In the ever-shifting landscape of cryptocurrency, Chainlink (LINK) has been somewhat of an enigma following the tumultuous events of October 10. After plummeting from a robust price of over $22 to a lull around $17, LINK has struggled to regain its footing, persistently hovering around this threshold. Just yesterday, it dipped another 1%, but there are signs that a potential resurgence could be on the horizon. Could LINK be setting the stage for a comeback? Let’s dive into the details.

Source: Chainlink: Exchange Reserve – All Exchanges / CryptoQuant

Recent insights from CryptoQuant illustrate that Chainlink’s exchange reserves have plummeted to multi-year lows. This dramatic decrease was unanticipated, but it might bear positive implications. The mass exodus of LINK tokens from exchanges suggests a growing trend toward long-term holding, which is often indicative of confidence from investors.

So, what’s driving this sudden withdrawal? One logical explanation is that a significant quantity of LINK has been shifted from exchanges into cold wallets or staking contracts. Given the stagnant price of LINK while other cryptocurrencies have bounced back, it raises speculation that whales and institutional investors are quietly accumulating large amounts of LINK off the exchanges. Could these players be setting the stage for a future rally?

Source: Chainlink: Exchange Netflow – All Exchanges / CryptoQuant

CryptoQuant’s netflow data reinforces this observation. Since the unfortunate downturn in October, daily statistics have largely reflected negative netflows, meaning the outflow of LINK from exchanges consistently outpaces inflows. This trend not only hints at a potential reduction in selling pressure but also signals a shift towards long-term holding. A scenario where patience pays off is coming into focus!

Looking forward, predictions for LINK’s price trajectory are stirring excitement. Some analysts speculate that with solid accumulation and technical indicators aligning, Chainlink could reach a price point of $30 by 2026. As we step into November, LINK is garnering renewed attention, bolstered by consistent buying interest that has it maintaining above key moving averages in the wake of October’s turbulence. The green zone on the charts mirrors a significant demand area, where buyers are shoring up their positions. If LINK can bounce from this level, the path to $19—and possibly $20—looks plausible. This segment signifies the next immediate resistance level to monitor.

Source: LINKUSD / TradingView

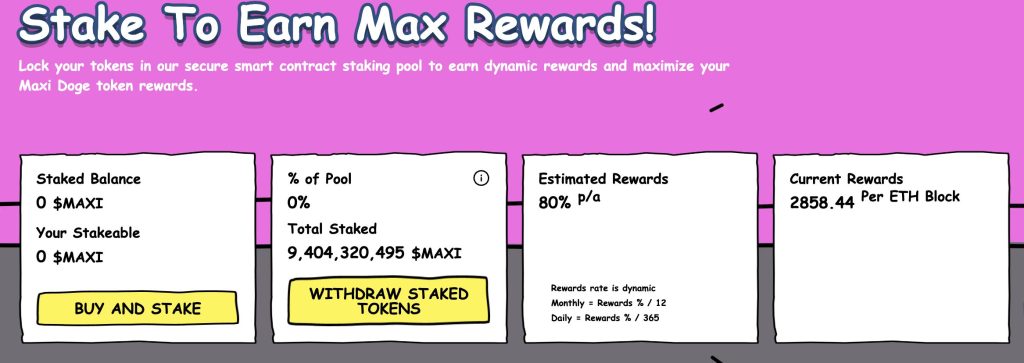

As we analyze other movements, it’s essential to stay updated with the broader crypto trends. Interestingly, while established players like Chainlink are setting the stage for their next act, the memecoin landscape is buzzing, especially with projects like Maxi Doge making headlines. This rising star has already attracted over $3.81 million in its presale, positioning itself as one of the fastest-growing meme initiatives of 2025. Beyond mere hype, holders stand to earn impressive staking rewards—up to 80%—which adds a layer of utility beyond just fun and games.

As the “Doge Gym Bro” theme takes hold, the project seems perfectly timed to capitalize on this renewed fervor for memecoins. Whales, known for their strategic buying power, appear to be pivoting towards higher-risk, higher-reward prospects, enhancing the narrative that Maxi Doge could be the breakout memecoin of this bull run.

As Chainlink and initiatives like Maxi Doge evolve, staying informed could be your key to navigating this dynamic cryptocurrency ecosystem. Will LINK break through its price barricades, or could other contenders like Maxi Doge take the spotlight? Only time will tell. For now, keep an eye on the charts and your favorite coins, and embrace the fluctuations of this thrilling market.

Want to learn more about Chainlink and other cryptocurrencies? Visit CoinDesk for the latest updates and analyses!