Bitcoin (BTC), the flagship cryptocurrency, is experiencing a noteworthy shift in its market power. Recent data from Glassnode highlights a sharp decline in Bitcoin’s market capitalization dominance, plummeting from 63.76% to 60.78% within just a week. This remarkable 2.98 percentage point drop marks one of the steepest declines of the year, signaling a pivot toward altcoins as investors diversify their portfolios.

#Bitcoin dominance fell from 63.76% to 60.78% over the past week – a 2.98 percentage point drop. One of the sharpest weekly declines this year, as capital rotated into altcoins. pic.twitter.com/aPpZtZsTQ9— glassnode (@glassnode) July 22, 2025

Interestingly, as of the latest updates, Bitcoin’s dominance has seen a slight recovery, bouncing back by about 0.5%. Yet, this resurgence comes amidst a broader trend indicating that institutional investors are increasingly eyeing altcoins. According to Mati Greenspan, the CEO of Quantum Economics, while traditional Bitcoin ETFs witness some outflows post a historic rally, there is a surging institutional interest directed toward coins like Ethereum (ETH), Solana (SOL), and Ripple (XRP).

Greenspan notes that an essential indicator to monitor the potential “altcoin season” is the fluctuation in Bitcoin dominance. “Just a month ago, Bitcoin dominance hovered around 66%. Fast forward to this week, and it nearly dipped to 60%, showcasing a noticeable shift in investor sentiment,” he explained. “The takeaway? After a lengthy period where Bitcoin held center stage, altcoins are making a triumphant return.”

Supporting this perspective, Danny Nelson, an analyst at Bitwise Asset Management, remarked that Bitcoin’s recent performance, coupled with Ethereum’s resurgence, has rekindled interest in various altcoin sectors. “At Bitwise, we’ve certainly observed an uptick in inquiries regarding Cardano (ADA), Ripple, Polkadot (DOT), Solana, and a host of other altcoins,” he shared. Greenspan adds that this diversifying behavior suggests a maturation of capital moving towards broader blockchain infrastructure, which could reshape the entire market landscape.

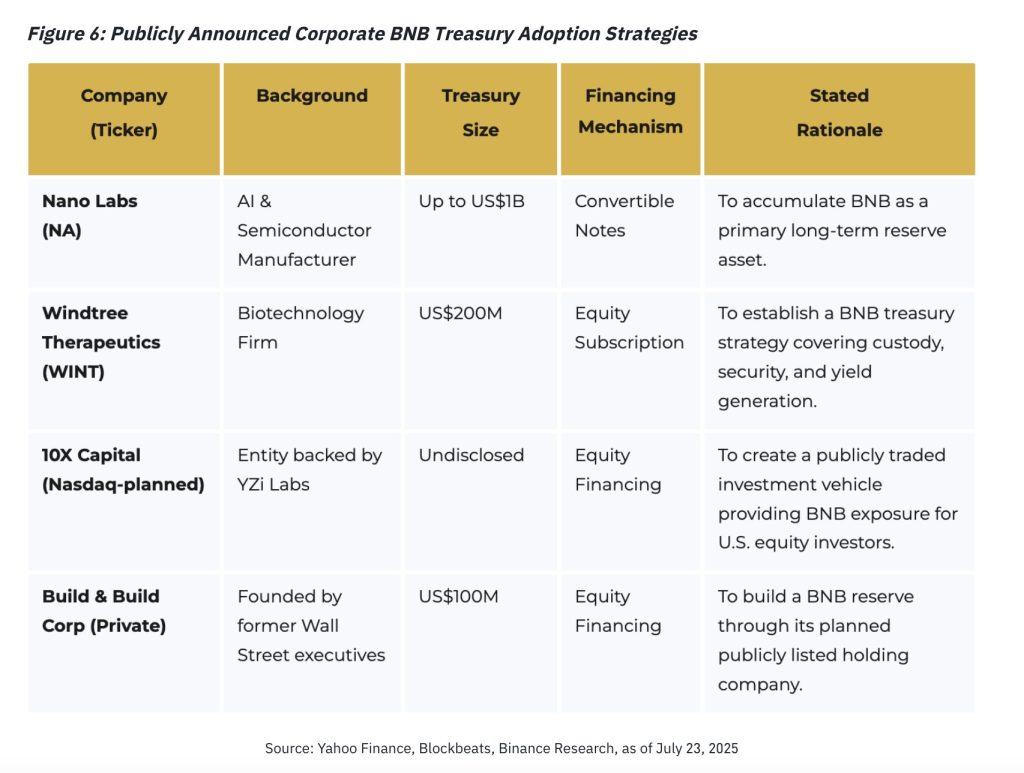

Indeed, altcoins are showing remarkable strength. Ethereum, buoyed by institutional inflows and a series of successful spot ETH ETFs, has seen over 100,000 ETH flow into these funds in recent weeks. Meanwhile, Binance Coin (BNB) has reached unprecedented heights, smashing through its previous all-time high of $794 and establishing a new peak above $800, contributing to a total market cap of $112 billion. This impressive feat has sparked interest in new “BNB Treasury” strategies among publicly traded companies aiming to leverage their treasury assets and enhance liquidity. Binance’s founder, CZ, revealed that more than 30 teams are exploring this savvy approach.

Yet, not all analysts share this optimism. While institutional interest is apparent, Nelson expresses caution, stating, “I’m skeptical that institutions are truly fueling an altcoin upswing.” He argues that despite the notable progress in the crypto industry throughout 2025, there remains a lack of robust frameworks for institutional capital to flow seamlessly into altcoins. He asserts that a breakthrough will only come with the introduction of more altcoin exchange-traded products (ETPs).

Jake Claver, CEO and Founder of Digital Ascension Group, speculates that once Bitcoin ETFs witness a major rotation, other altcoins like XRP may also attract significant investment. However, the timeline for such changes may stretch longer than anticipated. Recently, the U.S. Securities and Exchange Commission (SEC) caused a stir by reversing its approval for Bitwise Asset Management’s crypto ETF, which had initially received a nod from the SEC’s Division of Trading and Markets.

Two theories from @JSeyff on why SEC is holding up Grayscale & Bitwise crypto index ETFs…I lean towards the latter theory. Both of these were approved by SEC Division of Trading & Markets and then immediately stayed. Doesn’t make sense. via @isabelletanlee @nicola_m_white pic.twitter.com/UdmGG6TF9H— Nate Geraci (@NateGeraci) July 23, 2025

As it stands, following intense fluctuations, the crypto market is currently witnessing a correction phase. Greenspan notes that while Bitcoin holds steady near its all-time highs, many altcoins are pulling back after significant gains from the past week. “This correction seems natural after the substantial rally we’ve experienced,” he commented.

Alex Tapscott, managing director of Ninepoint Digital Asset Group, believes that if Bitcoin’s dominance continues to wane, we could indeed see a genuine altcoin season unfold. However, he cautions that this may also temper Bitcoin ETF inflows, as capital seeks out diverse assets. “The interplay within crypto is inherently reflexive—any influx into crypto assets, whether from ETFs or corporate investments, generally strengthens the ecosystem as a whole,” Tapscott concluded. “Access to invest in cryptocurrencies has never been more democratized than it is today.”

As the altcoin narrative evolves, it remains crucial for investors and enthusiasts alike to stay informed and actively engage with this dynamic marketplace. The future looks promising, yet unpredictable—a thrilling adventurer’s playground for anyone with an eye for innovation and opportunity in the world of cryptocurrency.