In a groundbreaking move that could reshape the landscape of digital payments, a coalition of nine major Wall Street banking institutions has come together to develop a new stablecoin. This ambitious initiative includes prominent names such as Goldman Sachs, Deutsche Bank, Bank of America, Banco Santander, BNP Paribas, Citigroup, MUFG Bank, TD Bank Group, and UBS. As reported by Bloomberg, the consortium aims to create a reserve-backed digital payment asset pegged directly to G7 currencies, offering an innovative alternative to existing stablecoins like Tether and Circle.

This collaboration signals a noteworthy shift in the banking sector, where traditional financial institutions are racing to adapt to the rapidly evolving world of cryptocurrencies. With regulators around the globe tightening frameworks, these banks are keen to leverage blockchain technology as a vehicle for modernizing payment processes. The allure of stablecoins lies in their potential to provide a faster, more cost-effective alternative to legacy payment methods. Bloomberg Intelligence estimates this technology could handle over $50 trillion in annual payments by 2030, presenting an enticing opportunity for banks to capture a slice of that market.

But why is this venture so significant? Stablecoins, which are designed to maintain a stable value by being pegged to traditional currencies, have already demonstrated their efficacy in financial transactions. The business model is beneficial, as issuers earn significant revenues from the Treasury securities and cash equivalents backing their tokens. This success story is best exemplified by Tether, whose robust profitability has garnered significant attention. Currently in the process of raising up to $20 billion in funding, Tether is on track to becoming one of the world’s most valuable private companies.

🔥 As experts note, this consortium is not operating in isolation. Numerous banking giants are actively pursuing blockchain initiatives. For example, JPMorgan recently piloted JPMD, a token representing dollar deposits, while HSBC has introduced a tokenized deposit service for corporate clients, thereby facilitating secure cross-border currency transactions using blockchain infrastructure. Such initiatives depict how financial firms are viewing blockchain as essential to their broader goals, which may include the tokenization of traditional assets like stocks and bonds.

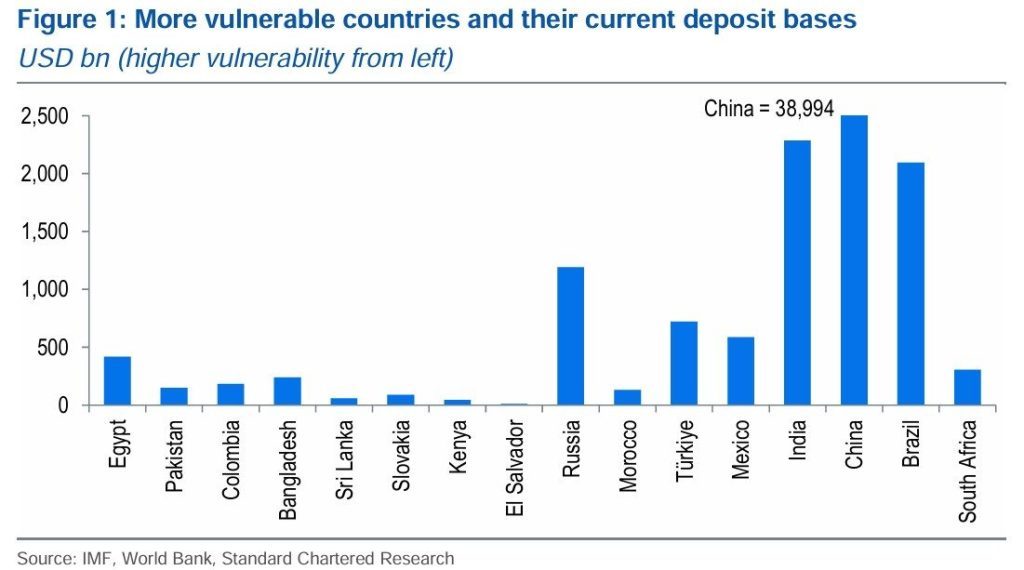

However, it’s not just the banks that are feeling the pressure to innovate. A warning from Standard Chartered suggests that stablecoin adoption might siphon over $1 trillion from emerging market banks by 2028. As economies grappling with high inflation increasingly turn to stablecoins like Tether’s USDT as substitutes for traditional dollar accounts, banks are realizing the urgency of enhancing their offerings.

As the stakes continue to rise, the regulatory landscape is adapting. UK regulators have previously proposed limits on stablecoin ownership for retail investors to mitigate potential deposit flight. Yet, recent schedules indicate that the Bank of England may soon allow exemptions for firms, including crypto exchanges, that require substantial holdings of stablecoins for operational purposes.

🚀 Looking ahead, competition in the digital payments space is heating up, not only among banks but also involving technology giants. Companies like Apple and Airbnb are reportedly exploring ways to integrate stablecoins into their payment ecosystems, while SWIFT initiates tests for stablecoin-like settlements with various global banks. In Europe, a consortium of nine major banks, including Deutsche Bank and ING, is aiming to launch a MiCA-regulated euro stablecoin by mid-2026. For more insights on regulatory developments, check out [CoinDesk’s guide on MiCA regulations](https://www.coindesk.com).

In conclusion, the acquisition and adaptation of stablecoins by traditional banks represent a pivotal moment in the evolution of the financial industry. As these institutions navigate the complexities of the digital landscape, they face a strategic decision: either collaborate with existing stablecoin players, develop their own solutions, or risk losing traction to new, crypto-native competitors. The journey of these Wall Street giants into the stablecoin arena could indeed redefine our understanding of money and how we transact in the digital age. Are banks ready to embrace this new frontier, or will they lag behind in the face of relentless technological advancement?