XRP is currently hovering around $2.38, reflecting a 3% decline in the past 24 hours. This downturn comes amidst a cloud of uncertainty that looms over the cryptocurrency market. While Bitcoin and Ethereum have managed to stay above crucial support levels, XRP’s stability is being threatened by significant whale sell-offs, ongoing ETF delays, and an overall cautious sentiment among investors.

At this moment, XRP boasts a market capitalization of approximately $142.7 billion, keeping it in the fifth spot among the leading cryptocurrencies. However, the recent weakness in its price has stirred concerns, especially with Bitcoin struggling to maintain levels above $112,000, which could extend XRP’s correction phase before we see any substantial recovery.

But why is the sentiment so bearish? One of the major factors is the flurry of activity among XRP whales. Over the last month, major holders have offloaded over 400 million tokens, worth around $1.25 billion. This rapid sell-off was closely synchronized with the ongoing U.S. government shutdown, a situation that has delayed the SEC’s review of seven pending XRP-spot ETF applications, further dampening market sentiment.

XRP sees sustained whale selling, with holders of 1M–10M tokens reducing balances by 440M #XRP over 30 days, leaving $6.51B in holdings. $50M/day outflows pressure $XRP sentiment, keeping price fragile near $3.30.Full Article 🔗 https://t.co/MZdPZtZ6dI— Coin Edition: Your Crypto News Edge ️ (@CoinEdition) October 11, 2025

Why This Matters

The looming decisions regarding these ETFs could hold substantial implications for XRP. Initially anticipated between mid-October and mid-November, the expected approvals are now postponed due to limited staff availability within the SEC. A betting platform, Kalshi, has even suggested that the shutdown might extend up to 25 days, pushing potential regulatory outcomes even further down the line.

Market analysts broadly anticipate that once government functions resume and ETF approvals trickle in, positive sentiment could return, potentially pushing XRP’s price back toward the upper resistance level of $3.30. But until then, the adverse news cycle is hanging heavily over XRP’s trading prospects.

“XRP’s drop today looked like that whale-feeding clip in real time, big players scooping liquidity while smaller traders got swallowed. China’s export control plans and Trump’s tariff reaction only deepened the risk-off wave. Classic case of whales tightening their grip amid macro…” pic.twitter.com/n4lOKutsxP— Charles Ugochukwu Odizuru-Abangwu Jr. (@Eze_Nwakaibeya) October 11, 2025

Additionally, the recent geopolitical climate exacerbated by Donald Trump’s announcement of 100% tariffs on certain Chinese imports has triggered a global risk-off mood. This led to considerable downturns not only in cryptocurrencies but also in traditional markets, with the S&P 500 and Nasdaq each plummeting over 2%, while Bitcoin suffered a staggering 10% drop in just one day.

XRP’s Technical Analysis

From a technical viewpoint, XRP is feeling the heat after it broke below a crucial multi-month symmetrical triangle pattern that had been guiding its price since July. As a result, a breach under $2.70 prompted a cascade of stop-loss orders, sending XRP tumbling to the $2.30 mark—the lowest it has seen in months. The immediate resistance now lies at the 100-day Simple Moving Average (SMA), pegged at $2.63, while the Relative Strength Index (RSI) sits at a stark 26.9, indicating oversold conditions.

If the bearish momentum persists, expect support targets at $2.02—a key Fibonacci level—and further down at $1.77, the last consolidation point before XRP’s remarkable rally in July. Traders should keep an eye out for potential bullish signals such as a Doji or hammer candle forming at $2.30, which might indicate selling exhaustion and a short-term reversal in fortunes.

#XRP faces heavy pressure after breaking below its multi-month triangle. Price hovers near $2.38, with RSI at 27 showing deep oversold conditions. A brief rebound toward $2.70–$2.80 is possible before sellers re-test $2.02 support. Bulls need a breakout above $2.80. pic.twitter.com/A1VHK4i0V2— Arslan Ali (@forex_arslan) October 12, 2025

For traders, a sensible strategy here would be to accumulate near the support zone while placing stop-loss orders just below $2.25, setting a target for a potential recovery toward $2.80-$3.18 if stability returns. However, it’s essential to remain cautious, as any sustained weakness in Bitcoin could further postpone XRP’s ability to regain its footing.

Looking Ahead

In conclusion, while XRP’s immediate outlook appears grim, several underlying factors could pave the way for a future recovery. Expect a shift in market dynamics as Bitcoin climbs above $115,000—this could set in motion XRP’s reclaiming its earlier highs. For those eyeing a potential rebound, consider accumulating around $2.00—$2.30. A broader market correction may well position XRP for a stronger performance in the fourth quarter once macroeconomic headwinds start to dissipate.

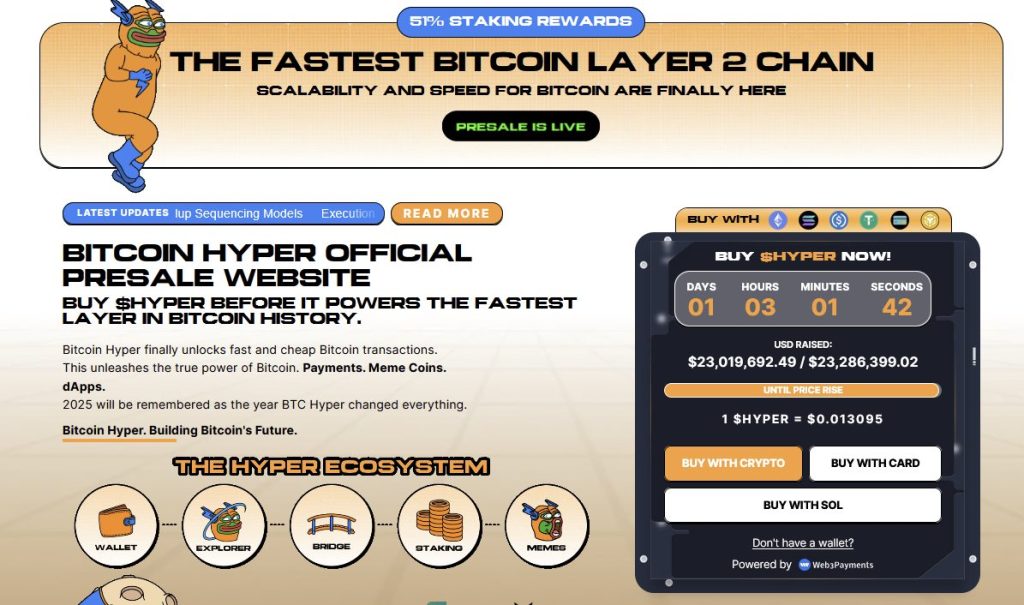

Also, exploring innovative projects like Bitcoin Hyper ($HYPER) could be worth your while. This project is designed to enhance the BTC ecosystem through speedy, low-cost smart contracts, offering exciting new use cases. The presale is generating momentum, with significant interest already. If you’re keen to dive into the presale, you can purchase HYPER tokens easily on their official website, using either crypto or a bank card. Don’t miss out on the opportunity—check it out today!