Ethereum has been navigating a bumpy week, marked by sharp price fluctuations that recently saw its value dip below the $3,800 threshold. Yet, as traders hold their breath, signs of stabilization are beginning to emerge. The recent turmoil was reminiscent of Bitcoin’s attempts to test its key support level at $112,000, sending ripples through the crypto market. Now, with various momentum indicators flashing hopeful signals, analysts are speculating whether Ethereum can rally back to its former glory and reclaim the $4,500 mark in the coming weeks.

This tumult in the crypto markets is not merely an isolated incident; it represents a larger narrative of resilience. Despite the rocky terrain, there’s an unmistakable shift in sentiment among traders leaning towards a more bullish medium-term perspective regarding Ethereum’s future. As sell pressure subsides, traders are cautiously optimistic that the correction phase may soon come to a close. Technical analyses reveal that Ethereum’s robust fundamentals and rising network activity are continuing to provide essential support for its asset value.

As the market consolidates, some investors are seeking swifter returns and are increasingly drawn to new projects like MAGACOIN FINANCE, which is gaining traction. The appeal of such projects could indicate broader shifts in trading behavior as the landscape evolves.

Right now, Ethereum finds itself between a narrow range of $3,700 and $3,950, marking a critical support base for the cryptocurrency. Recent performance metrics, including the Relative Strength Index (RSI), have approached neutral territory after recent oversold conditions. This shift could suggest that sell-offs have reached their limit. A breakout above the $4,050-$4,100 region would serve as a robust indicator of renewed momentum in the market.

Beneath the surface, trading activity remains steady, with both retail and institutional players keeping a close eye on Bitcoin’s movements. Despite recent slowdowns, Ethereum is displaying remarkable resilience, with staking participation and on-chain activity holding strong. Typically, extended periods of consolidation are precursors to significant price movements, making the ongoing trend an intriguing battleground for traders.

Technical indicators still echo a recovery narrative. With Ethereum’s 50-day moving average resting around $3,900 and the 200-day average generally around $3,500, a solid long-term support structure becomes evident. Such metrics suggest that the bullish trend is not yet over. The recent dip may even provide long-term investors with a golden opportunity to accumulate assets at lower price points.

Should Ethereum break through the $4,100 ceiling, analysts predict a swift climb toward the $4,500 target by early next year. Fibonacci retracement levels also align, reinforcing the case for a gradual ascent. Traders are now eagerly anticipating confirmation in the shape of higher lows and stronger daily closes.

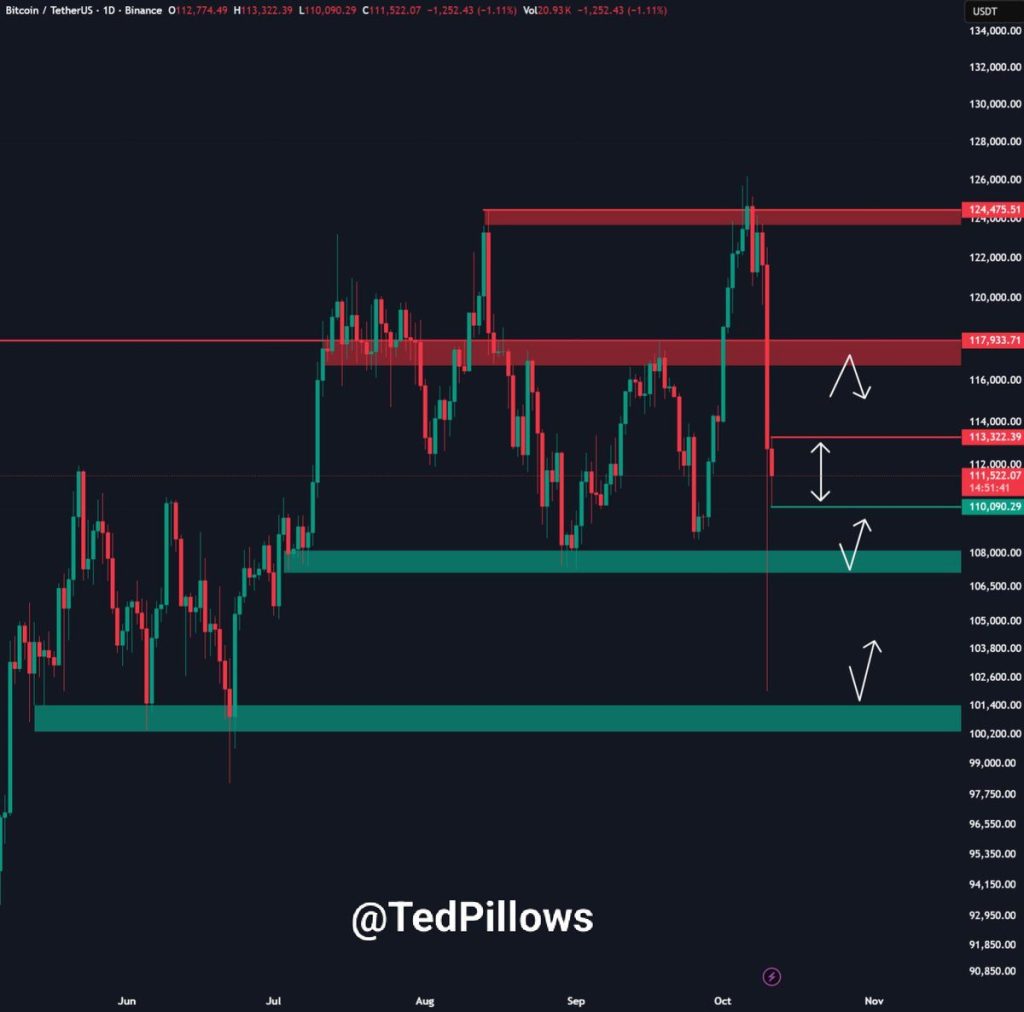

Bitcoin’s recent test of its $112,000 support level significantly influences Ethereum’s price trajectory. The close correlation between the two means that any resurgence in Bitcoin could lead to a ripple effect benefiting Ethereum. Analysts point out that if Bitcoin can maintain its support and rise to $120,000, it would likely translate into renewed interest and price momentum for Ethereum.

Despite the prevalent cautious sentiment, analysts believe the forthcoming days are pivotal. The outcomes during this period will be critical in determining if the broader crypto market maintains its upward trajectory. If Bitcoin falters at its support, the stretch toward $4,500 for Ethereum could face considerable headwinds.

Most industry experts maintain a bullish stance on Ethereum’s medium-term outlook, citing continuous developer involvement, heightened network usage, and a surge in institutional inflows as key factors contributing to potential price recovery. Several forecasts suggest Ethereum could reclaim $4,500 before the year ends, especially if it manages to secure support at current levels.

Moreover, whale accumulation is on the rise, signaling that long-term holders are confident in Ethereum’s potential. On-chain data shows significant wallet activity as large holders capitalize on the recent price dip. This trend often foreshadows bullish movements ahead, especially when paired with improving liquidity across the market.

In the midst of all this, MAGACOIN FINANCE has carved out a niche for itself with its unique blend of community buzz and real-world utility, distinguishing itself from many of its meme coin counterparts. While hype alone can fuel price surges, projects that offer tangible utility alongside community engagement tend to hold lasting value. MAGACOIN FINANCE is poised to leverage both aspects, reflecting a broader trend of innovation that keeps the crypto space vibrant and relevant.

In conclusion, while Ethereum remains in a consolidation phase, glimmers of recovery are evident as selling pressures decline. Analysts suggest that holding above the $3,700 mark could create a pathway for a rebound towards $4,500, particularly if Bitcoin stabilizes around $112,000. As momentum indicators improve and on-chain data shifts, a renewed bullish sentiment is beginning to take shape.

As confidence returns, Ethereum could very well lead the charge into the next phase of market recovery, backed by its strong underlying fundamentals and renewed investor enthusiasm. Meanwhile, projects like MAGACOIN FINANCE illustrate that innovation is flourishing within the blockchain space, where utility and community engagement can coexist harmoniously.

To find out more about MAGACOIN FINANCE and its unique offerings, visit their official channels: