In a bold move signaling a new chapter in the world of public finance and cryptocurrency, Florida lawmakers have unveiled a groundbreaking bill that could reshape how the state manages its investments. At the heart of this initiative is House Bill 183, introduced during the 2026 legislative session, which seeks to empower the state’s chief financial officer to allocate a striking 10% of public funds into Bitcoin and digital asset exchange-traded funds (ETFs). This decision could position Florida at the forefront of the evolving intersection between state finance and cryptocurrency.

According to the proposal, the public funds eligible for this investment include the General Revenue Fund and the Budget Stabilization Fund. In a state that has often been a trailblazer in financial innovation, the potential implications of this bill are enormous. Could this be the spark that ignites a broader acceptance of digital currencies in public finance across the United States?

🇺🇸 NEW: Florida files first Strategic Bitcoin Reserve bill of the 2026 legislative session.House Bill 183 would allow the state to invest 10% of public funds in digital assets, and permits retirement fund investment. pic.twitter.com/sI4bUBiiB3— Bitcoin Laws (@Bitcoin_Laws) October 16, 2025

As part of this ambitious legislation, the state’s retirement system may also see similar investment opportunities, albeit with certain restrictions in place. Former Florida Chief Financial Officer Jimmy Patronis laid the groundwork for this move last year, famously dubbing Bitcoin “digital gold.” He argued that including Bitcoin in pension funds would not only diversify Florida’s investment portfolio but also offer a creative way to boost the state’s financial resilience.

The proposal doesn’t merely stop at authorization; it comes with stringent custody and compliance measures designed to protect public assets. The legislation mandates that cryptocurrency holdings be managed by the chief financial officer in collaboration with qualified custodians. This framework aims to adhere to federal compliance standards and institutional investment best practices, ensuring that Florida’s foray into cryptocurrency is both responsible and secure.

Interestingly, the legislation also lays the groundwork for digital asset payments within the state. If the bill passes, Floridians would be able to settle certain taxes and fees using cryptocurrencies. However, these transactions would undergo a conversion to dollars before reaching the state’s General Revenue Fund—illustrating a cautious yet ambitious approach to crypto integration in public finance.

Beyond Bitcoin, the bill’s language suggests a broader scope, allowing for potential investments in a variety of digital assets, including NFTs (non-fungible tokens). This inclusivity reflects the rapidly evolving landscape of digital finance and the increasing interest from both lawmakers and investors in exploring what cryptocurrencies can offer.

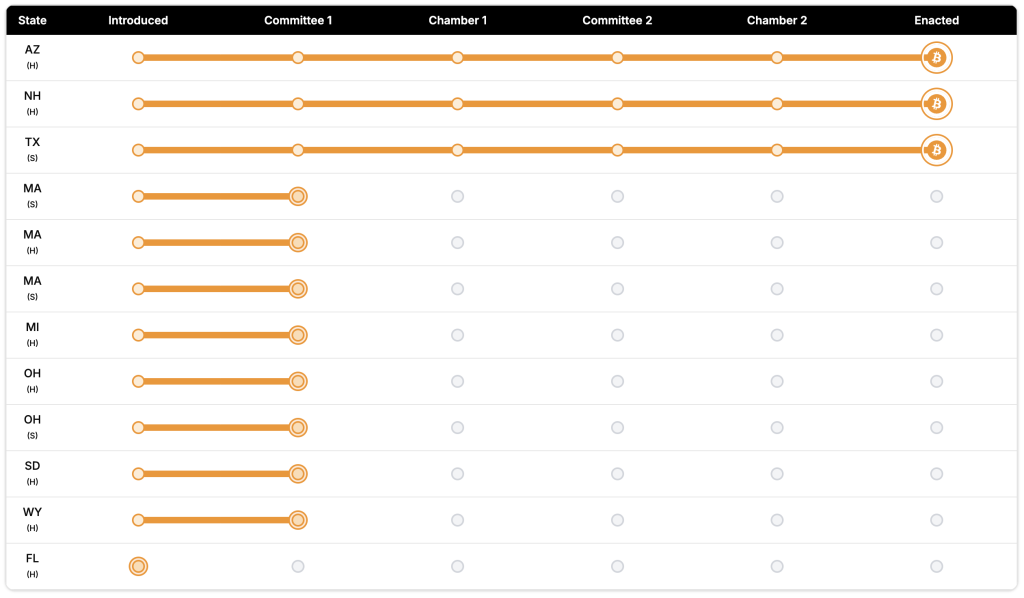

Notably, this proposal marks a significant shift for Florida, considering the previous challenges the state faced in establishing a strategic Bitcoin reserve. Last May, Florida abandoned similar efforts, aligning itself with states like Wyoming, Pennsylvania, Montana, and Oklahoma, which also struggled to pass legislation for Bitcoin-based investment strategies. Yet, as Florida moves forward with this bill, it joins the ranks of other states—such as Arizona, New Hampshire, and Texas—that have successfully enacted frameworks for cryptocurrency investments, as highlighted by the tracking platform Bitcoin Laws.

Proposed Strategic Bitcoin Reserve legislation. Source: Bitcoin Laws

What positions Florida in this transformative landscape? As Julian Fahrer, founder of Bitcoin Laws, aptly states, “States are seeking to modernize their balance sheets.” The introduction of House Bill 183 is a significant step toward that modernization, yet the bill still faces hurdles ahead. It awaits further hearings in the Florida House and must successfully clear the Senate before being put into effect through the governor’s approval.

As we stand at this exciting intersection of traditional finance and emerging digital assets, the question remains: Will Florida set a precedent for other states to follow, or will it merely represent a temporary interest in the ever-evolving cryptocurrency space? Only time will tell, but one thing is for certain: the conversation around cryptocurrency in public finance is just beginning.

@allensim, @Bitc0inExpert, @cryptosbypat, what do you think about Florida’s strategic leap into the crypto realm? Let us know your thoughts!