance is indicative of trader confidence. More liquidity often translates to better prices and lower volatility, a welcome aspect for anyone looking to trade actively.”

Furthermore, Binance’s commitment to transparent practices, specifically its publication of Proof-of-Reserves (PoR) reports, allows traders to verify its holdings on-chain. This transparency builds trust in an industry often scrutinized for compliance and security issues, offering a significant advantage over others that lack such comprehensive reporting.

🔥 Future Outlook: What Lies Ahead for Binance and the Crypto Market?

As we look ahead, the trajectory of Binance’s growth seems poised to climb even higher. Given the firm’s continuous stream of stablecoin inflows, combined with rising Bitcoin activity, analysts predict that Binance is set to solidify its stronghold in the market. Notably, as Bitcoin approached its staggering $112,000 peak, the average deposit to Binance surged to 7 BTC—leading all exchanges in Bitcoin scores for the month.

This robust activity from institutional “whales” indicates a clear preference for Binance, which, combined with its impressive stablecoin reservoir, positions the exchange as a cornerstone of global crypto liquidity. As more participants enter the market, Binance’s role could expand even further, reshaping the competitive landscape.

Conclusion: A Dominant Force in Cryptocurrency

In summary, Binance’s remarkable capture of stablecoin reserves not only enhances its liquidity but also strengthens its overall position within the cryptocurrency exchange ecosystem. While Coinbase currently leads in total reserves, Binance’s strategic adoption of transparency measures and consistent capital influxes highlights its resilience as a formidable contender.

As the crypto landscape evolves, observers will be keen to see how Binance navigates challenges and maintains its dominance. What do you think? Will Binance continue to lead, or do you see another challenger rising in this dynamic market? Join the discussion below!