In a provocative declaration at Miami’s America Business Forum on November 5, 2025, former President Donald Trump contended that cryptocurrency could alleviate some of the pressure on the U.S. dollar. As he rallied thousands of attendees, he boldly branded the United States as the “bitcoin superpower” and the “crypto capital of the world.” By touting his administration’s efforts to end the government’s “war on crypto,” Trump positioned himself in stark contrast to the Biden administration’s more stringent regulatory approach, asserting that the latter left industry leaders facing legal challenges.

Trump’s remarks raised eyebrows and ignited conversations amongst crypto enthusiasts and skeptics alike. He stressed that embracing digital assets isn’t just a regulatory shift; it holds significant economic implications. In his view, promoting crypto could strategically relieve stress on the dollar while reinforcing America’s leadership in both cryptocurrency and artificial intelligence, an area where he claimed the U.S. outpaces China.

JUST IN: 🇺🇸 President Trump says crypto “takes a lot of pressure off the dollar. It does a lot of good things.””We’re making the US the #Bitcoin superpower, the crypto capital of the world”. pic.twitter.com/31xK1qCnys— Bitcoin Magazine (@BitcoinMagazine) November 5, 2025

But why does this matter? Trump’s take on cryptocurrency reflects a broader acceptance and integration of digital assets into America’s economic fabric. As digital currencies proliferate, the tension between the strength of the U.S. dollar and the appeal of Bitcoin becomes increasingly pronounced.

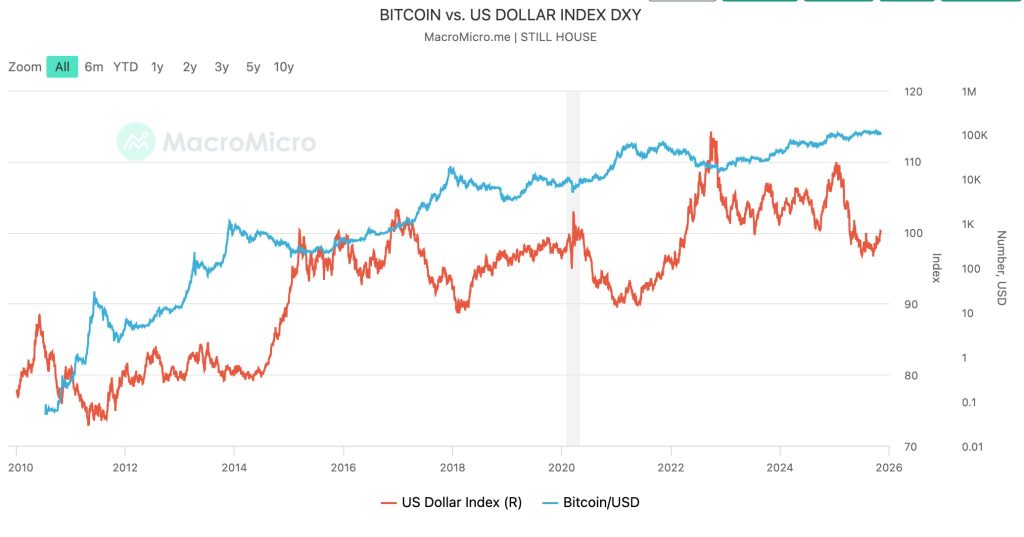

Interestingly, historical data suggests a complex relationship between the dollar and Bitcoin. Typically, Bitcoin exhibits an inverse correlation of around -0.7 with the U.S. Dollar Index (DXY). This means that as the dollar strengthens, Bitcoin prices tend to falter, and vice versa. For instance, during the Federal Reserve’s tightening period in 2022, the DXY rose to 114, while Bitcoin plummeted from approximately $47,000 to under $17,000. Conversely, when the dollar weakened during the easing phase from 2020 to 2021, Bitcoin surged to record highs near $64,000. Observers often note that Bitcoin behaves more like a high-risk asset rather than a safe haven, thriving in loose financial conditions and retreating during liquidity withdrawals.

This complex dance raises important questions: If cryptocurrency acts as a viable alternative to the dollar in transactions and as a store of value, could a stronger dollar inadvertently diminish the allure of Bitcoin? Numerous market analysts agree that Bitcoin tends to draw investment when investors seek alternatives to depreciating fiat currencies. When the dollar is robust, that incentive diminishes.

Moreover, there’s ongoing momentum behind the establishment of a Strategic Bitcoin Reserve, a concept that Senator Cynthia Lummis passionately supports. She argued it could be the critical mechanism needed to manage the staggering $35 trillion U.S. debt. The Biden administration’s interest in this concept bodes well for its future, with discussions reportedly underway about creative financing options—though specifics remain vague.

🇺🇸 Sen. @CynthiaMLummis says a Strategic Bitcoin Reserve is the only way to offset US debt, praising President Trump and Treasury for backing the plan.#BitcoinReserve #USDebt https://t.co/XG8J23vRnJ— Cryptonews.com (@cryptonews) November 5, 2025

In tandem with this, Eric Trump highlighted the potential of stablecoins to “save the U.S. dollar” by unlocking massive capital flows from around the globe. He specifically referenced World Liberty Financial’s USD1 token as a vehicle that could siphon “trillions into U.S. markets.” While the bullish perspective shines a light on potential benefits, critics like Representative Maxine Waters and Senator Elizabeth Warren are wary of perceived conflicts of interest, particularly concerning the recent GENIUS Act’s framework, which they believe lacks adequate safeguards against exploitation by political figures and their families.

Real-time market movements highlight the persistent tug-of-war between the dollar and Bitcoin. For example, in late September, robust U.S. job data sent the dollar soaring, causing Bitcoin’s value to slip below $111,000. This scenario unfolded again recently when promising payroll figures buoyed the dollar, limiting Bitcoin’s potential gains even as it briefly rose back above the $103,000 mark.

🔻 Strong jobs report sends dollar soaring while Bitcoin falls below $111,000 as Fed rate cut odds decline to 85.5%.#Bitcoin #Dollarhttps://t.co/izW8AEttYE— Cryptonews.com (@cryptonews) September 25, 2025

The ongoing market context reflects a broader sentiment wherein traders have adopted a “buy the dip, sell the rip” mentality. Traders remain cautious, continuously looking for opportunities to secure profits amid the prevailing narrative of sustained dollar strength. Notably, the Turkish lira recently experienced a dramatic decline against the dollar, plummeting to a staggering 42.1 per dollar, showcasing the allure of the dollar as a safe haven during economic instability.

They will keep adding paper till people keep considering it of any value https://t.co/5vJwjnnNM— Alok Jain ⚡ (@WeekendInvestng) November 6, 2025

As we navigate this shifting landscape, the evolving relationship between the dollar and cryptocurrencies, particularly Bitcoin, promises to be an intriguing subject for future discussions. What does this mean for investors? Could strategic policies reshape the future of both the dollar and digital currencies? With so much at stake, staying informed becomes crucial—a necessary step for anyone engaging with this rapidly changing financial frontier.