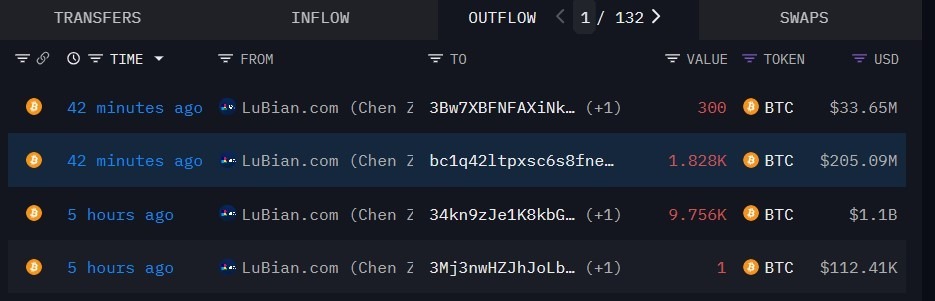

In a turn of events that has sent shockwaves through the cryptocurrency community, a dormant Bitcoin wallet associated with the Chinese mining pool LuBian has suddenly come back to life after more than three years, stirring curiosity and speculation. Just 24 hours after the U.S. Department of Justice (DOJ) announced a groundbreaking crypto forfeiture case, the wallet transferred nearly $1.3 billion in Bitcoin. This bold move involved 9,757 BTC, roughly valued at $1.1 billion, quickly followed by another transaction of 2,129 BTC, bringing the total to an astounding 11,886 BTC worth over $1.3 billion.

This remarkable timing has left many wondering: Is this a strategic reallocation of funds in response to the DOJ’s crackdown, or was it a calculated move that had been long in the works? Experts in blockchain analytics, including firms like Lookonchain and Arkham Intelligence, suggest that large transactions following major enforcement actions are not unusual; they often occur as significant holders seek to restructure their assets, protect their privacy, or even preempt the freezing of their holdings.

Adding fuel to the fire, recent activity among Bitcoin mining firms illustrates a rapidly shifting landscape. For instance, Marathon Digital Holdings made headlines by acquiring 400 BTC—worth approximately $46 million—on October 13, boosting its reserves to a total of 53,250 BTC, valued over $6 billion. Meanwhile, Riot Platforms produced 445 BTC in September and sold 465 BTC for around $52.6 million, while Bitfarms moved 1,052 BTC during Q2 but still retained over 1,400 BTC.

These varying strategies reveal a stark divergence among miners: some are amassing their holdings during market dips, while others are liquidating to fund operational growth. The unexpected resurgence of LuBian’s wallet, paired with its staggering $1.3 billion Bitcoin shuffle immediately following a significant DOJ announcement, has emerged as one of the month’s most riveting crypto narratives.

The connection between the DOJ’s ongoing case and this sudden wallet activation is hard to ignore. Just a day prior to the transfers, U.S. prosecutors unveiled an indictment against the Prince Holding Group—a Cambodian conglomerate accused of orchestrating a massive international crypto fraud and laundering operation. This case seeks the seizure of approximately $14.4 billion in Bitcoin, allegedly related to schemes run by the group’s founder, Chen Zhi, who reportedly laundered proceeds through substantial mining operations, including LuBian.

🚨 @USTreasury has moved to make its largest-ever cryptocurrency seizure, targeting $12B in #Bitcoin from a global “pig butchering” scam. #US #PigButchering

— Cryptonews.com (@cryptonews) October 14, 2025

Furthermore, Arkham Intelligence’s reports indicate that LuBian had previously suffered a massive hack in 2020, losing 127,426 BTC—around $3.5 billion at that time. Interestingly, a September report detailed the movement of 11,886 BTC to recovery wallets, precisely matching the amount that has recently been reactivated. This uncanny coincidence raises inevitable questions: are these events interlinked, or is it merely a fortuitous alignment of circumstances?

🕵️ A massive Bitcoin theft from 2020 has surfaced nearly four years later, and it’s now being called the largest crypto heist ever uncovered. #Bitcoin #Hack

— Cryptonews.com (@cryptonews) August 3, 2025

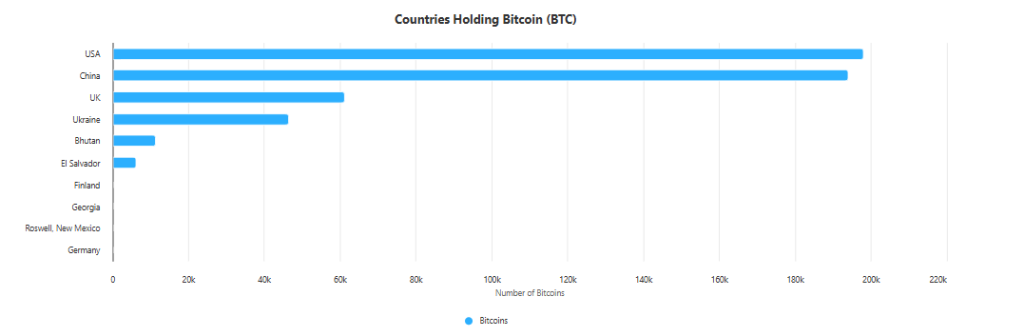

If the DOJ succeeds in its forfeiture claims, it could significantly boost the U.S. Treasury’s Bitcoin holdings, positioning the government as a major player in the cryptosphere. Such outcomes underscore the evolving nature of the U.S. government’s role in cryptocurrency, not merely as a regulator but as one of the largest sovereign custodians of Bitcoin globally.

Since March, when President Donald Trump signed an executive order establishing the Strategic Bitcoin Reserve, the U.S. has transformed its approach to managing seized cryptocurrencies. Rather than auctioning off confiscated assets, the reserve aims to hold onto Bitcoin and other digital currencies from criminal cases, potentially controlling up to $20 billion worth through recent seizures. Current estimates suggest that the U.S. government holds approximately 197,354 BTC, valued around $22.45 billion, thereby placing it at the forefront of global Bitcoin holders.

In addition to this, several other nations have embarked on their own journeys toward state-backed crypto reserves, signaling a growing trend in the global economic landscape. Countries like Bhutan, El Salvador, and Kyrgyzstan are either establishing or advancing initiatives to create sovereign cryptocurrency reserves.

As the intrigue surrounding LuBian’s $1.3 billion Bitcoin shuffle unfolds, the broader implications of these developments are hard to ignore. With the U.S. government flexing its cryptocurrency muscles, the landscape of digital assets is changing, ushering in new challenges and opportunities. Will other governments follow suit in creating their reserves? Only time will tell, but one thing is certain: the crypto narrative is evolving at an unprecedented pace.

What do you think? Are we witnessing a strategic overhaul in how cryptocurrencies are managed at a government level, or is this merely a case lost in the complexities of the blockchain? 🧐 Feel free to share your thoughts in the comments below!