In a bold move that signals its commitment to a modernized and regulated cryptocurrency landscape, Australia’s securities regulator has officially classified a range of digital assets— including stablecoins, wrapped tokens, tokenized securities, and digital wallets—as financial products. This pivotal decision comes from the Australian Securities and Investments Commission (ASIC), which has set a pathway for service providers by requiring them to obtain licenses to operate in this burgeoning sector, while also granting an eight-month transition period for compliance. This could reshape how Australia’s digital economy functions and spark innovation in the financial services sector.

In a recent statement, ASIC Commissioner Alan Kirkland noted, “Distributed ledger technology and tokenization are reshaping global finance.” This regulatory clarity allows firms to navigate the landscape with confidence, promoting a more secure and structured environment for both providers and consumers. The new guidance, introduced on a Wednesday, also includes a sector-wide no-action position effective until June 30, 2026, giving companies an adequate timeframe to adapt to these significant changes.

As part of its updated Information Sheet 225, ASIC clarified that many of the popular digital assets traded on exchanges will be categorized as financial products under existing laws. This classification means that any service provider dealing with these assets must secure an Australian Financial Services license, ensuring consumer protections are in place and enabling ASIC to enforce actions against any harmful practices. Crucially, while ASIC can take historical conduct into account under its current no-action position, it will remain vigilant against egregious behaviors that cause substantial consumer harm or systemic misconduct.

Moreover, the regulator has proposed extending omnibus account structures for digital assets under specific conditions, modifying existing custody standards to better accommodate holdings based on blockchain technology. This move follows ASIC’s earlier practical relief initiatives aimed at supporting the Reserve Bank of Australia’s Project Acacia, which explores the potential of wholesale tokenized asset markets.

🇦🇺 Australia’s central bank progresses Project Acacia CBDC testing with 24 industry participants conducting real-money transactions as potential economic gains reach AU$19B annually.#CBDC #Australiahttps://t.co/r5LIhbazpc— Cryptonews.com (@cryptonews) July 10, 2025

The push toward a comprehensive digital asset regulatory framework comes alongside the Australian government’s broader reforms aimed at digital asset platforms. Recently released draft legislation proposes strict penalties of up to 10% of annual turnover for platforms that breach new regulations. Under these proposed rules, exchanges and operators will be required to obtain Australian Financial Services licenses, with potential fines reaching A$16.5 million, three times the profits obtained from misleading conduct, or 10% of annual turnover for engaging in unfair contract terms.

💸 Australia is set to slap crypto platforms with fines as steep as 10% of turnover under tough new draft rules, the Treasury said Thursday.#Australia #CryptoRegulation https://t.co/eVdrLlJgnd— Cryptonews.com (@cryptonews) September 25, 2025

The consultation period for these robust draft laws closed on October 24, marking a significant development in the regulation of an industry featuring major international players such as Coinbase and Kraken. Interestingly, smaller platforms with under A$5,000 per customer and processing less than A$10 million in annual transactions are exempt from full licensing requirements, allowing them to operate with fewer barriers.

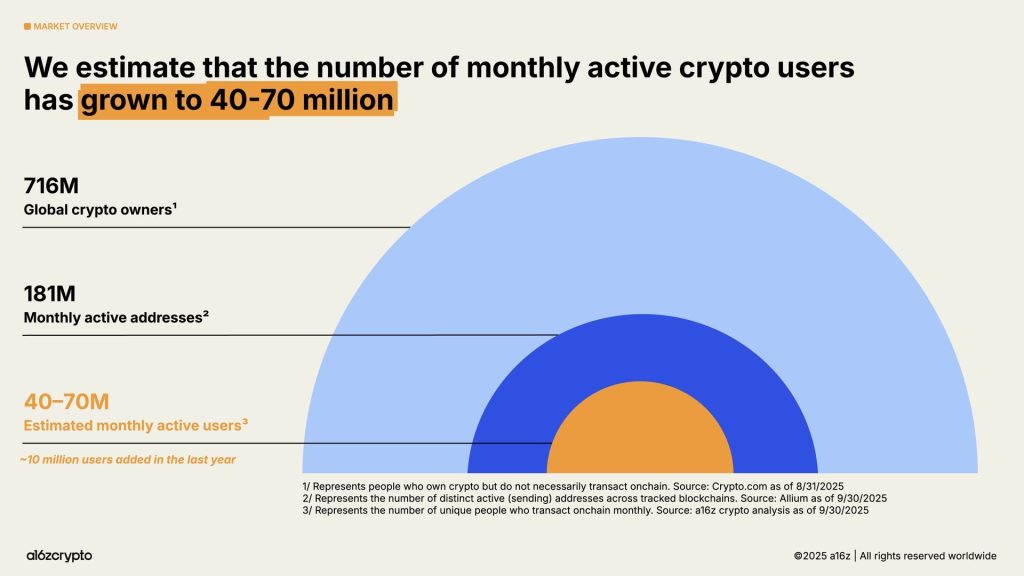

Treasury officials have expressed that the new regime will integrate digital asset and tokenized custody platforms into the Corporations Act. This shift will extend consumer protections while establishing formal licensing requirements, illustrating regulators’ delicate balancing act of fostering innovation while safeguarding investors in a rapidly evolving market. Notably, Australia has seen a significant uptick in cryptocurrency adoption, reaching 31% in 2025 compared to 28% the previous year, according to a16z’s State of Crypto 2025 report.

Australia’s evolving regulatory landscape for digital assets signals a promising era for innovation and investor protection.

On the horizon, ASIC has granted class relief for intermediaries involved in the distribution of stablecoins issued by licensed Australian Financial Services providers. This relief allows them to operate without the necessity of acquiring separate market, clearing, and settlement licenses until June 2028. Catena Digital Pty Ltd has already emerged as the first qualified issuer with its AUDM stablecoin, with subsequent relief plans aimed at addressing commercial viability concerns from the industry. Distributors are required to provide Product Disclosure Statements to retail clients, a critical step towards ensuring consumer protection while easing operational hurdles.

🇦🇺 Australia’s crypto adoption hits 31% outpacing other developed nations as stablecoins power $46T in transactions and crypto market cap crosses $4T globally.#Australia #Crypto #Adoption https://t.co/ujNdEiEQDn— Cryptonews.com (@cryptonews) October 24, 2025

Australia is witnessing a remarkable growth spurt in cryptocurrency adoption. As highlighted in the a16z’s State of Crypto 2025 report, the nation, alongside South Korea, leads developed countries in token-related web traffic. What’s particularly fascinating is that Australian adoption appears more focused on trading and speculation compared to other markets. Self-managed superannuation funds now represent a considerable segment of the pension system, with their crypto exposure skyrocketing sevenfold since 2021 to A$1.7 billion across Australia’s massive $2.8 trillion pension pool.

In response to this shift, major cryptocurrency exchanges are accelerating their efforts within Australia’s retirement sector. Notably, Coinbase is poised to introduce a dedicated SMSF service, boasting over 500 investors on its waiting list, thus illustrating the vibrant interplay between regulation and innovation in Australia’s crypto landscape.

In conclusion, the regulatory changes initiated by ASIC and the Australian government are not just about compliance; they represent a significant opportunity for growth and innovation in the digital asset space. As these reforms take shape, we may see a more vibrant, secure, and innovative market emerge, fostering greater trust among consumers and paving the way for a dynamic financial future.