The third quarter of 2025 has proved to be a game-changer for the cryptocurrency landscape, showcasing remarkable advancements that have left investors abuzz. Recent insights from CoinGecko, a prominent crypto data aggregator, reveal that while Bitcoin (BTC) surged to a new all-time high (ATH), it was the altcoins, especially Ethereum (ETH), that truly stole the spotlight with impressive gains.

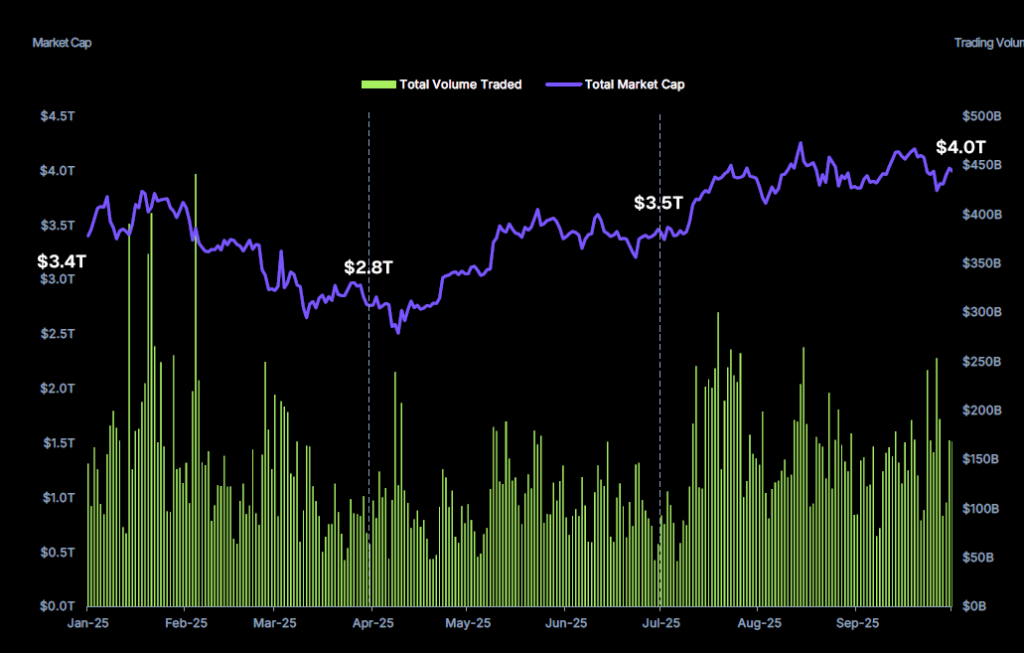

This quarterly report marks not just a continuation of upward trends, but also a powerful narrative of revival, as the crypto market enjoyed its third consecutive rallying quarter. The second quarter’s momentum carried forward, leading to “significant capital appreciation” across various assets. CoinGecko’s assessment highlights that the total market capitalization soared by 16.4%, reaching an impressive $4 trillion—the highest benchmark since late 2021.

Beyond the total market cap, the average daily trading volume witnessed an eye-popping increase of nearly 44% from the previous quarter, climbing to $155 billion. This rise is indicative of enhanced participation in the market, recovering from previous downturns in trading activity. With Bitcoin dominance dipping to 56.9%, the market is clearly experiencing a pivotal shift, favoring large-cap altcoins like Ethereum. Just how crucial is this development? It suggests that investors are diversifying, moving away from the traditional ‘flight to quality’ they exhibited earlier in the year.

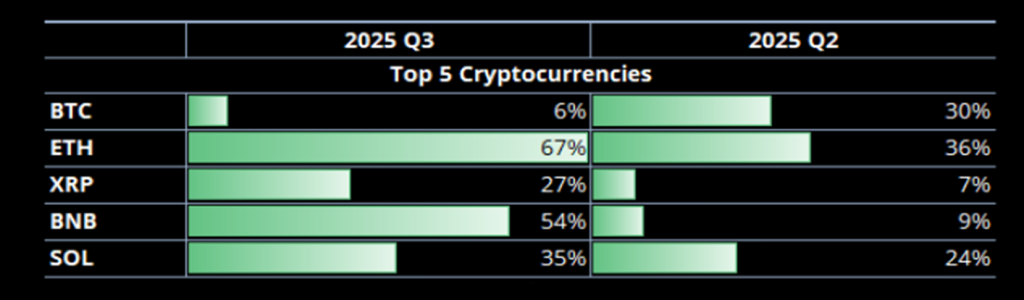

Ethereum has emerged as the clear champion in this landscape, increasing its market share to 12.5% and reflecting a resurgent interest from traders. Major altcoins such as XRP, BNB, and SOL also enjoyed positive outcomes, further illustrating the breadth of this quarterly surge. As we dive deeper, the performance of these tokens stands as a testament to the evolving dynamics in the crypto world.

In stark contrast to the first half of 2025, where Bitcoin maintained the spotlight, the third quarter was all about Ethereum’s extraordinary performance. CoinGecko’s report points to Bitcoin’s modest 6.4% increase compared to Ethereum’s staggering 66.6% rise, as it reached nearly $5,000—an unprecedented ATH for the asset. This invites the question: what propelled ETH to such heights?

One significant driver of this enthusiasm can be attributed to the robust inflows into U.S. spot ETH exchange-traded funds (ETFs) and substantial institutional purchases, with firms like Tom Lee’s Bitmine Immersion and Joe Lubin’s SharpLink leading the charge. Furthermore, BNB displayed remarkable growth of 53.6% while SOL climbed by 34.7%. The Binance ecosystem, leveraging tools such as Binance Alpha and the success of the perpetual decentralized exchange Aster, also played a crucial role in fueling BNB’s surge.

As for SOL, despite hitting a peak of $248 during the quarter due to substantial treasury company investments, it experienced a setback amid market fluctuations and ETF approval delays, highlighting the volatile nature of crypto landscapes.

Speaking of market mechanisms, ETFs continue to shape the investment landscape dramatically. CoinGecko’s figures show that while Bitcoin ETFs attracted significant retail and institutional interest, they faced outflows toward the end of September, resulting in a drop from $12.8 billion in net inflows in Q2 to $8.8 billion in Q3. Conversely, Ethereum ETFs saw a meteoric rise with $9.6 billion in net inflows—remarkably outpacing Bitcoin for the first time. This shift highlights the evolving nature of investment strategies as ETH ETFs captured a whopping 177.4% increase in total assets under management (AUM) from the previous quarter, reaching $28.6 billion.

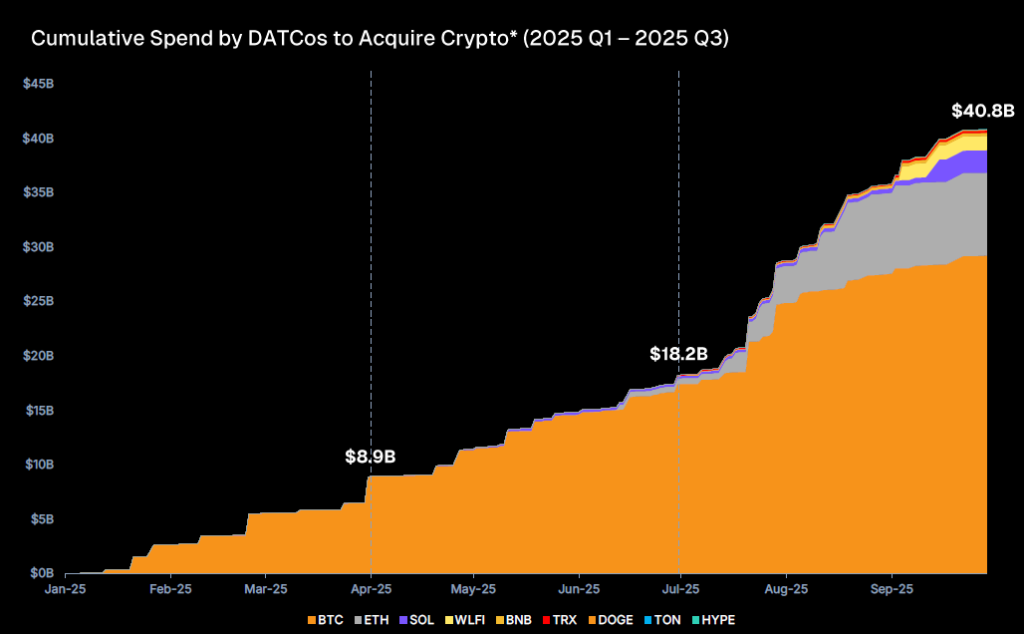

Adding to this vibrant market activity, crypto Digital Asset Treasury Companies (DATCos) invested a staggering $22.6 billion in new crypto acquisitions in Q3 alone. This reflects a marked increase in interest toward altcoins, with DATCos accounting for nearly $10.8 billion of the total. The strategic hold by major players like Bitmine Immersion and Sharplink showcases a forward-thinking approach towards asset allocation in an evolving financial ecosystem.

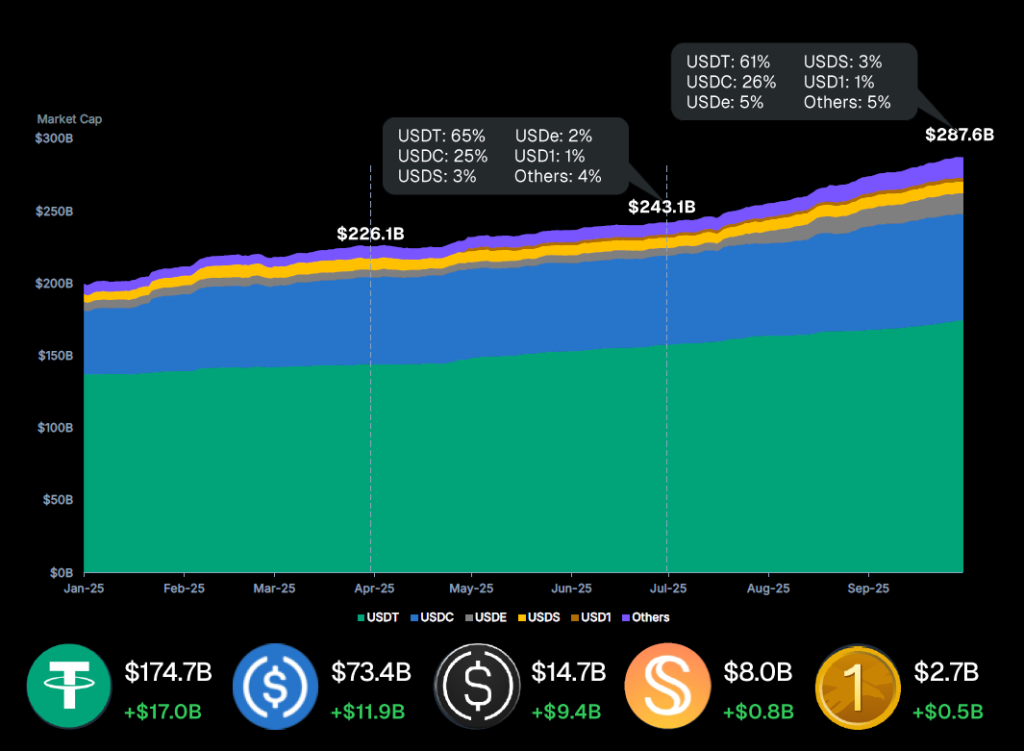

As we dissect the stablecoin arena, it’s noteworthy that it has also basked in newfound growth, with the top 20 stablecoins collectively surging by over 18%, reaching a total market cap of $287.6 billion. Ethena’s USDe leads the charge with a remarkable 177.8% growth. Tether’s USDT remains dominant but did see a slight drop in market share, edging down from 65% to 61% amid fierce competition from emerging stablecoins.

Looking forward, the decentralized finance (DeFi) sector continued to shine in Q3, with Total Value Locked (TVL) increasing by 40.2%, indicating a burgeoning interest in these innovative financial solutions. The DeFi market cap follows suit, hitting peaks driven by Ethereum’s ascension and a wave of new token launches from perpetual DEXes.

As we progress into Q4 2025, the landscape seems poised for heightened activity. With centralized exchanges (CEX) reporting significant trading volume increases and perpetual decentralized exchanges (DEX) marking 87% growth in trading volume, the narrative suggests a strong ongoing commitment from investors across the board.

In conclusion, the third quarter of 2025 stands as a testament to the vibrant and evolving nature of the cryptocurrency market. As we look ahead, the role of institutional investors, the rise of altcoins, and the expansion of financial instruments like ETFs and DeFi are bound to shape the future trajectory of this dynamic space. Will Ethereum maintain its lead, or can Bitcoin stage a comeback? Only time will tell, but for now, the crypto community has much to celebrate.