In an exciting twist in the cryptocurrency landscape, Solana’s exchange-traded funds (ETFs) have skyrocketed in popularity, setting records and challenging market trends. This week, particularly on Monday, Solana ETFs racked up a staggering $58 million in daily net inflows, the best performance since early November. With this impressive tally, Solana has now chalked up 20 consecutive days of positive inflows, demonstrating remarkable resilience in a tumultuous market. Such sustained interest speaks volumes about Solana’s potential and growing acceptance among investors.

the unbroken streak of daily inflows to the solana etf (topped off by a record day of inflows) is greatly under appreciated.thank you for your attention to this matter https://t.co/8ItbDL85JO— raj 🖤 (@rajgokal) November 25, 2025

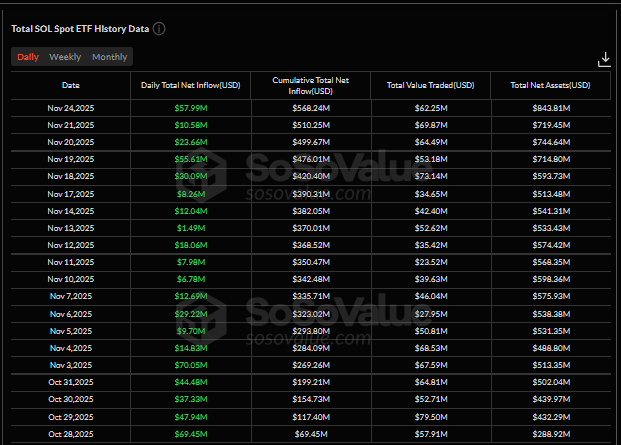

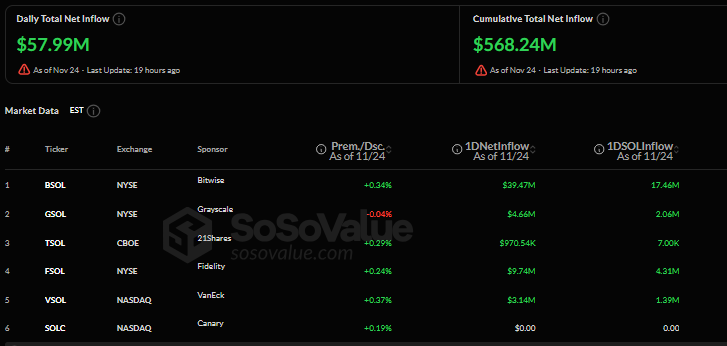

This surge in inflows starkly contrasts with the broader cryptocurrency market, where major players like Bitcoin and Ethereum have seen significant capital outflows. Data from SoSoValue highlights that Bitwise’s BSOL ETF alone attracted $39.5 million on that record-setting day, marking one of the three largest inflows since the fund’s inception in late October. Collectively, Solana ETFs have amassed total net inflows of $568.24 million since their launch, pushing their combined assets under management (AUM) to an impressive $843.81 million, or about 1.09% of Solana’s overall market capitalization.

As Bitcoin ETFs faced a staggering monthly outflow of $3.70 billion and Ethereum ETFs lost $1.64 billion, Solana remains a beacon of strength, rallying $369 million in inflows over the past three weeks. This trend highlights a potential shift in investor sentiment, with institutions increasingly viewing Solana as a ‘blue-chip’ asset in the digital currency sphere. Observers noted a growing number of traditional finance firms opting to utilize Solana for tokenization efforts, signaling an uptick in institutional engagement.

But what does this all mean for the future? Enthusiasts should keep a keen eye on this trend as analysts speculate that it might lead to a more permanent reshaping of investment strategies within the crypto market. The ongoing ETF strength could provide a much-needed cushion against declining risk appetites across the broader sector. However, it’s worth remembering that upward momentum in ETF performance doesn’t automatically translate to immediate price increases for SOL. The token remains susceptible to overarching market sentiments, and any noticeable price recovery may take time to materialize.

Looking at individual ETF performances, Bitwise’s BSOL has emerged as the clear leader, boasting net assets of $567.10 million, followed by Grayscale’s GSOL at $117.90 million, which secured $4.66 million in fresh capital on that record daily inflow. Other players, like Fidelity’s FSOL and VanEck’s VSOL, are also seeing their highest daily inflows to date, contributing to the positive momentum, while 21Shares’ TSOL and Canary’s SOLC reported positive but more modest activity. In just a six-day window between November 17 and November 24, Solana ETFs attracted an additional $177.93 million, inching closer to a significant milestone of $1 billion in combined assets.

As we look ahead, Franklin Templeton’s Solana ETF, which is yet to launch, is anticipated to serve as a further catalyst in attracting institutional demand once approved. However, amid these optimistic inflows is a complicated backdrop; the SOL token remains down by approximately 30% over the last month, trading around $137—a slight 1% dip on the day and a 13% fall over the past fortnight. Analysts caution that SOL is still navigating a broader corrective phase, with projections indicating potential price movements between $80 and $95 if current support levels falter.

In closing, as Solana’s ETFs continue to break records against a struggling market backdrop, investors are left wondering just how far this momentum can carry the asset. Will Solana’s rising status among institutional investors translate into lasting price support? As we navigate these intricate market dynamics, keeping a close eye on Solana—and the broader cryptocurrency ecosystem—will be essential for forecasting future developments. Whether you’re a seasoned investor or new to the space, now is the time to engage with these unfolding narratives. For further insights into market movements and investment opportunities, consider following trustworthy sources such as CoinDesk and CoinDesk Learn.