In the ever-evolving landscape of cryptocurrency, few stories have emerged as compelling as that of Plasma (XPL). Just days after launching its mainnet, this innovative platform has made waves, securing its position as the fifth-largest DeFi chain, boasting an impressive total value locked (TVL) of $6.4 billion. However, even as it experienced a 15% price pullback in the past 24 hours, the robust growth in network adoption and on-chain activity paints a promising picture for Plasma’s future.

The surge in interest is palpable, with stablecoin reserves rising to an astronomical $5.3 billion. This uptick reflects sustained capital inflows and growing confidence in the Plasma ecosystem. Indeed, the financial community seems to be rallying around Plasma’s purpose-built lending capabilities, highlighting an unprecedented demand for its services.

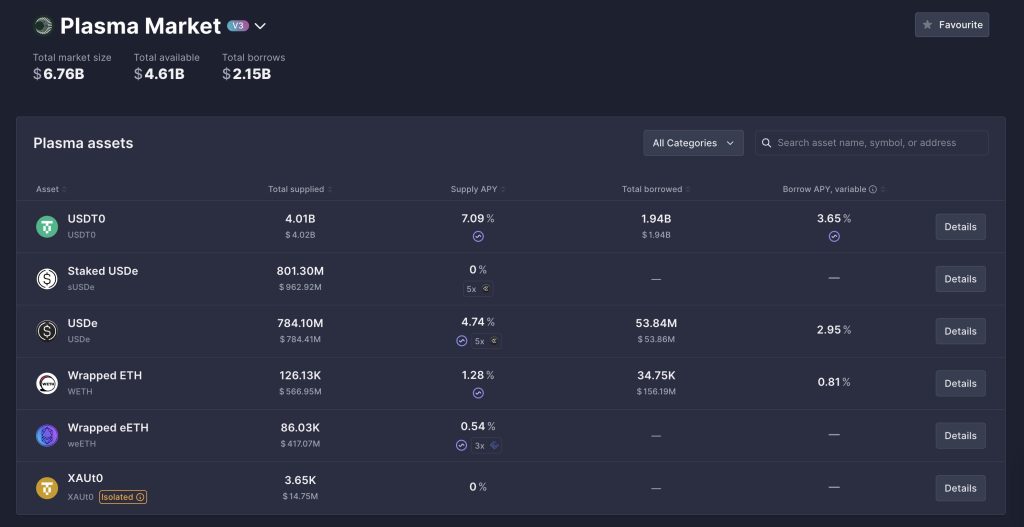

In a remarkable twist, Plasma has already attracted $6.7 billion in deposits within the AAVE ecosystem, with $2.15 billion actively borrowed by users. It’s noteworthy that the lending vault currently offers an enticing 9.92% annual percentage yield (APY), drawing in both retail investors and institutional capital. But that’s not all: recent data from Nansen reveals that Plasma’s transaction volume has skyrocketed by 5,000% over the last month, showcasing explosive user engagement.

The market is buzzing, and analysts are closely monitoring Plasma’s price movements. Recently, XPL broke out from a descending triangle pattern on the hourly chart, signaling potential for a short-term trend reversal. Although the price briefly retraced after reaching the 200-period exponential moving average (EMA), it has now begun retesting its previous trendline resistance from above—a defining moment that could set the stage for further upward momentum.

As market enthusiasts eye this pivotal moment, the prospect of XPL bouncing back toward the $1 mark appears likely, translating into a potential 15% upside in the short term. But that’s just scratching the surface. With Plasma’s rapidly expanding on-chain metrics, many believe a rally back to $1.70 or even higher is within reach—representing a staggering 95% potential gain based on current valuations.

While XPL showcases remarkable strength amid the backdrop of large-cap tokens, savvy investors are also considering emerging opportunities in the space, such as the promising presale for Bitcoin Hyper ($HYPER). This innovative project aims to address Bitcoin’s inherent limitations, like slow transaction times and high fees, effectively ushering in a new wave of decentralized applications—their core vision is to empower developers while enhancing the Bitcoin ecosystem.

What sets Bitcoin Hyper apart is its utilization of the Solana blockchain to propel efficiency. This layer-2 solution promises lower latency and a capacity to handle thousands of transactions per second. As adoption of the Bitcoin Hyper network grows, so too does the anticipated demand for its native token, $HYPER. Interested investors can easily participate by visiting [Bitcoin Hyper’s official website](https://www.bitcoinhyper.com/) and connecting a compatible crypto wallet, allowing them to swap funds or use bank cards to secure their investment.

In a world where the dynamic interplay of crypto projects can swiftly alter landscapes, keeping an eye on both established players like Plasma and innovative newcomers like Bitcoin Hyper could yield valuable insights and opportunities. Are you ready to dive deeper into these trends and explore the possibilities they present?