In the fast-paced world of cryptocurrency, every subtle movement in the market can signal significant changes ahead. Recently, Binance’s visionary founder, Changpeng “CZ” Zhao, stirred excitement by highlighting a noteworthy trend: the CoinMarketCap’s Altcoin Season Index is on the rise, suggesting that an altcoin rally could be just around the corner.

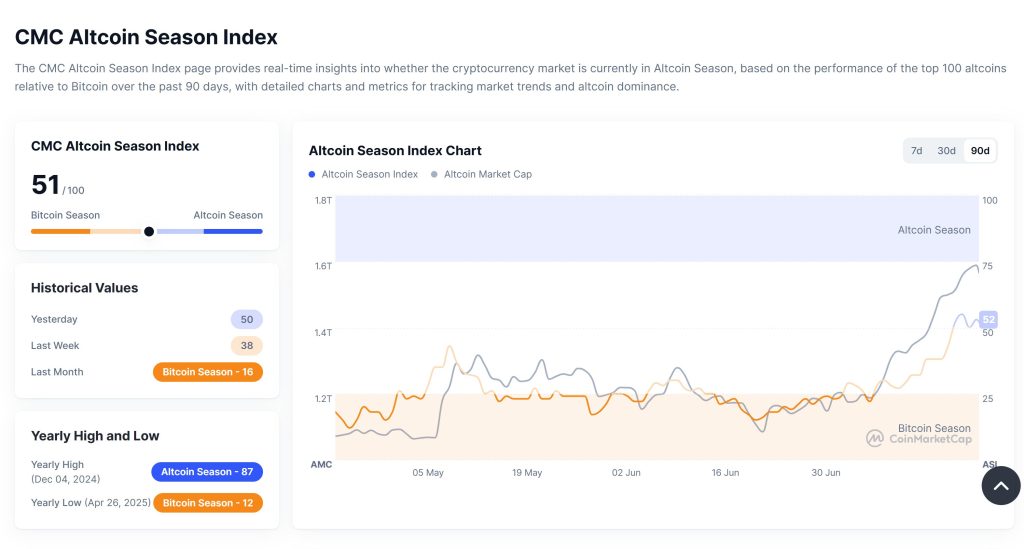

Imagine this: as Bitcoin, the king of cryptocurrencies, has begun to take a backseat, altcoins are starting to accelerate, capturing the attention of traders hungry for new opportunities. With the Altcoin Season Index climbing to 51—up from a mere 16 just a month ago—the stage is set for potential FOMO (Fear of Missing Out) that could propel altcoins to new heights.

Why should you pay attention to this? A rising Altcoin Season Index indicates a shift in market sentiment—a pivot away from Bitcoin dominance, suggesting that investors are looking beyond the leading crypto asset. When the Index surpasses 75, it officially declares an “Altcoin Season,” where at least 75 of the top 100 altcoins have outperformed Bitcoin over the previous three months. While we’re not there yet, the climb to 51 reflects a growing interest in alternative digital assets.

Historically, the trajectory of crypto markets suggests a cyclical pattern: first, Bitcoin rallies, generating bullish sentiment that breathes life into the broader market. Then, the spotlight turns to Ethereum and altcoins, often fueled by innovative projects, speculative narratives, and increased developer engagement. For instance, during the 2021 altcoin season, many altcoins surged by over 170% compared to Bitcoin’s modest 2% increase during the same time frame.

Recent observations suggest we may be witnessing this trend again. Ethereum has soared by 110% over the past 90 days, while meme coins, which have captured the public’s imagination, have posted astonishing gains: BONK is up by 148.7%, and FLOKI 119.1%. Even lesser-known projects like PENGU and M have experienced incredible growth, exceeding 500% in gains as of CoinMarketCap’s latest statistics. This revival of altcoins paints a vibrant picture of the current market dynamics.

However, amidst the rising tide of altcoins, Bitcoin is grappling with a significant decline in dominance, plummeting by 5.8% in just one week to below 61%—its lowest level since March and the most considerable drop since June 2022. This has coincided with a notable increase in the overall cryptocurrency market cap, which has surged from $3 trillion to approximately $3.8 trillion in just three weeks. The narrative is clear: investors are shifting their focus and reallocating funds toward altcoins, particularly Ethereum.

Yet, caution remains. As one X user, Henry, wisely pointed out, many indicators commonly associated with the start of an “altseason” have yet to trigger. With Bitcoin still commanding a substantial market share and the Altcoin Season Index just halfway to a critical threshold, the excitement may be premature. A measured approach might be necessary as the market navigates these turbulent waters.

Everyone is saying ALTSEASON has started but if you look at indicator they say ~ Not yet. Out of 30 bull market top indicators, not a single one has triggered. • Bitcoin dominance is still high at 61% • Altcoin Season Index is sitting at 51/100 (needs to hit 75+) • Puell,… @LordOfAlts

So, where are we headed? The current landscape suggests that while altcoins are gaining traction and momentum, it’s essential to watch how these developments unfold. Will we see a full-blown altseason, as many speculate, or is patience the name of the game? One thing is certain: as the cryptocurrency market continues to evolve, staying informed is crucial. Are you ready to dive into the next chapter of crypto trading, or will you wait to see how the dust settles? The choice is yours!