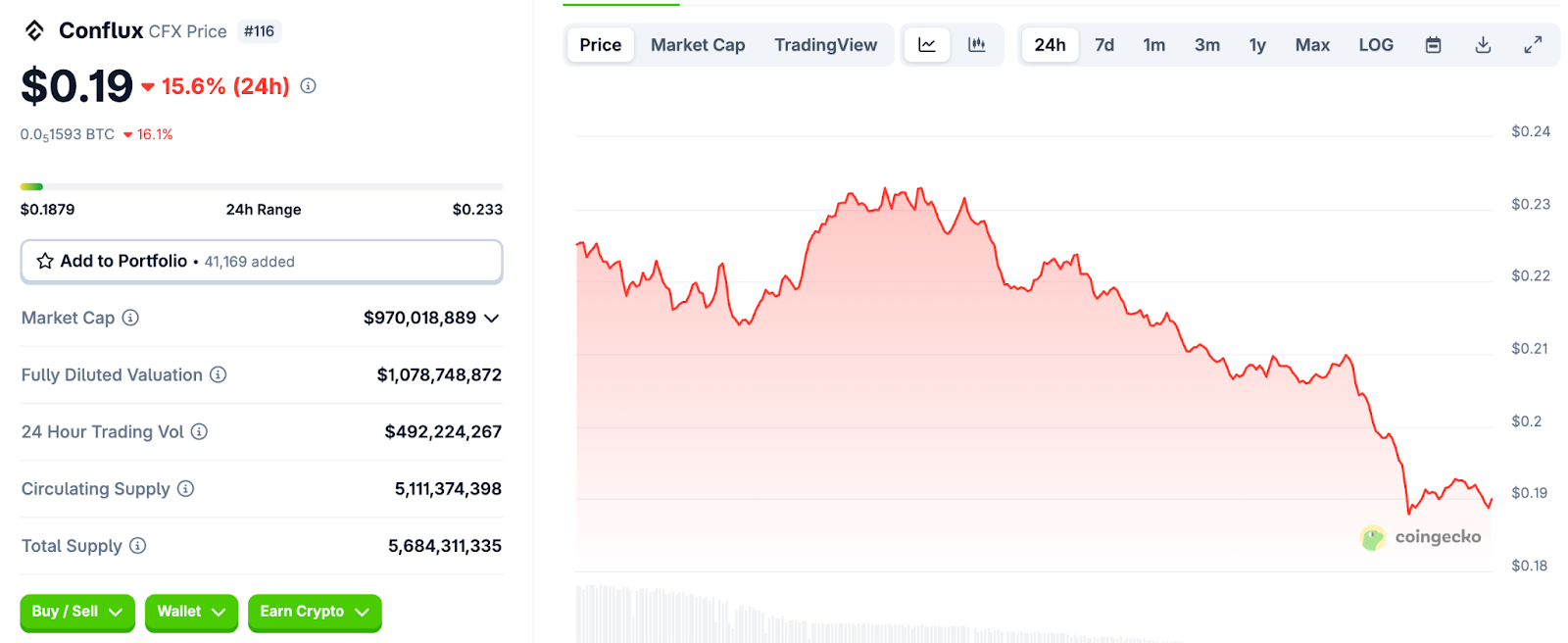

In a dramatic twist of events, Conflux ($CFX) experienced a significant tumble, dropping by 15% overnight. This sudden selloff caught the attention of traders who swiftly took profits after the token’s remarkable 91% rally during the past week. With all eyes now locked onto the crucial support level at $0.185, the question looms large: is this merely a healthy pullback, or are we witnessing the end of an exhilarating price surge?

This pullback follows an astounding 52% rally, which can largely be attributed to the excitement surrounding Conflux’s Tree-Graph 3.0 upgrade and its newly forged partnerships aimed at launching China-focused stablecoins. However, as the Relative Strength Index (RSI) approaches oversold territory and the Moving Average Convergence Divergence (MACD) indicator shifts into a bearish stance, the next phase for $CFX hinges on the bulls’ ability to protect that key support level.

What makes Conflux compelling in the current crypto landscape? Let’s explore why this recent price movement matters. Conflux boasts a unique Tree-Graph consensus mechanism that seamlessly integrates Proof-of-Work (PoW) security with a parallelized Proof-of-Stake (PoS) overlay. This innovative approach allows the network to process an impressive 15,000 transactions per second—a significant leap above typical Layer-1 benchmarks.

Founded by Turing Award laureate Dr. Andrew Yao in 2018, Conflux Network aspires to bridge creators, communities, and markets across various borders and protocols. The team is actively focused on tokenizing real-world assets and developing cross-chain bridges while piloting exciting Web3 and metaverse initiatives that promise future growth.

Recent advancements have served as pivotal catalysts for both bullish momentum and subsequent profit-taking. The highly anticipated Tree-Graph 3.0 mainnet upgrade, unveiled at the Conflux Technology & Ecosystem Conference, is set for a late July release and aims to deliver remarkable scalability through parallel block processing. This announcement alone fueled a 52% spike in prices, showcasing market confidence.

Moreover, the introduction of axCNH, a stablecoin pegged to the offshore yuan and developed alongside partners AnchorX and Eastcompeace, seeks to enhance cross-border payments within Belt and Road economies. This expansion into the stablecoin arena underscores Conflux’s ambition to play a significant role in emerging digital financial ecosystems.

Conflux $CFX to Support Offshore Yuan-Pegged Stablecoin #Chinese Layer 1 blockchain @Conflux_Network has partnered with AnchorX and Eastcompeace Technology to develop offshore #yuan-pegged stablecoins for use in Belt and Road Initiative (BRI) countries. pic.twitter.com/qmLvmVutjd

In addition to its technical strides, Conflux has ventured into collaborations with major entities such as McDonald’s China and the Shanghai government. These partnerships focus on testing digital collectibles and creating immersive customer experiences, further solidifying Conflux’s position in the broader market.

Great collab with @McDonalds China. #NFTs 🔥🍟🍔 https://t.co/7mgMhSyqwE

Despite these bright prospects, $CFX is now transitioning into a corrective phase after peaking at around $0.248 on July 20. This level has become a recent ceiling, challenged unsuccessfully on July 21, leading to a chain of selling pressure that has pushed the asset back toward the $0.188 mark.

Analysis reveals that this downward slide is backed by clear volume clusters. Data from the Footprint analytics platform shows significant negative deltas early on July 22, indicating fierce selling activity as traders locked in profits. The volume turnover reflected a dramatic delta of -16.42 million within a single hour. Although there have been sporadic buy-side responses, these have yet to break the prevailing bearish trend.

The RSI has slipped into the mid-30s, suggesting a weakening bullish momentum and nearing oversold conditions. Meanwhile, the MACD has also turned bearish, further corroborating the market’s current sentiment favoring sellers. If buyers fail to reclaim and maintain momentum beyond the $0.20 mark, the outlook could become even more cautious.

Currently, the $0.185–$0.188 support zone stands as a pivotal battleground. If this level can be defended, it might set the stage for another upward movement. So, what’s next for Conflux? The balance remains precarious; as traders digest these recent developments, it will be fascinating to see whether the bulls can muster enough strength to initiate yet another rally.

Stay tuned to the market pulse, as the cryptocurrency landscape can shift rapidly, presenting both risks and opportunities for savvy traders. Have your eyes on $CFX? Join the conversation and let us know where you think it’s headed next!