🚀 Aave ($AAVE) Soars Past $300: What’s Driving This Phenomenal Surge?

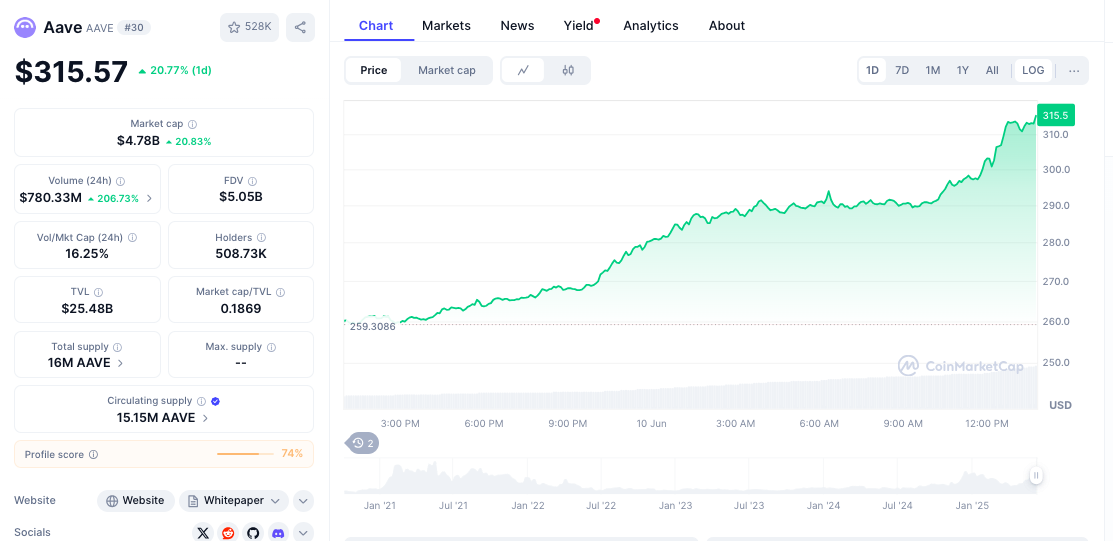

In an explosive display of market activity, Aave ($AAVE) has breached the $300 milestone, ascending a remarkable 20% as DeFi borrowing volumes surge to an impressive $17 billion. The momentum is not just a product of market speculation; it is being fuelled by significant developments in both decentralized finance (DeFi) and notable institutional interest, especially in light of partnerships involving figures connected to the political arena.

The Ethereum-based lending protocol now boasts a robust total value locked (TVL) of $26 billion, with the cryptocurrency climbing back into the top 30 by market capitalization at approximately $4.78 billion. Traders now eagerly anticipate further highs, setting ambitious targets around the $1,000 mark—contingent on the bulls maintaining their momentum.

📌 Why This Matters

Aave’s remarkable performance highlights an overarching trend within the cryptocurrency world: the shift toward risk-on assets. Investors, emboldened by Bitcoin’s recent rally to $110,000, are looking for new opportunities, particularly within the DeFi sector. As these platforms demonstrate their capabilities in lending and borrowing, they harness a growing user base eager to dive into decentralized financial solutions.

💡 Market Dynamics and Institutional Interest

The spike in Aave’s value correlates with high-profile engagements in the realm of digital finance. Recently, Aave’s founder, Stani Kulechov, visited the White House, discussing the importance of protecting DeFi innovations during his meeting with Donald Trump’s Executive Director of the Council of Advisers on Digital Assets. This visit may not only boost investor confidence but also bring mainstream attention to DeFi protocols, further legitimizing their role in the financial ecosystem.

It was a pleasure to meet today @BoHines at the @WhiteHouse and discuss @aave and how to protect DeFi innovation in the U.S. DeFi will win. pic.twitter.com/6WO8S71F2w— Stani.eth (@StaniKulechov) June 9, 2025

Institutional participation is another cornerstone of Aave’s current surge. World Liberty Financial (WLFI), a DeFi venture with connections to high-profile figures, recently borrowed $7.5 million USDT using Aave’s platform. Such activities demonstrate a growing comfort level among institutions in engaging with decentralized lending frameworks.

2 hours ago, World Liberty Finance (@worldlibertyfi) has:– Supplied 7,900 $ETH ($21M), 162.69 $WBTC ($17.91M), and 5,010 $stETH ($13.31M) on #Aave V3.– Borrowed $7.5M in $USDT from #Aave V3. pic.twitter.com/ASP3QH9UPY— Onchain Lens (@OnchainLens) June 9, 2025

🔥 Expert Opinions: Aave’s Future Potential

With strong fundamentals backing its performance, analysts are predicting a bright future for Aave. Notably, Ethereum proponents are increasingly vocal about the token’s potential. Analyst AltcoinRambo has boldly categorized Aave as a “true altcoin with real technological strength” and suggested a long-term target of $1,000 per token. While such predictions often stir excitement, they must be approached with caution due to market volatility.

Yo surely this $AAVE monthly chart is one of the most bullish on the planet? An actual altcoin with genuinely great technology, not too many of those around. $4B Marketcap, $25B TVL. Way way higher for @aave. $1K is the target. pic.twitter.com/jgN37VzRX5— Rambo (@AltcoinRambo) June 10, 2025

📈 Technical Analysis: Navigating Resistance and Overbought Indicators

Currently, Aave’s price action is revealing a bullish breakout from an ascending channel on the daily chart, but with the RSI (Relative Strength Index) sitting at a concerning 71.53, there are signs of an overbought scenario. Traders should consider the potential for a pullback before aiming for new highs.

Technical indicators suggest that immediate resistance is within the $350 to $364 range, a historically significant selling zone. If Aave can maintain its momentum, it could push toward this area, offering an 18.3% upside potential. However, traders should remain aware of emerging bearish divergences, where RSI signals lower highs while price action creates higher highs—an indication that upward momentum may be weakening.

🚀 Conclusion: Engage and Anticipate

Aave’s surge past $300 underscores the exciting possibilities that decentralized finance holds, particularly as it gains traction among institutional players and innovative minds in the regulatory sphere. As we watch the developments closely, it’s essential for investors to remain vigilant, assess their strategies, and engage in discussions that shape the future of this vibrant sector. Are you ready to take part in the evolving world of DeFi? Let us know your thoughts in the comments below!