In a groundbreaking move for the Islamic finance sector, Fasset, a digital banking and investment platform based in Dubai and Jakarta, has been granted a provisional banking license by Malaysia. This approval paves the way for the launch of the world’s first stablecoin-fueled Islamic digital bank. With this innovative approach, Fasset seeks to bridge financial gaps in Muslim-majority regions in Asia and Africa, where access to Shariah-compliant, asset-backed products has often been limited.

By enabling Shariah-compliant savings accounts, zero-interest deposit options, and investment services utilizing stablecoins and tokenized assets, Fasset is positioned to revolutionize how financial services are offered to Muslims across the globe. Customers will enjoy the ability to store deposits safely, invest in prominent options like US stocks and gold, and leverage a Visa-linked crypto card for everyday transactions. The company is also set to introduce “Own,” an Ethereum Layer 2 network built on Arbitrum, allowing for the seamless settlement of regulated real-world assets on the blockchain.

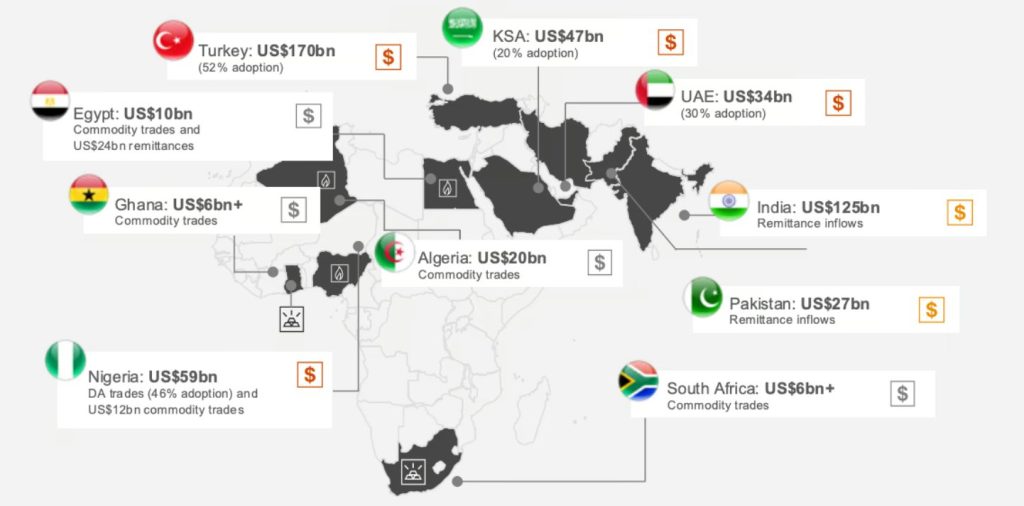

Currently, Fasset boasts an impressive annual transaction volume exceeding $6 billion, operating in 125 countries, supported by regulatory approvals not only in Malaysia but also in the UAE, Indonesia, the EU, Turkey, and Pakistan. Moreover, Fasset has received acknowledgment from Bahrain’s Central Bank to pilot blockchain-based asset tokenization solutions since 2020, and has successfully attained both a Category 3 Crypto-Asset Service Provider license and a Virtual Asset Service Provider license from Dubai’s regulatory authority just last month.

Why is this significant? The ripple effects of Fasset’s venture extend far beyond the scope of traditional banking. Malaysia is positioning itself as a pioneering hub for Shariah-compliant cryptocurrency innovation. The country’s crypto market revenue is anticipated to reach around $484.1 million by 2025, with an active user base projected to stabilize at approximately 2.8 million. This positions Malaysia firmly within the top 50 globally for crypto adoption by transaction volume. As regulatory frameworks mature and provide clarity on stablecoin usage, there’s a distinct potential for enhancing cross-border payments and fostering local financial inclusion.

Expert insights highlight that the country’s Securities Commission is spearheading reform in its digital asset exchange regulatory framework. Following record trading volumes that exceeded RM13.9 billion ($2.9 billion) in 2024—more than double what was recorded in 2023—the proposed changes will expedite the process for certain tokens to list on regulated exchanges without needing prior approval. This shift is likely to decrease regulatory hurdles, encouraging innovation while maintaining consumer safeguards.

🔍 @SecComMalaysia proposes regulatory enhancements to the digital asset exchange framework by accelerating token listings. #DigitalAssets #Malaysia https://t.co/EV3L8ir6m1— Cryptonews.com (@cryptonews) July 1, 2025

Looking ahead, the convergence of Islamic finance and cryptocurrency is rapidly taking shape across the Middle East and Asia. Notable initiatives include Binance’s introduction of the Sharia-compliant staking platform, Sharia Earn, certified by Amanie Advisors as the first of its kind. This platform allows users in 31 countries, including Pakistan, Turkey, and the UAE, to stake major cryptocurrencies in a manner consistent with Islamic law. The funds are staked under a Wakala agreement, which ensures no exposure to interest or excessive uncertainty—core tenets of Shariah principles.

👉@Binance has launched Sharia Earn, a #sharia-compliant multi-token (#BNB, #ETH, #SOL) #staking platform, certified by @AmanieAdvisors. https://t.co/VV3UT1XMgT— Cryptonews.com (@cryptonews) July 11, 2025

Additionally, Bybit has launched its Islamic Account, offering trading tools that are Sharia-compliant, while Crypto.com has partnered with Dubai Islamic Bank to introduce products like tokenized Islamic sukuks and real-world asset tokenization. With over 100 million global users, Crypto.com’s move to create a local currency wallet for deposits and withdrawals is indicative of the seismic shifts happening in digital finance.

In the midst of these advancements, the UAE has witnessed a staggering $34 billion influx in crypto investments for the year ending mid-2024—an impressive year-on-year growth of 42%. With a rapidly growing user base of 15 million crypto app users, the dynamics of the Middle Eastern crypto economy are shifting at an unprecedented pace.

The Middle East’s crypto ecosystem blossomed with approximately $338.7 billion in inflows last year, placing the region as the seventh-largest crypto economy worldwide. A call to action has emerged from economic leaders, like Saudi economist Ihsan Buhulaiga, advocating for a unified regulatory framework across the Gulf Cooperation Council (GCC) to harmonize regulations among member states. This alignment would be crucial as the UAE introduces new stablecoin initiatives, such as the recently approved AE Coin, pegged to the UAE dirham and fully backed by national reserves.

In a rapidly evolving landscape, the convergence of Islamic finance and cryptocurrency holds immense potential. As regulations continue to adapt and innovate, the financial needs of millions in Muslim-majority countries are finally being addressed with modern solutions that align with their values. Are we ready to witness a new era of financial inclusion and ethical investment driven by technology?

Stay tuned as more developments unfold in this exciting intersection of finance and innovation. Engaging with these trends not only enhances our understanding but also shapes the future of finance globally. Will you be part of this transformative journey?