In a revealing commentary that’s turning heads in the financial world, billionaire investor Ray Dalio has raised alarms about the Federal Reserve’s recent decision to halt its quantitative tightening. This pivotal moment, he argues, could signal the onset of a precarious cycle that leads to a hazardous “bubble” instead of a prudent reaction to economic challenges. As the founder of Bridgewater Associates, Dalio’s insights carry significant weight, especially as he outlines the implications of what he describes as a classic late-stage debt cycle.

Effective December 1, 2025, the Federal Reserve plans to transition away from quantitative tightening, maintaining a balance sheet of $6.5 trillion and redirecting its agency security income into Treasury bills. This shift is not just a technical maneuver, according to Dalio; it’s a potential precursor to larger economic imbalances, coinciding with expanding fiscal deficits and a surge in private credit creation. Interestingly, with the S&P 500’s earnings yield hovering at 4.4%, only slightly above the 10-year Treasury yield of 4%, equity risk premiums are at an alarming low of merely 0.4%—a scenario that has experts apprehensively eyeing the markets.

https://t.co/BytVjrzXkL— Ray Dalio (@RayDalio) November 5, 2025

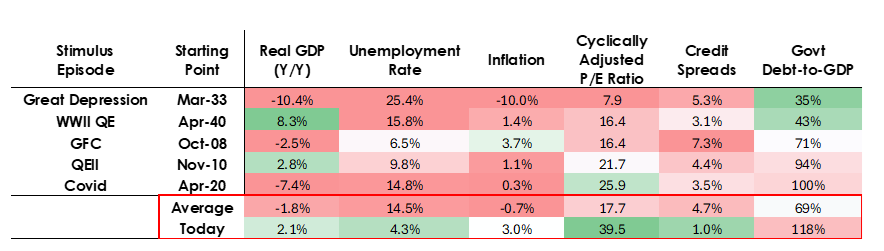

Dalio reflects on history, noting that past instances of quantitative easing were executed in completely different economic environments. These previous measures were necessitated by downturns, characterized by plummeting asset values, decreasing inflation, and wider credit spreads. Now, the landscape is markedly different: stocks are soaring to record highs, the economy is growing at 2% annually, unemployment sits at a low 4.3%, and inflation has crept above the Fed’s target, standing over 3%.

“This time, easing will be into a bubble rather than into a bust,” Dalio forewarned. His proprietary indicators categorize AI stocks as already indicative of bubble status. With massive fiscal deficits and a contraction in long-term bond demand, the effects of central bank balance sheet expansion appear to be spiraling into what Dalio terms the “classic Big Debt Cycle late cycle dynamics.”

Market analysts are echoing his warnings. Cristian Chifoi pointed out that while discussions around QE (Quantitative Easing) and QT (Quantitative Tightening) dominate, real liquidity has started to pour into the markets beginning late last year when QT effectively came to a halt, with the Reverse Repo Program becoming an essential facilitator.

The FED will end QT in DecemberSo everyone prepared for the REAL liquidity injections to start in December right?😂While we are late in the cycle and everyone thinks the 4y cycle is overBut QE or QT were always narratives, liquidity was starting to flood markets since… https://t.co/TQmID4D3vu pic.twitter.com/odHw9vnZ0b— Cristian Chifoi (@ChifoiCristian) October 29, 2025

Ted Pillows cautioned that the cryptocurrency markets, which have typically reacted sensitively to liquidity shifts, may continue to decline until actual quantitative easing takes place—rather than just a cessation of tightening. He pointed to a 40% drop in altcoins that followed the Fed’s pause on QT in 2019, illustrating the potential for a similar scenario to play out.

The market’s reaction to this recent policy announcement has been nothing short of dramatic. Gold prices have surged past $4,000 per ounce, rebounding from volatility immediately following the Fed’s declaration. According to the World Gold Council, global demand for gold saw a remarkable rise of 3% year-over-year to 1,313 tons, with investment demand reaching unprecedented heights—marking the quarter with 13 new all-time highs.

Dalio emphasizes the mechanics at play here: with zero yield on gold and current prices around $4,025 compared to 10-year Treasuries yielding 4%, investors must anticipate annual gold price appreciation exceeding 4% to prefer it over bonds. “The higher the inflation rate, the more gold prices are primed to rise because inflation primarily results in a decline in the purchasing power of other currencies, which contrasts with the relatively stable supply of gold,” he elaborated. Central bank purchases have also ramped up, rising 10% year-over-year, with notable activity from Poland and Brazil, the latter resuming purchases for the first time since July 2021.

In moments of financial turmoil, Bitcoin has historically outperformed gold and other risk assets, showcasing its potential as a hedge against traditional market fluctuations.

Dalio’s predictions are especially striking as he projects that the combination of increasing Fed balance sheet expansions and imminent interest rate cuts amid significant fiscal deficits will lead to a classic scenario where monetary and fiscal policies intertwine to monetize government debt. This dynamic is expected to drive real interest rates lower, compress risk premiums, and expand price-to-earnings multiples—particularly benefitting long-duration assets like technology stocks, as well as inflation hedges such as gold and inflation-indexed bonds.

“It would not be unreasonable to anticipate a strong liquidity-led melt-up, akin to late 1999 or the years 2010-2011,” Dalio wrote. “Such phases usually become excessive, compelling a necessary restraint, often marking the optimal time to divest just before the tightening that can trigger a bubble burst.” His cautionary remarks serve as a stark reminder of the cyclical nature of markets and the importance of strategic timing in investment decisions.

As these developments unfold, investors would do well to remain vigilant, examining the fluid landscape closely and considering their strategies in light of Dalio’s insights. The landscape of finance is not just shifting; it’s undergoing a profound transformation that requires both caution and acumen.