In a move echoing the cautious sentiment around stablecoins, the Bank of England has announced that it will implement temporary limits on stablecoin holdings for both individuals and businesses. This decision aims to maintain the availability of credit in the face of burgeoning interest in digital currencies. Despite the gravity of the situation, Deputy Governor Sarah Breeden candidly admitted that there is no clear timeline for when these limits might be lifted, leaving many in the financial community pondering what this means for the future of stablecoins in the UK market.

Breeden’s announcement confirmed that individuals will be limited to holdings between £10,000 and £20,000, while businesses could face caps of up to £10 million on stablecoins deemed systemic for payments. In her statement, she expressed optimism that these limits might be removed once the transition to a more regulated landscape no longer jeopardizes the provision of finance to the real economy. However, the absence of a clear timeline or specific metrics has left stakeholders anxious.

This cautious approach starkly contrasts with developments in the United States, where the recently passed GENIUS Act has set the stage for federal regulation of stablecoins without imposing ownership limits. Critics in the UK have been vocal about this discrepancy. Tom Duff Gordon, Vice President of International Policy at Coinbase, was quoted in the Financial Times arguing that capping stablecoin holdings would ultimately harm UK savers, as well as the city’s financial ecosystem and the value of the pound itself. He pointed out that other major jurisdictions have not deemed such restrictions necessary, raising questions about the UK’s regulatory path.

But what does this mean for the broader economy? The Bank of England has articulated a clear concern about deposit outflows into stablecoins, with Breeden stating that unchecked movement towards these digital assets could lead to a significant drop in credit for both businesses and households. Such a downturn could stem from banks’ struggles to quickly access necessary funds through wholesale financing, particularly in turbulent market conditions.

Interestingly, the Bank of England is looking to mitigate these risks by offering accounts to systemic stablecoin issuers, allowing them to hold reserves at the central bank. This strategic move could offer a buffer against the volatility that was starkly illustrated during the USDC de-pegging crisis earlier this year, following the collapse of Silicon Valley Bank.

🇬🇧 Nigel Farage proposes UK Bitcoin reserve with £5B in seized assets and cutting crypto tax from 24% to 10% as Reform becomes first major party accepting crypto donations.#UK #Bitcoinhttps://t.co/w67fZLQTDR— Cryptonews.com (@cryptonews) October 13, 2025

Amid this uncertainty, experts like Varun Paul, former Head of the Fintech Hub at the Bank of England, are urging a deeper examination of the economic implications tied to stablecoins. Paul pointed out that the ongoing discussions around regulation should consider whether separating payment systems and credit creation can be a sustainable approach moving forward. He hinted at possibilities for regulatory features that could provide safeguards to non-bank stablecoin issuers, which may include protection mechanisms akin to the Financial Services Compensation Scheme (FSCS).

As the regulatory landscape continues to evolve, the Bank also announced plans to enhance its Digital Securities Sandbox, expanding settlement assets to include regulated stablecoins. This could open new avenues for financial collaboration as firms such as Euroclear, HSBC, and JP Morgan prepare to launch trading venues that blend traditional finance with emergent blockchain technologies as early as next year.

However, not everyone is convinced that imposing limits on stablecoin holdings is an effective strategy. Industry voices like Simon Jennings, executive director of the UK Cryptoasset Business Council, have argued that such caps are impractical. The logistical hurdles of monitoring holder compliance in real-time could impose substantial cost challenges that might outweigh any intended benefits of the limits.

As the UK government faces increasing scrutiny over its crypto regulatory framework, political figures such as Reform UK leader Nigel Farage are proposing drastic changes. Farage has publicly vowed to reduce crypto capital gains tax from 24% to 10% and establish a £5 billion Bitcoin reserve should he gain political power, denouncing the Bank’s new stablecoin measures as “frankly ridiculous.”

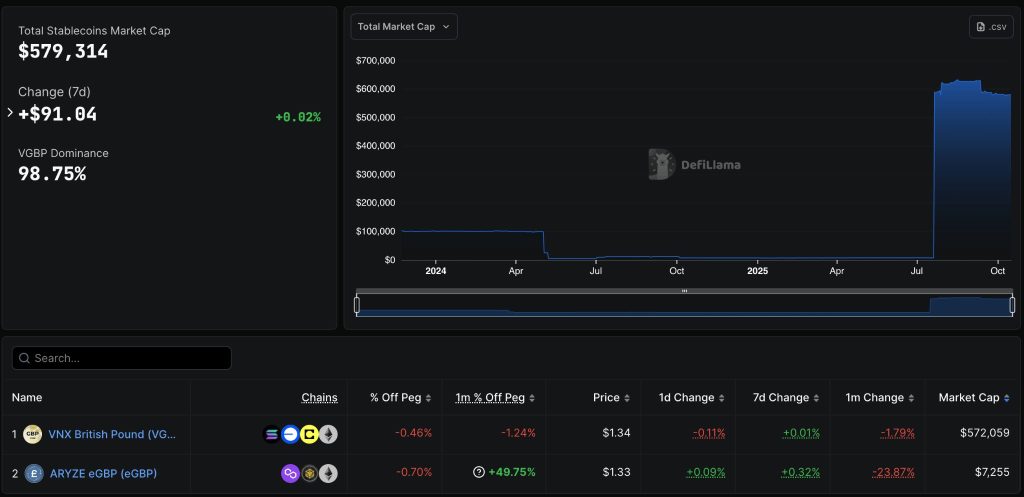

Overall, this tangled web of government regulation, industry concerns, and political aspirations creates a highly dynamic landscape for cryptocurrency in the UK. The worldwide stablecoin market is expanding rapidly, now exceeding $300 billion, yet the uptake of sterling-pegged stablecoins remains low, highlighting perhaps a missed opportunity for innovation within the UK financial sector as it grapples with how best to pave a path forward.

As this saga unfolds, stakeholders across sectors will be watching closely to see how these developments impact credit availability, the broader economic environment, and the evolving relationship between traditional finance and the exciting world of cryptocurrencies. Are these caps a temporary stopgap or a symptom of deeper anxieties within the UK’s financial landscape? Only time will reveal the answers.