In the fast-paced world of cryptocurrency, few events have stirred as much discussion as the recent price plunge of Aster (ASTER), a decentralized exchange (DEX) token that has seen its value tank by over 20% in just 24 hours. This significant drop follows a remarkable surge triggered by a high-profile endorsement from Binance CEO Changpeng Zhao (CZ), who announced he had purchased more than $2 million worth of ASTER. But what does this rollercoaster ride mean for traders and the market at large? Let’s dive in.

Upon CZ’s announcement, celebrations were in order as ASTER’s price skyrocketed from about $0.91 to an impressive high of $1.26, sparking a wave of buying interest. However, the party came to a swift halt as savvy traders, including a notable figure dubbed the “Anti-CZ Whale,” capitalized on the brief momentum. This trader had strategically opened shorts on ASTER just after CZ’s announcement, resulting in a staggering $21 million in unrealized profits when the price corrected sharply.

🏦 Changpeng Zhao posted on Sunday that he bought Aster protocol’s token (ASTER) using his own money on Binance.#ChangpengZhao #ASTER #Binance https://t.co/uzYZOHcXQD— Cryptonews.com (@cryptonews) November 3, 2025

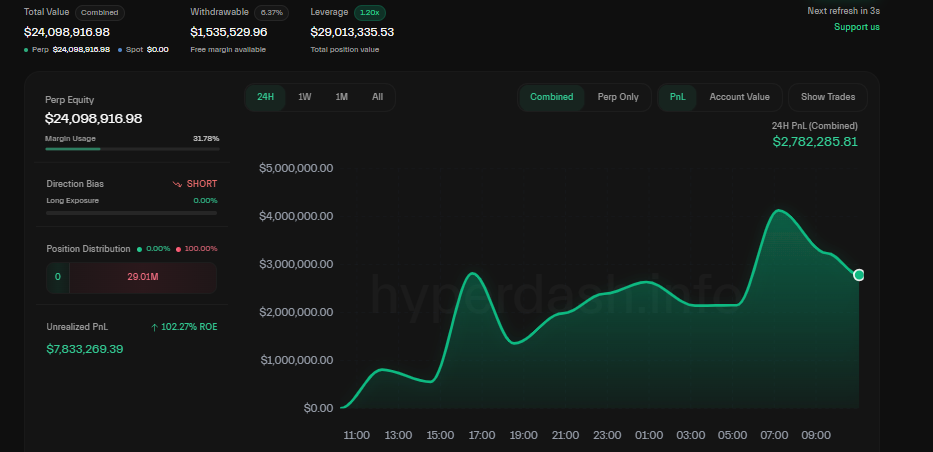

The sharp price correction back to below $0.90 was fueled by an influx of short-selling from the same whale, whose two wallets now control shorts worth over $51 million. The overall unrealized profit from these positions sits at approximately $18.4 million—a clear indication that this trader knows how to play the market. As market dynamics shifted, on-chain data from analytics firms like Lookonchain and Hyperliquid highlighted how this trader also managed to short other popular cryptocurrencies including DOGE, ETH, XRP, and PEPE, raking in profits across the board.

As the price falls, the Anti-CZ Whale who added to his $ASTER shorts after CZ’s buy post is now sitting on over $21M in unrealized profit across 2 wallets. His total profit on #Hyperliquid is now close to $100M!… pic.twitter.com/vfmAPf9ke6— Lookonchain (@lookonchain) November 4, 2025

The trading volume for ASTER has taken a hit too, plummeting to around $1.35 billion—down by 47% from the previous day. This decline signals a cooling off of market enthusiasm following the initial peak. In fact, ASTER has dropped over 63% from its all-time high of $2.41, demonstrating the volatility inherent in such speculative assets. Analysts now watch closely, as the token has dipped over 17% in the past week and nearly 57% in the last month.

One of the wallets tied to this influential trader shows an unrealized profit of around $8.38 million, primarily from its ASTER short, which dropped from an entry price of $1.16 to just $0.88. In another wallet, assets have increased in value to $73.7 million, with over $14 million of that coming from ASTER alone. The positions are heavily leveraged, ranging between 3x and 20x, pointing to an aggressive trading strategy that could adjust drastically given market conditions.

Reflecting on these tumultuous developments, CZ took to social media, admitting that he often experiences “poor timing” in his trading decisions. He recounted past purchases, such as his Bitcoin buy at $600, which subsequently fell to $200, and the acquisition of BNB, which also saw significant drops. He noted, “Every time I buy coins, I get stuck in a losing position,” adding humorously, “So everyone, please watch out for risks.” His remarks signal a level of humility and caution amidst the chaos, highlighting the unpredictable nature of cryptocurrency trading.

我每次买币都被套,100%的记录。 😂2014年,均价$600买了BTC,一个月内跌倒$200,持续了18个月。2017年,买了BNB,也跌了20-30%,持续了几周。这次。。。还说不准呢。昨天又加了点仓。所以大家要注意风险啊。以后不再披露了。免得影响大家的行情。🤣 https://t.co/jezvlAbXax— CZ 🔶 BNB (@cz_binance) November 4, 2025

Despite the downward trend, some analysts are spotting potential for a short-term rebound in ASTER’s price. Technical analysis suggests that the ASTER/USDT trading pair is forming a falling wedge pattern, a setup often associated with bullish reversals. If the price manages to break above the critical level of $1.01, it could kickstart a recovery, pushing values toward $1.20 or even $1.50. Conversely, failing to hold above $0.85 may lead to further declines, with support levels hovering near $0.76.

As we witness this unfolding drama in the cryptocurrency market, the interplay of sentiment, trading strategies, and market psychology becomes increasingly fascinating. Traders and investors alike should stay vigilant and informed, given the unpredictable tides of the crypto world. Will ASTER find a way to recover from this turbulence, or will the sellers continue to dominate? Only time will tell, but for those engaged, now might be the perfect moment to weigh risks carefully and consider their next moves.