Bitcoin Holds Its Ground: Current Trends and Insights

As we delve into the latest happenings in the cryptocurrency universe, Bitcoin (BTC) showcases remarkable resilience, hovering near the $93,628 mark as of April 25. Despite a slight dip of 0.5% during the Asian trading session, the overarching trend remains remarkably positive. This sustained strength is underscored by surging institutional interest, with significant players like BlackRock leading the way.

Recently, BlackRock, recognized as the largest asset management firm globally, has bolstered its Bitcoin holdings by an impressive 12,500 BTC, approximately valued at $327.3 million. This escalates its total Bitcoin exposure to around $1.16 billion, highlighting a growing confidence in Bitcoin not just as a digital asset, but as a reliable treasury asset and a hedge against macroeconomic fluctuations.

📌 Why This Matters: The Expanding Institutional Confidence in Bitcoin

The increasing institutional investments in Bitcoin signal an essential shift in how cryptocurrencies are perceived. With institutional giants stepping into the arena, Bitcoin is starting to gain recognition as a legitimate store of value, much like gold. The current trading price of Bitcoin still remains approximately 40% below its estimated intrinsic value of $130,000, as suggested by Charles Edwards of Capriole. This discrepancy indicates a potential for substantial long-term growth and value adjustment in the future.

📆 SEC Delays Polkadot ETF Decision: What’s the Impact?

Turning our focus to regulatory affairs, the U.S. Securities and Exchange Commission (SEC) has postponed its decision regarding Grayscale’s Polkadot (DOT) ETF proposal, now slated for a verdict on June 11, 2025. This delay is part of a broader evaluation that encompasses more than 70 cryptocurrency fund proposals, including those for XRP, Solana, and Dogecoin.

🚨 NEW: SEC Delays decision on Polkadot ETF. The SEC has extended its review of Nasdaq’s proposal to list the Grayscale Polkadot Trust ($DOT) and will make a final decision by June 11th. pic.twitter.com/SwgGgTQLM0— Cointelegraph (@Cointelegraph) April 24, 2025

As these delays persist, the tone of regulatory policy seems to be shifting towards a more accommodating stance. Increasing institutional interest coupled with growing political pressure hints at an imminent breakthrough for ETF approvals in the cryptocurrency market.

🔄 Regulatory Shifts: A New Era for U.S. Banks and Cryptocurrencies

In a groundbreaking move, the regulatory framework surrounding cryptocurrencies is evolving in the United States. The Federal Reserve, alongside the FDIC and OCC, has rescinded previous guidelines that mandated banks to seek prior approval for engaging in cryptocurrency activities. This strategic withdrawal of four admonitions from 2022 and 2023 aims to eliminate the obstacles that have historically stifled banking involvement in the crypto sector.

🏦💱📉 U.S. Regulators Roll Back Crypto Caution Memos in Shift Toward Industry-Friendly Stance: U.S. banking regulators, including the Federal Reserve, FDIC, and OCC, have withdrawn key guidance documents that had urged banks to seek prior approval and exercise… pic.twitter.com/vyQ9a9LwSc— PiQ (@PiQSuite) April 24, 2025

This regulatory easing promises to diminish friction for institutions, enabling both traditional and crypto-native firms to more readily adopt Bitcoin. As barriers lower, we can expect an uptick in demand for cryptocurrencies, contributing to market stability in the long term.

🔥 Expert Opinions: ARK Invest’s Bold Bitcoin Forecast

In a captivating update, ARK Invest has forecasted that Bitcoin could soar to a staggering $2.4 million by the year 2030, under an optimistic scenario. Their analysis outlines the base and bear case figures adjusted to $1.2 million and $500,000, respectively. This ambitious projection is grounded in three core themes:

- Institutional Allocation: The increased involvement of asset managers and corporate treasuries is a significant factor.

- Digital Gold Narrative: Bitcoin holds potential to capture a substantial portion of gold’s vast $18 trillion market cap.

- Emerging Market Demand: Bitcoin is increasingly viewed as a store of value in countries grappling with inflation.

JUST IN: ARK Invest updates their 2030 #Bitcoin price prediction to $2.4 million 🚀 pic.twitter.com/aWWdE6HsNx— Bitcoin Magazine (@BitcoinMagazine) April 24, 2025

If ARK’s most optimistic projection materializes, it could result in a Bitcoin market capitalization of $49 trillion—greater than the combined GDP of the U.S. and China!

📈 Bitcoin Technical Analysis: Is the Breakout Sustainable?

Currently, Bitcoin is navigating within a crucial resistance zone just shy of $94,750—the 0% Fibonacci level following a rally from $88,461 to $94,758. The ongoing price movement remains within an ascending channel, with the 50-period EMA sitting at $91,398, providing dynamic support. However, cautious analysts note that the MACD histogram is showing signs of tapering, which may indicate potential fatigue in momentum.

Bitcoin Trade Setup:

- Buy Entry: Above $94,750 on robust bullish volume.

- Targets: $96,150 and $97,500.

- Stop Loss: Below $92,800.

Pro Tip: This situation embodies a classic “pullback and retest” setup; be sure to wait for a candle and volume confirmation to validate your entry and avoid chasing weak breakouts.

🔮 Conclusion: Navigating the Future of Bitcoin and Crypto Markets

As Bitcoin maintains its footing above the $93,000 threshold, bolstered by a surge of institutional investment and increasingly favorable regulatory conditions, the future seems ripe with potential. While ARK Invest’s forecast of $2.4 million appears ambitious, the narrative surrounding Bitcoin’s scarcity, adoption, and correlation with macroeconomic trends remains compelling.

As the cryptocurrency market evolves, the upcoming months could well indicate whether Bitcoin enters a transformative new era or finds itself stymied at critical resistance levels. Regardless of where you stand on the bullish-bearish spectrum, it’s clear that this dynamic situation calls for attention and analysis from both supporters and skeptics alike.

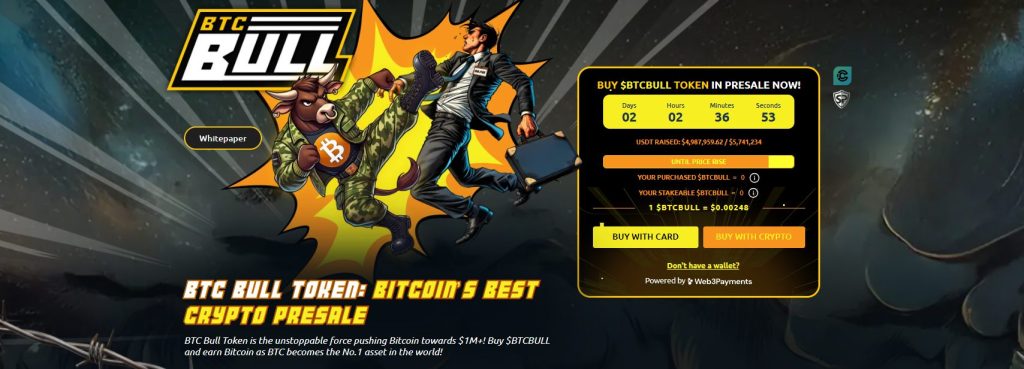

🚀 BTC Bull Token Approaches Milestone: Staking Trends Catch Fire

In related news, investor enthusiasm for the BTC Bull Token ($BTCBULL) continues to rise, with the Ethereum-based venture nearing a significant fundraising milestone. As of Thursday, the presale has amassed $4,987,959.62, bringing it close to its next pricing threshold set at $5,741,234. Currently priced at $0.00248, potential buyers are finding a narrow window to jump in before the next price adjustment.

💼 Why BTCBULL Stands Out in the Crypto Landscape

Unlike typical meme coins, BTCBULL features a utility-centric approach. The project’s staking mechanism proposes an eye-catching 83% annual yield alongside distributions linked to Bitcoin, all while allowing stakers to access their tokens at their convenience, without arduous lockups or withdrawal delays.

Current Staking Stats:

- Total Tokens Staked: 1,268,011,229 BTCBULL

- Annual Yield: 83% APY

- Unstaking: Anytime access

This hybrid structure merges yield generation with the potential for price appreciation, offering a unique entry point for users in a rapidly changing meme token landscape. As the funding goal nears completion, an anticipated increase in the token price may be just around the corner.

In summary, whether following Bitcoin’s ambitious trajectories or exploring innovative token structures like BTCBULL, now is a pivotal moment for those engaged in the cryptocurrency space. What are your thoughts on Bitcoin’s prospects or the rise of new tokens? Let us know in the comments!