The cryptocurrency landscape was electrified this past week as BlackRock, the world’s largest asset manager, made waves by acquiring over $1 billion in Bitcoin and Ethereum for its exchange-traded funds (ETFs) in just 24 hours. This remarkable move occurred during a significant market downturn—one of the summer’s steepest pullbacks—raising eyebrows and questions across the crypto community.

On August 14, shortly after the U.S. Producer Price Index (PPI) revealed higher-than-expected inflation data, crypto prices took a sharp dive. Bitcoin, having recently hit an all-time high near $123,700, saw its value tumble to $119,098. Ethereum followed suit, falling from $4,765 to as low as $4,452 before briefly recovering. The sudden sell-off resulted in a $133 billion reduction in total crypto market capitalization, with over $1 billion in leveraged positions liquidated among 221,000 traders. In the midst of this chaos, BlackRock’s iShares Bitcoin Trust (IBIT) and iShares Ethereum Trust (ETHA) capitalized on the opportunity.

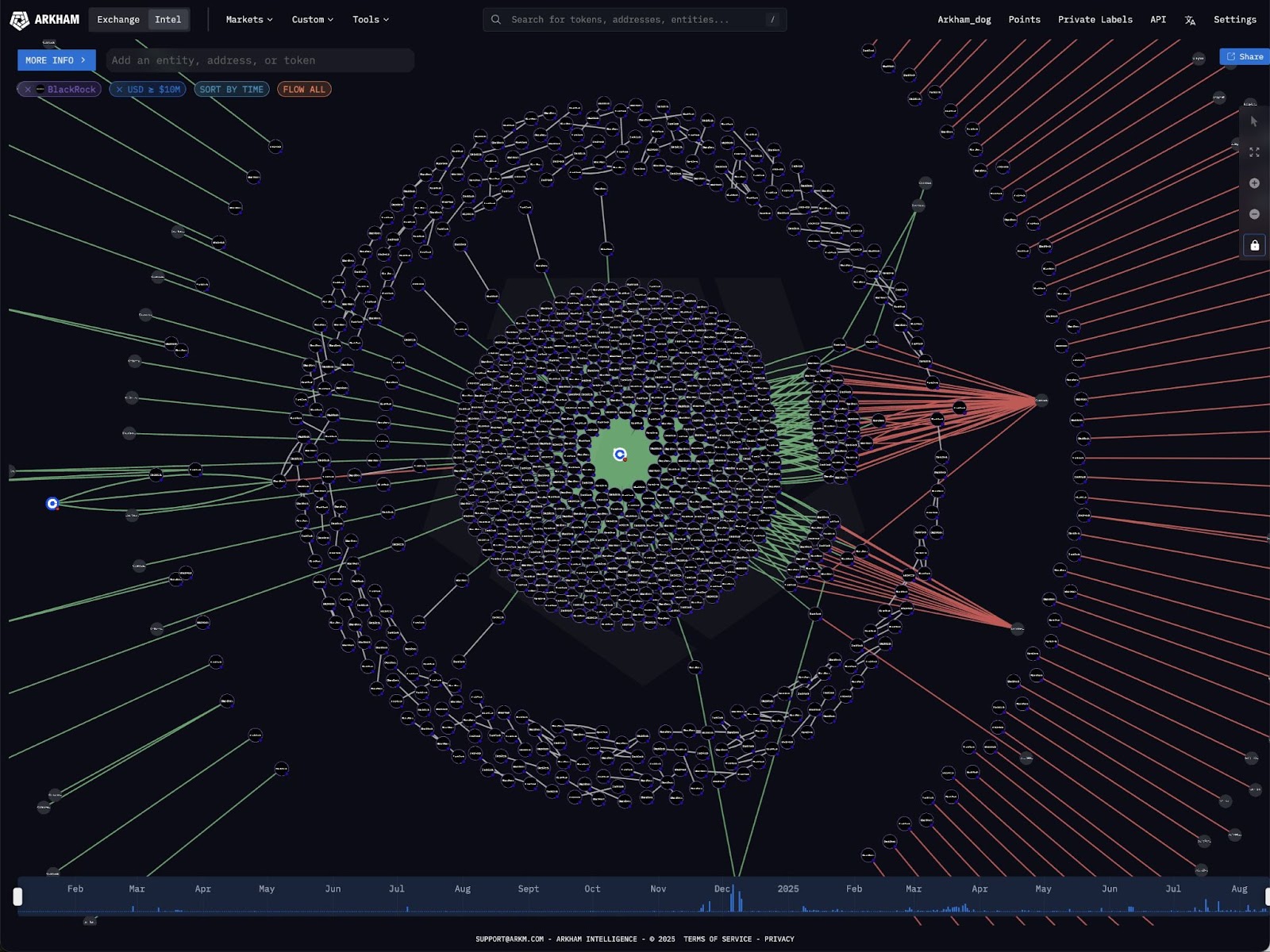

According to insights from Arkham, BlackRock’s aggressive strategy saw them purchase 4,428 BTC, valued at approximately $526 million, alongside 105,900 ETH, totaling around $488 million. This bold move was not just an isolated incident; it marked one of the largest daily accumulation events for both funds, culminating in a staggering total of over $1 billion invested in cryptocurrencies on that fateful day.

But why does this matter? BlackRock and Fidelity’s significant buys reflect an increasing confidence among institutional investors in cryptocurrencies, particularly in an environment characterized by fluctuating interest rates and inflation. The timing of BlackRock’s purchases has sparked discussions around what institutional players may know about future market conditions that retail investors might overlook. Trader and analyst Bitbull noted, “This shows that big money wants some dip so they can accumulate more,” suggesting a strategic play to enhance their holdings at perceived bargain prices.

BlackRock went all in $BTC and $ETH yesterday. After the hot PPI data, BTC and ETH dumped quickly. During this dump, BlackRock bought $523M worth of BTC and $519M worth of ETH. This shows that big money wants some dip, so that they can accumulate more. I hope you didn’t sell… pic.twitter.com/TfNNlSCO3A— BitBull (@AkaBull_) August 15, 2025

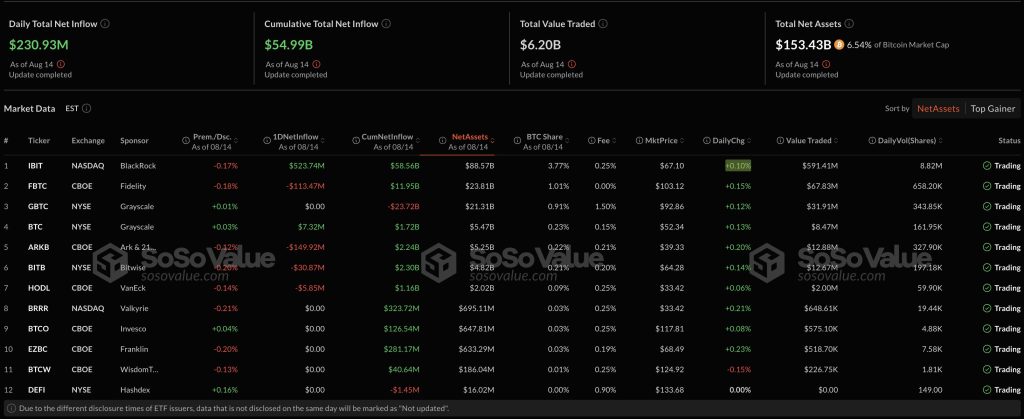

Even amidst a bearish sentiment in the crypto market, the U.S. spot Bitcoin ETFs experienced considerable inflows, grabbing $230.93 million on August 14 alone, largely driven by BlackRock’s own funds. In remarkable contrast, Ethereum captured even greater attention that day, with ETH ETFs drawing in $639.61 million, showcasing an impressive $519.68 million inflow for the iShares Ethereum Trust.

Observing these trends, it’s evident that August has been a transformative month for Ethereum ETFs, which have amassed over $3 billion in net inflows thus far, including a record single-day accumulation of $1.02 billion. Thanks to these robust inflows, cumulative assets within Ethereum ETFs have reached a staggering $12.73 billion, underpinning the asset’s growing institutional appeal.

Moreover, BlackRock’s crypto investments now hover around $100 billion, with a substantial $90.36 billion in Bitcoin alone, solidifying its status as the largest institutional holder of the leading cryptocurrencies. The IBIT fund encapsulates this surge, boasting $91.06 billion in assets, which represents approximately 3.72% of the total Bitcoin supply. Such dominance begs the question: what’s next for BlackRock as the macroeconomic landscape evolves?

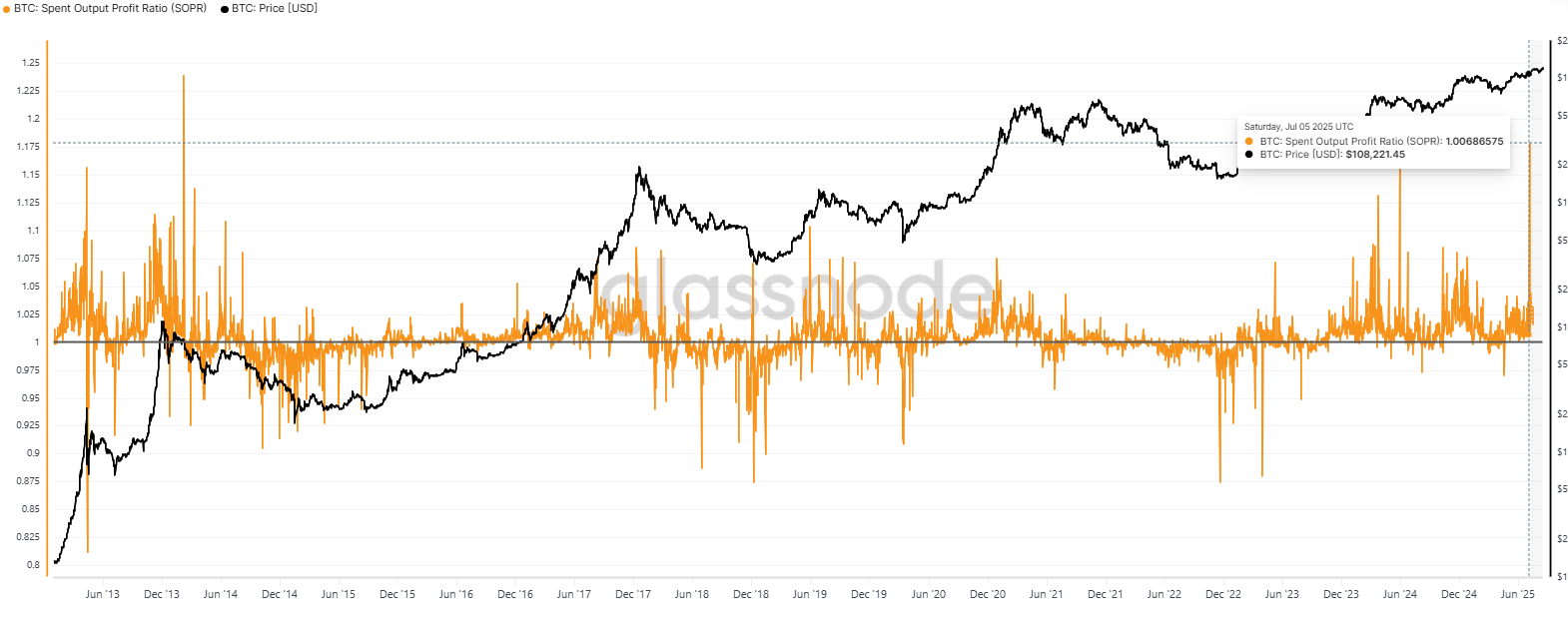

As we peer into the future, there’s speculation about what the shift in macro dynamics may mean for cryptocurrencies. As inflation appears to cool and the prospect of a Federal Reserve interest rate cut looms, expected improvements in liquidity may prompt further institutional accumulation. Analysts believe that BlackRock’s purchases are rooted in a keen understanding of upcoming market behavior—buying value on weakness in anticipation of a more favorable environment.

The Crypto Fear and Greed Index fluctuated dramatically during this period, oscillating from extreme fear to a more neutral stance, reflecting the market’s volatile nature during this buying spree. For Ethereum, indicators of network health—like active addresses and stablecoin flows—have shown solid growth, underscoring a potential shift in market sentiment that is heavily driven by data, rather than mere retail enthusiasm.

Ultimately, BlackRock’s calculated steps could signify a new narrative for institutional participation in the crypto space. With both on-chain metrics and macroeconomic conditions supporting this growing interest, one has to wonder: will we see more players follow suit, diving into the depths of cryptocurrency investments when the market gets rocky? The next few months will be crucial as we watch how these trends unfold in tandem with broader economic indicators.

As crypto enthusiasts, now is the time to stay informed and engaged. Whether you’re a seasoned investor or just dipping your toes into this fascinating world of digital assets, watching the movements of institutional giants like BlackRock could provide the insights needed to navigate this dynamic market landscape.