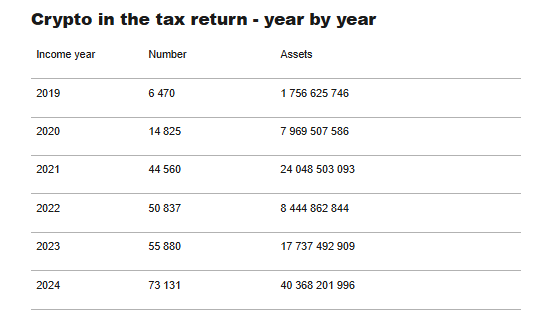

In a striking development for the cryptocurrency landscape, Norway is witnessing a remarkable surge in the number of individuals declaring their digital asset holdings. The latest figures from the Norwegian Tax Administration (Skatteetaten) reveal that over 73,000 people reported their cryptocurrency investments in their 2024 tax returns—a stunning 30% increase compared to the previous year. This surge marks the largest year-on-year jump in crypto declarations since the government began tracking this type of financial reporting, illuminating a growing trend towards transparency in Norway’s burgeoning digital asset market.

The total value of declared cryptocurrency assets has skyrocketed, more than doubling to NOK 40.3 billion (approximately $3.9 billion). This signifies not just compliance but a noteworthy evolution in how Norwegians view their digital investments. So, what’s fueling this boom?

Tax Director Nina Schanke Funnemark highlights that this uptick in declarations is a direct result of various measures aimed at encouraging voluntary compliance among taxpayers. “It’s heartening to see that more individuals are acknowledging their cryptocurrency holdings, thereby ensuring accuracy in tax assessments,” Funnemark remarked. “Our initiatives in recent years have clearly resonated with the public, and we can see the positive outcomes.” Previously, in 2019, a mere 10,000 Norwegians had reported owning cryptocurrency, indicating that the number of crypto investors has now surged more than sevenfold.

This trend is largely attributed to a systematic initiative by Skatteetaten, which included sending out digital reminders, affectionately dubbed “dults,” to taxpayers who might hold crypto assets but hadn’t declared them. Additionally, the ongoing rise in cryptocurrency prices throughout 2024 also played a significant role, enhancing the overall value of declared holdings. For instance, the reported gains from crypto investments reached NOK 5.5 billion, while reported losses were noted at NOK 2.9 billion.

In Norway, the legal framework classifies cryptocurrency not as currency but as a capital asset. This distinction means profits and losses incurred during trading are subject to capital gains tax. The flat tax rate is currently set at 22%, with similar rates applied to capital loss deductions as well. For example, if an investor acquires one Ethereum (ETH) for 20,000 Norwegian kroner and later sells it for 50,000 kroner, the taxable profit of 30,000 kroner would incur a tax liability of 6,600 kroner.

But there’s more to the taxation system than meets the eye. Norway utilizes a First-In, First-Out (FIFO) approach for determining the cost basis of crypto sales. This means that when an individual divests their holdings, the first assets they acquired are presumed to be the first ones sold. Furthermore, each year, crypto holders must declare their digital assets within their net wealth. Any wealth exceeding NOK 1.7 million is subject to additional wealth taxes, varying depending on income and the specific municipality.

Ensuring compliance rests heavily on self-reporting, placing the onus on individuals to accurately disclose their crypto activities through Skatteetaten’s online portal. Taxpayers are responsible for calculating their holdings, trades, and related income in Norwegian kroner based on the exchange rate at the time of each transaction. Failure to declare these assets can lead to hefty penalties and potential audits. Funnemark has noted that while many first-time filers report modest amounts, significant undeclared sums have also been uncovered through various audit processes. Fortunately for some, those who voluntarily correct their filings can revise declarations as far back as three years before incurring penalties, provided these adjustments happen before an official audit is triggered.

Looking ahead, Norway’s oversight is set to expand even further. Starting in 2026, new third-party reporting regulations will require crypto exchanges and wallet providers to report user data directly to Skatteetaten. This development aims to provide the tax authority with a clearer picture of residents’ crypto transactions, enhancing the effectiveness of tax collection. “This is a crucial step forward in attaining accurate taxation of digital assets,” Funnemark stated. “We will gain a significantly improved understanding of who holds crypto assets, both within Norway and abroad.”

🌍 Norway government announces a temporary ban on new power-hungry crypto mining centers.#CryptoMining #Norway https://t.co/3MCBUdEqOc— Cryptonews.com (@cryptonews) June 20, 2025

Taxes collected from crypto activities contribute to the national treasury, helping fund essential services such as infrastructure, education, healthcare, and social welfare programs. This approach treats cryptocurrency-related income in the same manner as revenue from conventional capital investments.

The fresh rise in tax declarations arrives amid increasing regulatory scrutiny in Norway’s digital asset domain. In 2025, the government took bold steps to harmonize national legislation with the European Union’s Markets in Crypto-Assets (MiCA) framework. This has introduced stricter licensing requirements for crypto service providers and improved consumer protection regulations. Additionally, a temporary halt on new high-energy crypto mining projects was announced due to environmental concerns, highlighting Norway’s dual commitment to both innovation and sustainability.

As it stands, Norway is navigating the complexities of the crypto space with a blend of caution and proactivity, reflecting not just a growing acceptance of digital assets but also a strong emphasis on regulatory compliance. For individuals engaging in crypto investments, now is the time to stay informed and ensure all reporting meets the evolving legal expectations. Remember, in the world of cryptocurrency, transparency is not just encouraged — it’s essential.