In the fast-paced world of cryptocurrency, few figures command attention like Vitalik Buterin, the co-founder of Ethereum. Recently, Buterin stirred the pot once again with his latest on-chain activities. On October 10, 2025, he made headlines by selling a trove of meme coins he received for free, resulting in a lucrative conversion to 22.14 ETH, approximately $96,000, through the decentralized exchange Uniswap.

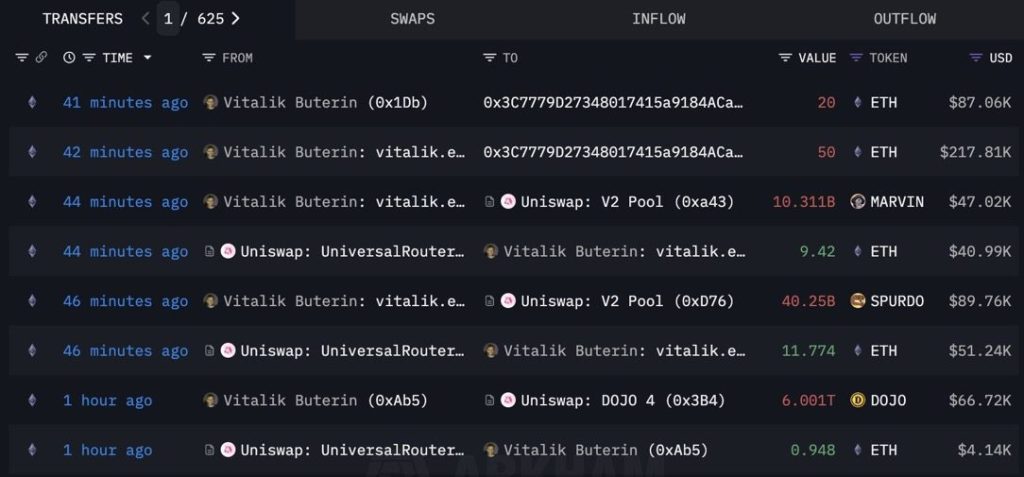

So, what exactly did he offload? According to blockchain records, Buterin’s wallet traded an immense 40.25 billion SPURDO tokens, 10.31 billion MARVIN tokens, and a staggering six trillion DOJO tokens—all via Uniswap’s Universal Router. The swaps were executed in rapid succession, directly funneling the tokens into ETH.

vitalik.eth(@VitalikButerin) just sold some #memecoins received for free again and got 22.14 $ETH($96.4K).https://t.co/pMvkZHjIyD pic.twitter.com/yoq8zz3yXC— Lookonchain (@lookonchain) October 10, 2025

Shortly after these trades, Buterin transferred 70 ETH—approximately $304,000—to a new wallet associated with the Methuselah Foundation, an organization dedicated to longevity research. This fund later used Railgun, a privacy-centric protocol, to obscure the transaction details, showcasing Buterin’s continuous efforts to keep parts of his financial dealings discreet.

The meme coins in question were distributed to Buterin’s wallet without solicitation, adhering to a philosophy he has long championed: unsolicited tokens sent to his “vitalik.eth” wallet are either sold or donated. This practice has become a clear stance against the speculative hype that often swirls around his name and Ethereum’s brand. He’s criticized airdrops as “disruptive” and unnecessary, reinforcing his commitment to a healthy crypto ecosystem.

Interestingly, this isn’t the first time Buterin has made waves with similar actions. In 2021 and 2023, he sold or donated various meme tokens, including well-known names like SHIBA INU and AKITA, after receiving them unsolicited. Those transactions sparked significant price fluctuations and trader reactions in the respective tokens. It’s a pattern that raises questions about the influence of prominent figures in the crypto space and the volatile nature of meme-driven investments.

SPURDO and MARVIN, the coins sold in Buterin’s latest batch, owe their existence to internet culture. MARVIN is centered on community engagement and charitable initiatives, such as animal rescue efforts, while SPURDO is inspired by a Finnish meme character. Despite gaining initial attention, both tokens rely heavily on social media trends for trading activity.

Source: Lookonchain

Source: Lookonchain

Observers suggest that Buterin’s sell-off could create short-term pressure for these meme coins. Still, any impact seems unlikely to persist beyond the immediate community reactions. His approach emphasizes a responsible narrative, utilizing his position to shift the energy typically spent on volatile meme tokens towards fostering charitable endeavors. For instance, in a significant act of philanthropy, he donated 10 billion tokens to an organization advancing anti-airborne disease technology and contributed animal-centric tokens to the Effective Altruism Funds’ Animal Welfare Fund.

🧬 @VitalikButerin has liquidated nearly $1 million worth of meme coins, using the proceeds to support his Kanro charity.#VitalikButerin #CryptoPhilanthropyhttps://t.co/dhWHWHvzES— Cryptonews.com (@cryptonews) January 6, 2025

Earlier this year, Buterin liquidated an impressive $2.5 million worth of meme coins, channeling $984,000 in USDC into the Kanro biotech fund, significantly impacting biotechnology and public health research. His on-chain activities have become a frequent topic of discussion, with many scrutinizing his every move. In 2024, for instance, he sold a total of 950 ETH, a staggering $2.28 million, in structured trades designed to minimize market impact.

Currently, Ethereum finds itself navigating a tricky market landscape, with obvious signs of softening performance. As of now, ETH is hovering around $4,357, having dipped nearly 2% within the last day. Analysts have identified the $4,000-$4,800 price range as a critical “danger zone,” indicating that the digital currency is susceptible to formidable selling pressure historically.

I wasn’t lying when I told you $4,000–$4,800 is a danger zone for Ethereum $ETH! https://t.co/KlHhiUGo91 pic.twitter.com/SlR9lV7HAY— Ali (@ali_charts) October 10, 2025

While the long-term uptrend remains intact for ETH, there are warnings about a potential deeper correction toward $3,400 if the crucial $4,000 support level fails. As these market dynamics continue to unfold, Buterin’s actions serve as a compelling reminder of the complexities and challenges present within the crypto space.

Ultimately, Buterin’s latest maneuvers illustrate not just his personal investment strategies but also the broader narrative of transparency, responsibility, and the potential for positive societal impact in the cryptocurrency world. It’s a thrilling time to keep an eye on cryptocurrency, especially as influencers like Buterin navigate the ever-evolving landscape of digital currencies.

For more about the influences in the crypto arenas, check out resources like [Cointelegraph](https://cointelegraph.com) and [CryptoSlate](https://cryptoslate.com) for the latest insights and comprehensive news coverage.