Bitcoin enthusiasts, get ready—there’s exciting news on the crypto front! Currently, Bitcoin (BTC) is trading at approximately $114,390, showing a brisk uptick of nearly 1% in the last 24 hours. This surge comes alongside impressive daily trading volumes nearing $69.6 billion, reinforcing Bitcoin’s status as the world’s largest cryptocurrency, with a staggering market capitalization of $2.27 trillion. Out of a capped supply of 21 million Bitcoin, about 19.9 million are already in circulation. Yet, despite this notable rebound, charts indicate that Bitcoin is grappling with short-term support levels, suggesting cautious navigation ahead.

What’s unfolding in the world of Bitcoin? Recent technical analysis provides a mixed picture for traders. Bitcoin has dipped below its 50-day moving average, now resting at $116,033, which has turned into a resistance level. This downward movement was punctuated by a bearish engulfing candle near the $124,450 mark, highlighting a potential loss of momentum following July’s rally. Current observations show traders eyeing the neckline of a possible head-and-shoulders pattern around the $112,000 mark. Should Bitcoin fall below this pivotal point, the price could potentially tumble toward $108,000 and possibly even $105,150, as indicated by projections from TradingView.

Momentum indicators suggest a cautious approach as well. The MACD has crossed into negative territory, which signals bearish momentum, while the Relative Strength Index (RSI) sits at 44—leaving room for potential further losses. Traders have observed successive bearish candlesticks forming patterns reminiscent of three black crows, a pattern typically associated with deeper pullbacks in price action. However, it’s not all doom and gloom; Bitcoin has shown resilience since June, maintaining a series of higher lows, indicated by the presence of small-bodied dojis near $113,000. These suggest a degree of indecision in the market rather than outright panic selling.

Looking ahead, should Bitcoin reclaim the $116,150 level, it could pave the way toward $120,900, and potentially revisit previous resistance at $124,450. A breakout beyond this would see targets extending to $127,540 and even the eagerly anticipated $130,000 milestone.

On the fundamental side, there’s no shortage of bold predictions. Brian Armstrong, CEO of Coinbase, recently stirred up interest by forecasting that Bitcoin could reach an astonishing $1 million per coin by 2030. He articulated this as a “rough idea,” citing factors like increased adoption, innovation, and the ongoing development of technology as key drivers behind Bitcoin’s anticipated monumental growth. [Read More](https://www.coindesk.com/learn/what-is-bitcoin/) about Bitcoin’s potential and its transformative impact on finance.

JUST IN: Coinbase CEO Brian Armstrong predicts Bitcoin will reach $1,000,000 by 2030. pic.twitter.com/rT95DfJbTG— Watcher.Guru (@WatcherGuru) August 20, 2025

What does this mean for both traders and long-term investors? For traders, clear strategies are emerging: a close above $116K could suggest a bullish run toward the $124K–$130K range, while a close below $112K might point toward short positions targeting $108K. Meanwhile, for the long-term investor, current prices present a potential accumulation phase in a larger bull market.

In the broader context, Armstrong’s ambitious $1 million prediction reflects a growing consensus among market leaders. Bitcoin transcends a mere speculative asset; it’s increasingly seen as a cornerstone for the future of digital finance. Regardless of whether BTC retraces to $108K or bounces back to $130K in the immediate term, the overarching path seems to point higher as we look to the years ahead.

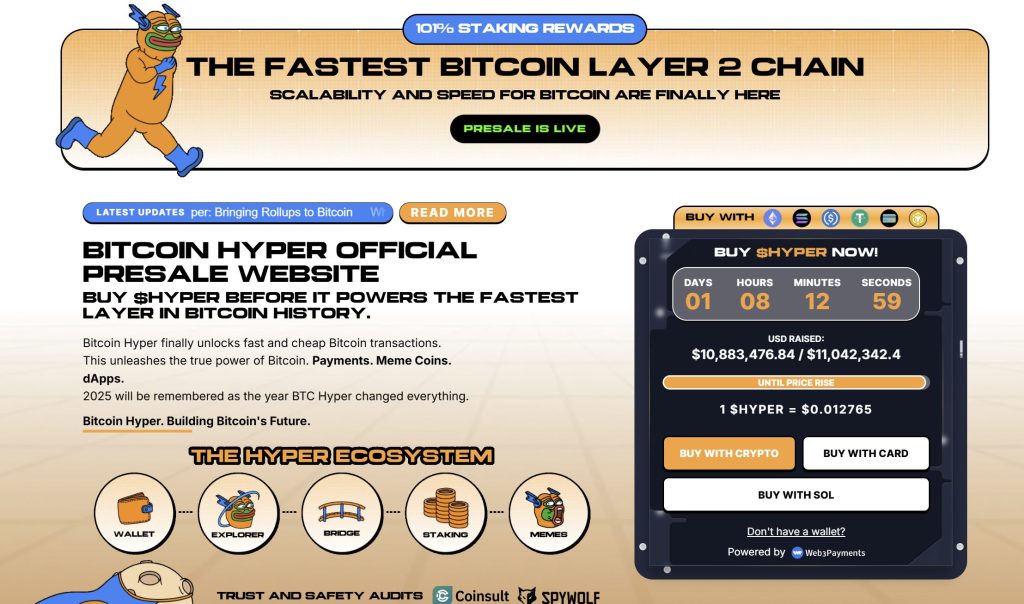

In the realm of innovative projects, a new contender is making waves: Bitcoin Hyper ($HYPER). Positioned as the first Bitcoin-native Layer 2 solution backed by the Solana Virtual Machine (SVM), it aims to enhance the Bitcoin ecosystem by facilitating ultra-fast, cost-effective smart contracts, decentralized applications (dApps), and meme coin creation. It’s an ambitious undertaking that promises to blend Bitcoin’s unrivaled security with Solana’s high-performance capabilities.

This initiative opens up new horizons, allowing for extremely fast Bitcoin bridging and scalable dApp development. The team has placed strong emphasis on both trust and scalability, having undergone audits by Consult to assure investors of the project’s integrity.

As momentum continues to build for this presale, which has already surpassed the $10.8 million mark, only a limited number of tokens remain available. Currently, HYPER tokens are priced at an accessible $0.012755, a figure that is likely to increase as the presale progresses. Interested investors can participate directly through the [official Bitcoin Hyper website](https://www.bitcoinhyper.com/) using either cryptocurrency or a bank card.

As we stand at the crossroads of innovation and investment, the road ahead for Bitcoin and its ambitious initiatives continues to inspire confidence and excitement. Buckle up, because the journey is just beginning!