Imagine a future where buying shares in a private company feels as effortless as tapping your phone to purchase a stock. Gone are the days of daunting paperwork, restrictive minimum investments, and geographical barriers. With real-world assets like stocks, bonds, and real estate being tokenized and moved on-chain, we are inching closer to that reality. Recently, Coinbase Global made headlines by agreeing to acquire Echo, an investment platform, for nearly $375 million in cash and stock. This bold step is aimed at pioneering the way we think about blockchain-based capital formation. However, a significant challenge lurks beneath the surface: the existing infrastructure that tracks ownership records, verifies identities, enforces compliance, and manages investor onboarding often falls short.

In an age when trading interfaces and platforms evolve rapidly, the foundational systems remain disjointed and cumbersome. This inefficiency results in slower tokenized offerings, increased costs, and a fragmented experience that has kept the promise of accessible tokenized markets tantalizingly out of reach.

When a company sets its sights on tokenizing an asset, the excitement often centers around the flashy aspects: minting smart contracts, securing marketplace listings, or celebrating a successful fundraising milestone. But the real drama unfolds behind the scenes, where critical processes like cap-table management, identity verification (KYC), compliance workflows, and transfer coordination play out. Unfortunately, these critical components often operate in separate silos, akin to running a modern e-commerce business with disconnected cash registers.

This fragmentation isn’t just inefficient; it creates significant friction. Issuers face delays in launching offerings, increased risk of errors when trying to reconcile separate records, and ballooning compliance costs because of the reliance on manual checks. Investors, on the other hand, can experience sluggish onboarding processes, confusion over ownership rights, and even limited options for secondary market trading due to the convoluted navigation through various disconnected systems. Regulators are also caught in a bind, struggling with inconsistent audit trails that are difficult to monitor. In this perplexing landscape, despite billions in tokenized assets, trading volumes remain depressingly low, with most tokens gathering digital dust rather than changing hands.

In short, the bottleneck isn’t at the smart contract level or the marketplace listings; it lies in the infrastructure behind ownership tracking, asset transfers, and regulatory audits. Until these systems are interwoven into a cohesive framework, tokenization will struggle to transition from a niche pursuit to a robust market infrastructure.

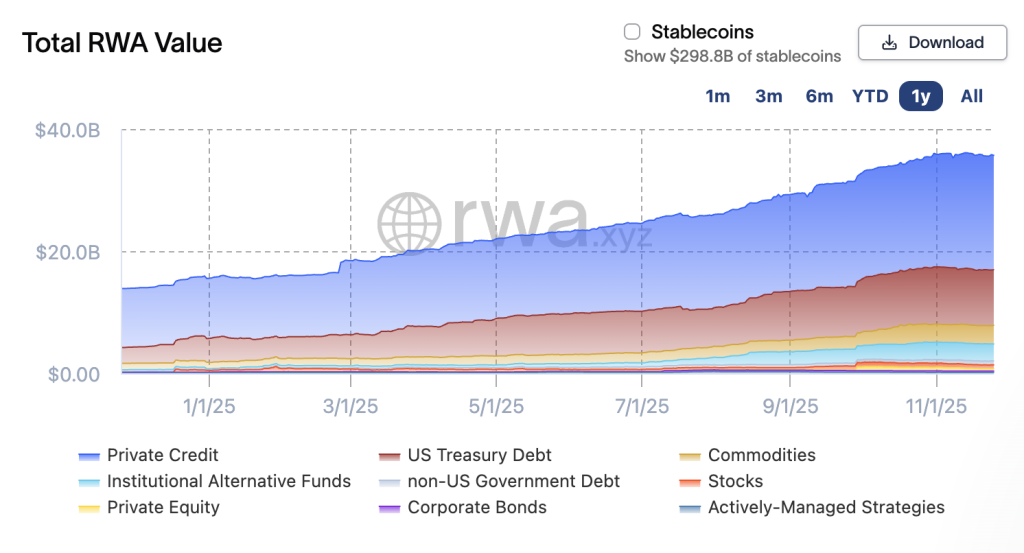

Source: rwa.xyz

To turn the vision of tokenized markets into reality, next-generation platforms must rise to the challenge. The real allure of these markets does not lie merely in the issuance of tokens but in the entire lifecycle: from issuance and onboarding to holding and trading, and finally to auditing and reporting. An efficient platform should connect all aspects seamlessly instead of applying temporary fixes across various systems. Imagine a workflow where issuers can log in, verify an investor’s identity, issue tokens that automatically update the cap table, embed compliance rules in the tokens, and generate audit-ready records in real time.

Consider how different this is compared to today’s reality, where investors must go through multiple systems to verify their identity, issuers update separated databases, and audits require manual reconciliations. This new model allows issuers to bring offerings to market promptly, with fewer errors and reduced costs, while investors enjoy smoother onboarding and transparency regarding their ownership. It also benefits regulators by providing them with real-time oversight and enhanced record-keeping.

When we achieve this integration, the impact on markets and investors could be transformative. Tokenized assets could become genuinely liquid, regulated, and easily accessible, allowing investors to access previously illiquid asset classes with lower barriers to entry and greater clarity. For issuers, the benefits would include expedited fundraising, a broader global investor base, and fewer operational hurdles. Importantly, this seamless infrastructure fosters transparency and trust, essential components for integrating on-chain assets with traditional financial systems.

Experts predict that the evolution of these systems could unlock trillions of dollars in tokenized value. However, without addressing the underlying infrastructure, tokenized assets may continue to underperform, being created and held but seldom traded. Consequently, the promise of digital finance—a more rapid, equitable, and inclusive investing landscape—may remain only partially realized.

In conclusion, the future offers the tantalizing possibility of a more efficient and inclusive investment process, but achieving this vision hinges on fixing the foundational elements of our financial systems. While tokens capture attention on the surface, the real transformation will occur in the shadows, where compliance, identity, and ownership come together harmoniously. Once we overcome these infrastructural hurdles, tokenized markets won’t just be a compelling concept; they’ll become an unstoppable force in finance.

**Disclaimer**: The views expressed in this article are solely those of the author and do not necessarily reflect the opinions of Cryptonews.com. This content is for informational purposes only and should not be construed as financial or investment advice.