In a captivating turn of events, Coinbase has revealed an insightful outlook on the cryptocurrency market, hinting that we might be on the brink of an exhilarating altcoin season. This potential shift is driven, in significant part, by surging institutional interest in Ethereum and the prospect of a Federal Reserve rate cut this September, setting the stage for an influx of retail investments.

In its latest research outlook, published Thursday for August, Coinbase noted that the cryptocurrency landscape has largely followed its forecasts from earlier this year. Notably, Coinbase projected new highs for the market in the latter half of 2025. Propelled by unexpectedly favorable macroeconomic conditions and clearer regulatory frameworks, this momentum has taken a strong hold.

Interestingly, Bitcoin’s dominance in the market has seen a decline—from a robust 65% in May to approximately 59% in August. This drop hints at an initial capital rotation towards altcoins, reflecting a shift in investor sentiment. In tandem, the overall market capitalization of altcoins has skyrocketed by over 50% since July, now standing at an impressive $1.4 trillion.

“Altcoin Season is coming! As September approaches, the transition to a full-scale altcoin season is likely. Our positive 3Q25 outlook stems from macro trends such as potential Fed rate cuts and expected regulatory advancements.” — Coinbase Institutional 🛡️ (@CoinbaseInsto) August 14, 2025

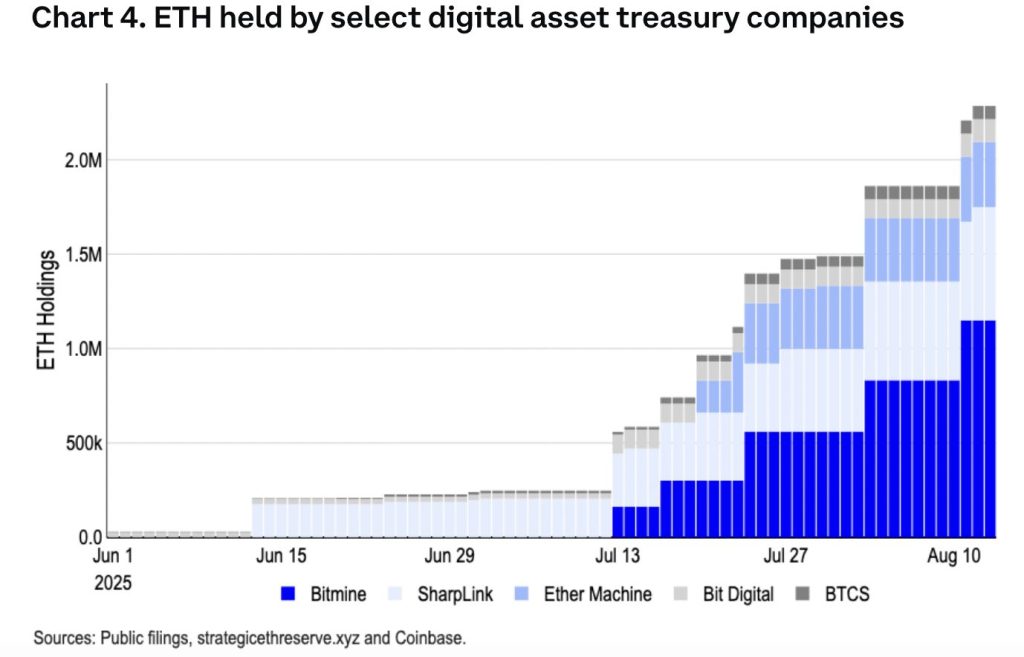

As the altcoin narrative unfolds, Ethereum has emerged as a standout beneficiary. Since the beginning of July, Ethereum’s market capitalization has surged by 50%, fueled by heightened demands from digital asset treasuries and an evolving narrative surrounding stablecoins and real-world assets. A significant player in this space, Bitmine Immersion Technologies, made headlines by acquiring 1.2 million ETH after raising $20 billion, with an extraordinary capacity to purchase an additional $24.5 billion worth. This move has established the company as a major force, overtaking Sharplink Gaming to become the leader among Ethereum-focused treasuries. Collectively, the top institutional holders now command nearly 3 million ETH, or about 2% of the total supply.

Moreover, tokens closely associated with Ethereum, including Arbitrum, Ethena, Lido DAO, and Optimism, have followed ETH’s upward trajectory. Notably, Lido has made impressive gains, rallying by 58% this month. According to Coinbase, Lido’s surge is attributed to its direct ties to ETH and a recent statement from the SEC indicating that liquid staking tokens might not be classified as securities under specific conditions.

While the institutional flow of capital is clearly a driver in the Ethereum narrative, retail investors are also biding their time. An astonishing $7.2 trillion is currently parked in U.S. money market funds—the highest level ever recorded. These balances represent what Coinbase refers to as “missed opportunity costs” due to prevailing high valuations in traditional markets, trade uncertainties, and persistent concerns regarding economic growth. The anticipated Federal Reserve cuts are expected to alter the allure of money market funds, potentially redirecting capital into cryptocurrencies and other high-risk assets.

Furthermore, Coinbase’s liquidity index, which monitors stablecoin issuance, trading volumes, order book depth, and free float, has shown signs of recovery after a six-month decline, heralding a resurgence of liquidity in the crypto market. “Our 3Q25 outlook remains constructive, although our perspective on an altcoin season has evolved,” the report states. It notes that the recent dip in Bitcoin’s dominance suggests an emerging rotation of investment into altcoins, rather than signaling a fully-fledged altcoin season at this moment. With the Fed potentially softening its stance in September and the SEC appearing more accommodating towards certain token models, the groundwork for a more significant altcoin season appears to be taking shape.

As we watch these developments unfold, it begs the question: Are you ready to seize the opportunity? The world of altcoins may be ripe for exploration, and the upcoming months could offer intriguing prospects for investors willing to dive in.