The cryptocurrency scene never sleeps, and right now, all eyes are on Solana as a new proposal could reshape its future, potentially boosting its block capacity by a staggering 66%. This initiative isn’t just a simple upgrade; it’s a pivotal moment that could pave the way for institutional adoption and solidify a bullish outlook for Solana’s price. With altseason enthusiasm fueling investments in riskier assets, Solana’s momentum is particularly noteworthy, driven by vibrant retail demand. But as the countdown begins for a possible spot SOL ETF by October 10, could this move unleash a surge in institutional interest in the cryptocurrency space?

Adding to the excitement is the upcoming CLARITY Act, which is anticipated around the same time and aims to deliver regulatory clarity, unlocking pent-up demand from institutions that have been cautious until now. This dual momentum, regulatory progress coupled with technical enhancements, sets the stage for an intriguing next chapter in Solana’s story.

💥BREAKING:🇺🇸 BLOOMBERG’S ETF ANALYSTS RAISE APPROVAL ODDS FOR MOST SPOT CRYPTO ETFS TO 90%+ BULLISH! 🔥 pic.twitter.com/x5LK8LFOD0— Crypto Rover (@rovercrc) June 21, 2025

Let’s dive deeper into the specifics of this transformative proposal: the SIMD-0286. Unveiled in a recently posted GitHub document, this proposal aims to increase Solana’s per-block compute limit from 60 million to an impressive 100 million compute units. What does this mean for the network? Quite simply, it will enable Solana to handle a greater number of transactions and support more complex decentralized applications, such as decentralized exchanges (DEXs), minimal extractable value (MEV) systems, and sophisticated restaking protocols. It’s an upgrade that not only enhances performance but also positions Solana as a preferred network for tokenized equities, especially with projects like xStocks gaining traction.

#xStocks @xStocksFi by @BackedFi is picking up steam fast 👀$300M+ traded onchain in just 4 weeks. Tokenized U.S. stocks, fully backed, live on Solana, Bybit & Kraken. 24/7, borderless, and DeFi-native. This isn’t hype — it’s real demand. TradFi is moving onchain. #BackedFi pic.twitter.com/Mzi1PI5ZIU— ShadowCipher (@ShadowCipher_) July 25, 2025

This isn’t the first time Solana has been put under the spotlight for its capacity upgrades. The previous adjustment, SIMD-0256, successfully raised the block limit to 60 million compute units, allowing the network to sustain around 1,700 transactions per second (TPS) during peak times. In contrast, traditional financial markets like NASDAQ usually experience transaction loads of 10,000-20,000 TPS. A bump to 100 million compute units could significantly bridge that gap and enhance Solana’s readiness for institutional transactions.

As we consider the potential implications of these changes for Solana’s price, speculation arises: is Solana poised for a substantial uptick? The truth is, while the upcoming proposal looks to invigorate institutional interest, the tangible effects will likely be contingent on the enactment of the CLARITY Act, which could eliminate uncertainty in regulatory environments.

Currently, Solana’s price movements are indicative of an ascending channel, although recent selling pressure has begun to wane. After a notable 15% drop earlier this week, the price seems to have found a support base around the $176 mark, a key Fibonacci retracement level that often serves as an accumulation zone.

Momentum indicators suggest that a price reversal is on the horizon. The Relative Strength Index (RSI) has been recovering, currently sitting at 41 after recently dipping into oversold territory. Meanwhile, the MACD histogram is beginning to flatten beneath the signal line, which can often indicate early signs of a reversal on shorter timeframes. Should buying pressure resume, Solana might just test the upper resistance of its channel, with an impressive potential breakout target of $300— a 64% increase from current levels! However, should $176 falter, the next layer of support sits at $166.50 near the 0.5 Fibonacci retracement, a common zone for accumulation and reversal signals.

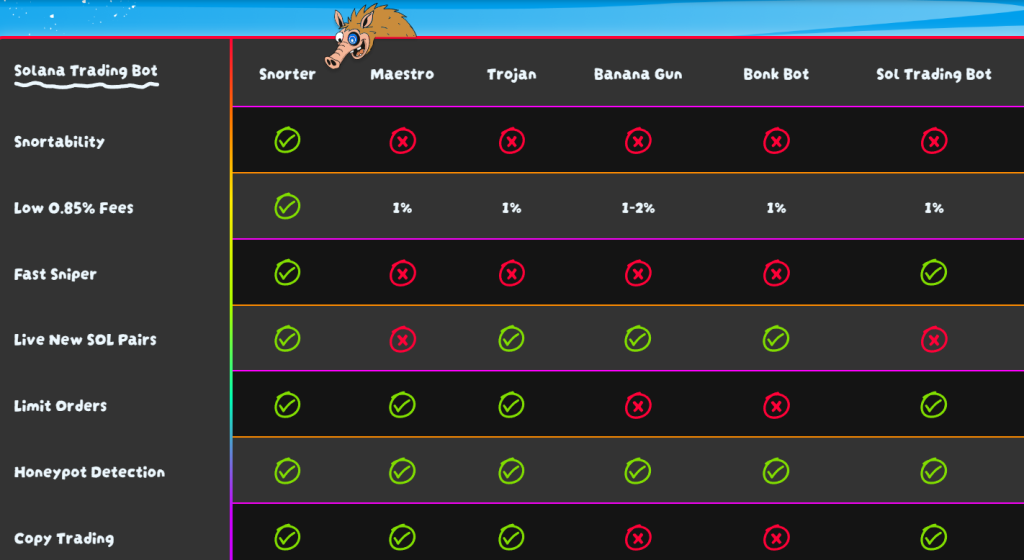

While Solana’s price is at a crucial juncture, the ecosystem around it remains vibrant, holding opportunities for discerning investors. As major tokens struggle for substantial gains, we see smaller cap projects within the Solana ecosystem witnessing explosive growth, sometimes yielding returns of 10x to 100x. Enter Snorter ($SNORT), a purpose-driven trading bot designed to detect early momentum, enabling investors to capitalize before the crowd arrives. Unlike conventional trading bots, Snorter is crafted specifically for key functionalities such as priority sniping, MEV resistance, limit orders, copy trading, and protection against rug pulls. Getting in early is only half the battle; knowing when to sell is equally paramount—this is where Snorter shines.

With an impressive early presale that has already raised nearly $2.4 million, Snorter is gaining traction fast, aided by a high 173% annual percentage yield (APY) on staking, attracting early backers eager for promising returns.

For those looking to join the Snorter movement, keep up to date on their progress via their profiles on X and Instagram, or dive into their presale on the official Snorter website. This partnership of innovation and ecosystem growth marks an exhilarating time for Solana enthusiasts and the broader crypto community.