AURA Price Skyrockets: What’s Behind the Meme Coin Resurgence?

After a lengthy period of dormancy, AURA has made an explosive comeback, skyrocketing nearly 60 times in value within just 24 hours. This astonishing rise has drawn parallels to the meme coin frenzy that encapsulated the crypto market in late 2024. With retail investors once again pouring their capital into meme coins, AURA has positioned itself at the forefront of the crypto conversation.

The dramatic surge is strikingly contrasted by a steady decline that followed the market’s mid-April plateau, marking a pivotal moment in this cryptocurrency’s trajectory. This revitalization coincides with growing optimism regarding regulatory clarity in the United States. Key figures such as SEC Chair Paul Atkins and Brian Quintenz, the Trump administration’s pick for the CFTC, have both expressed unequivocal support for the crypto industry, adding a layer of legitimacy to this revival.

🚨 Caution: Hurdles Ahead for the AURA Rally

However, not everyone is convinced by the recent developments. David, a notable cryptocurrency fraud watchdog, has issued a stern warning, labeling AURA’s sudden upswing as an “Expert SCAM” in a thread on X. He dissected various factors contributing to this concern:

🧵(1)🚨SCAM ALERT NO 1004 – FULL REPORT #CryptoScam #MemeCoinScam #RugPull 🔵aura, $aura $DtR4D9FtVoTX2569gaL837ZgrB6wNjj6tkmnX9Rdk9B2 Rating: Level 3 – Expert SCAM ⛔️ Very old coin, created over 1 year ago ⛔️ Rugged from $70M MC to $500K, suddenly pumped today – no clear reason… pic.twitter.com/zTEEzD3HWf— David Crypto Scam Hunter (@CryptoScamHuntO) June 10, 2025

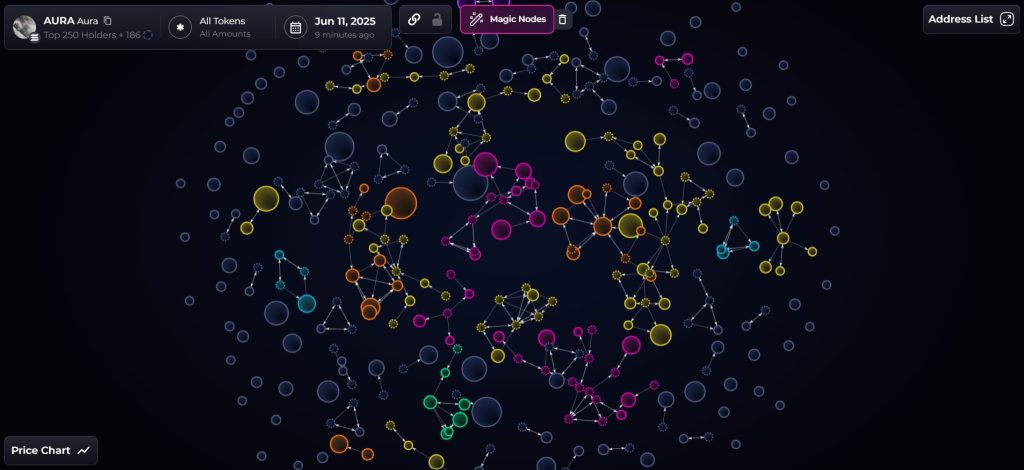

David’s analysis criticized AURA for its lack of transparency and tangible utility. With no verifiable partnerships and an absence of influencer backing to rationalize its rapid climb, concerns are mounting. Additionally, suspicious trading patterns have emerged, particularly an abrupt buying surge around 6 PM UTC, which raises the possibility of manipulation rather than genuine market interest.

Moreover, wallet concentration issues signal a cause for alarm. David pointed out the bundling of tokens into new wallets on the very day of the rally—a behavior often associated with deceptive practices like rug pulls. This bundling tactic obscures true ownership and could mislead new investors.

🧐 AURA Price Analysis: Is the Peak in Sight?

An analysis of AURA’s price movements suggests that the rally may soon hit a ceiling. As buying pressure begins to wane, profit-taking and panic selling might loom on the horizon, potentially turning latecomers into exit liquidity. With the Relative Strength Index (RSI) soaring to an extreme level of 99.87—well beyond the typical overbought threshold of 70—analysts foresee an imminent correction.

Resistance is building around the $0.060 mark, a level that previously marked AURA’s peak in late 2024. Should buyers struggle to break through this barrier, we could witness a steep correction of about 40%, reverting to the 0.5 Fibonacci retracement level around $0.032—often a common consolidation zone after a spike.

Yet, there remains a glimmer of hope. If AURA can stabilize above $0.063 with increased trading volume, it might propel upwards to its next target of $0.10—yielding an 80% rise aligned with the 1.618 Fibonacci extension. Still, traders should tread cautiously, as recent developments raise red flags about potential rug pulls and supply centralization.

📌 Why This Matters

The sudden resurgence of AURA serves as a microcosm of the volatility and unpredictability in the meme coin market. Such dramatic price movements not only draw in retail investors but also trigger warnings from experts about the risks of speculative trading. This situation underscores the importance of due diligence in the crypto realm, where facts can often be obscured by hype and uncertainty.

🔥 Expert Opinions: What Analysts Are Saying

Market analysts are divided on the AURA situation. While some echo cautionary remarks from watchdogs like David, others suggest that the potential for significant profits could be too enticing for traders to ignore. Many analysts encourage investors to focus on trading volume, market sentiment, and the broader regulatory landscape, as these factors can influence price movements profoundly.

🚀 Future Outlook: What Lies Ahead for AURA?

Looking ahead, the future of AURA remains uncertain. As the market shifts and adapts to regulatory developments, tokens like AURA could experience wild fluctuations. Investors should remain vigilant, constantly reassessing their strategies in light of ongoing news and technical analysis.

For those willing to navigate this high-stakes environment, tools like trading bots may provide a crucial edge. Enter Snorter ($SNORT), a specialized Telegram trading bot designed to help users capture opportunities before they fade away. This innovative tool promises to enhance the trading experience, allowing users to engage in limit orders, copy trading, and even providing rug-pull protection.

With the crypto market’s current state, timing could mean the difference between soaring gains or heart-wrenching losses. Snorter’s rapid rise in popularity—having raised nearly $700,000 in its initial presale—indicates a keen demand for its protective and proactive features.

🔚 Conclusion: What Are Your Thoughts?

The meteoric rise of AURA has sparked discussions across the crypto community—some are thrilled by the potential of meme coins, while others express skepticism rooted in caution. As traders and investors, what do you think lies ahead? Will AURA maintain its momentum, or will it be a cautionary tale of speculation gone wrong? Share your thoughts in the comments below!