Unveiling the Hidden Players of Cryptocurrency Schemes

In the complex and often turbulent world of cryptocurrency, a recent study has revealed a startling revelation: approximately 440 individuals are orchestrating artificial trading activities worth trillions. Conducted by researchers at Cornell University, this groundbreaking work highlights the grim reality of pump-and-dump schemes that plague the digital currency landscape.

The PERSEUS Tool: A Game Changer in Crypto Surveillance

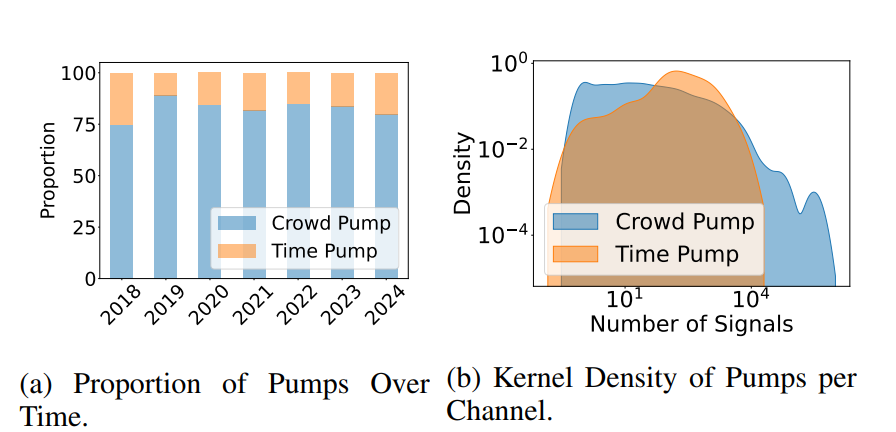

Researchers Honglin Fu, Yebo Feng, Cong Wu, and Jiahua Xu have introduced an innovative tracking tool named **PERSEUS**, specifically designed to detect and analyze the notorious pump-and-dump operations that frequently deceive investors. By monitoring these schemes, the team has categorized the players into two distinct roles: **masterminds**—the architects behind these manipulations—and **accomplices**, who carry out their bidding.

At the core of their research is the identification of these masterminds, who not only conspire but also execute strategies to artificially inflate asset prices, thereby enticing new investors. This manipulation often involves creating a facade of exuberance around a cryptocurrency to lure unsuspecting buyers, only for the masterminds to subsequently sell their holdings and leave others with significant losses.

Market Disruptions: The Extent of the Manipulation

The study reveals that the PERSEUS tool operated efficiently from **February 16 to October 9, 2024**, successfully identifying **438 masterminds** operating across **322 different cryptocurrencies**. This aligns with their findings that strength in numbers can exponentially amplify the impact of these schemes—one mastermind was even able to target **192 cryptocurrencies** simultaneously! Over the course of the analysis, these players contributed to a staggering **167% spike in trading volumes**.

As the dust settles, the report highlights Bitcoin (BTC) as the most frequently targeted asset, with five identified masterminds aiming to exploit its popularity—signifying the urgent need for tighter regulatory measures to protect investors.

Why This Matters: The Implications for Investors and Regulators

The findings are sobering. Scams of this nature not only undermine the integrity of the cryptocurrency market but also inflict devastating financial damage on average investors. The researchers noted that in 2023 alone, these manipulators are estimated to have swindled **$241.6 million** via decentralized exchanges (DEXs). This figure accounts for **10%** of the total trading volume, underscoring how rampant these schemes are, especially on centralized exchanges (CEX).

Understanding who these masterminds are and how they operate is crucial for regulators striving to safeguard investors and maintain a fair trading environment. The PERSEUS tool offers a new lens into the pandemic of pump-and-dumps, paving the way for enhanced oversight and accountability.

Expert Insights: Perspectives from Analysts

Industry analysts have voiced serious concerns regarding the implications of these findings. “The ability to pinpoint masterminds equips regulators with critical intelligence to combat fraud effectively. However, the persistent exploitation of cryptocurrency through these schemes calls for immediate action and stricter regulations,” states Dr. Elaine Moore, a cryptocurrency market expert.

Others suggest that a combination of technological innovation and proactive investor education could ultimately reduce the risks associated with such manipulative practices. “These schemes thrive in shadowy corners of the internet; transparency and awareness are key to dismantling their operations,” adds Johnathan Rice, a financial analyst focused on the crypto sector.

Future Outlook: How the Crypto Landscape May Evolve

As cryptocurrency continues to evolve, so too must our methods of safeguarding it. The ramifications of PERSEUS’s findings indicate a pressing need for innovation in both monitoring technologies and regulatory frameworks. Experts predict that the scope of manipulation will likely expand unless decisive measures are taken.

With this study, we may be at the threshold of a significant shift in how cryptocurrency is perceived and regulated. By leveraging tools like PERSEUS, we could see a future where market integrity is preserved, and investors can trade with more confidence.

The Bottom Line: Your Participation is Key

The revelations brought to light by this study serve as both a warning and a call to action. As the cryptocurrency market continues to develop, it is at the forefront of not just financial innovation but also massive scams that can induce catastrophic losses for unassuming traders.

Staying informed, utilizing reliable tools for tracking investments, and being wary of suspicious trading activities are essential for all participants in this vibrant but volatile market. We encourage readers to discuss their views on these findings and share their insights on how to fend off the shadowy figures attempting to manipulate the crypto space.

Let’s not allow the masterminds to hijack our financial future—stay vigilant, and engage with the community to safeguard your investments.