Blockchain Group Launches Ambitious $342 Million Capital Raise to Boost Bitcoin Reserves

In a dramatic stride towards becoming Europe’s first dedicated Bitcoin Treasury Company, the Blockchain Group, listed on Euronext Growth Paris, has unveiled a monumental plan to raise $342 million in partnership with the leading asset manager TOBAM. This strategic move is not just about boosting capital; it’s a clear signal of the company’s commitment to expanding its Bitcoin holdings and enhancing shareholder value. With this ambitious capital raise, Blockchain Group is set to redefine its financial strategy focused on the world’s foremost cryptocurrency.

How the Capital Raise Works

Blockchain Group plans to issue new shares via a mechanism reminiscent of the “at-the-market” program popularized in the United States. This innovative approach allows TOBAM to subscribe to shares at market pricing, with each issuance capped at 21% of the previous day’s trading volume. The aim? To gradually elevate the Bitcoin holdings per share on a fully diluted basis, which aligns seamlessly with the company’s Bitcoin-first balance sheet strategy.

Monitoring and Reporting: Transparency at Its Core

Under this partnership, TOBAM will consolidate its weekly share requests, enabling Blockchain Group to publish regular updates about the total number of shares issued as well as the Bitcoin purchases made from each tranche. This commitment to transparency reassures investors and stakeholders, showcasing the company’s ongoing dedication to accountability in its investment activities.

🟠 The Blockchain Group Launches a €300 Million “ATM-type” Capital Increases Program with TOBAM⚡️Full Press Release (EN): https://t.co/DbXXbb6OT8Full Press Release (FR): https://t.co/XbaTfaOqfnBTC Strategy (EN): https://t.co/EiVKw8s4zB pic.twitter.com/dZQCIckgK8— The Blockchain Group (@_ALTBG) June 9, 2025

TOBAM’s Growing Influence: A Potential Shift in Shareholding Dynamics

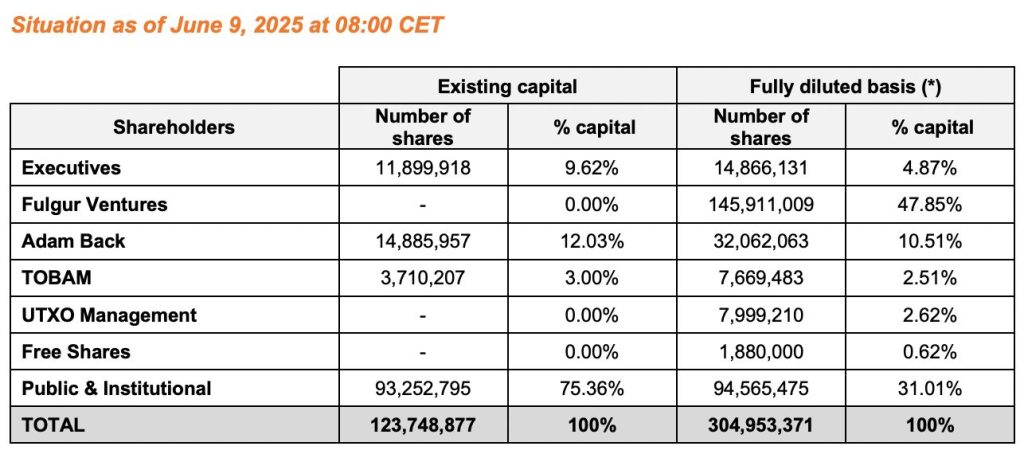

TOBAM, a stalwart advocate for Bitcoin investment since 2017, is stepping up to a significant role in Blockchain Group’s future. Interestingly, they won’t be acting as a financial intermediary nor collecting a fee for their participation. This distinction underscores a shift in market dynamics where strategic partnerships can enhance institutional investment without added transactional costs. Should TOBAM fully subscribe to its allocation and hold on to these shares, it may soon find itself with over 39% of Blockchain Group’s capital, effectively becoming the largest shareholder. This potential shift would place TOBAM ahead of established investors like cryptography pioneer Adam Back and venture capital entity Fulgur Ventures.

Source: The Blockchain Group – Overview of the Bitcoin treasury strategy.

Accelerating Bitcoin Accumulation: A Bold Move Post $68.6 Million Purchase

This announcement follows closely on the heels of Blockchain Group’s recent acquisition of 624 Bitcoins valued at approximately $68.6 million, which significantly amplified the company’s total Bitcoin reserves to 1,437 BTC—worth an impressive $150 million. This acquisition marks one of the largest Bitcoin treasury allocations by a publicly listed firm in Europe, reinforcing the Group’s proactive stance in the digital asset landscape.

The Road Ahead: Future Implications of the Capital Raise

Blockchain Group’s capital raise is not merely a financial maneuver; it is rooted in a broader strategy aimed at adapting to changing economic conditions. A recent shareholder resolution in February approved funding initiatives that target strategic investors in high-growth sectors like Web3 and AI. Currently under consideration is a second resolution that could increase the funding cap from $40.4 million to a staggering $538.5 million, further empowering the board to extend this capital program.

Why This Matters

The implications of Blockchain Group’s bold financial strategy are enormous, particularly in a time of rising inflation and economic volatility. As companies around the globe reassess traditional treasury models, Blockchain Group’s pivot to Bitcoin reflects a rising belief in the cryptocurrency as a robust long-term store of value. For both investors and industry observers, this represents a shift in how institutional players are viewing digital assets—moving from skepticism to strategic allocation.

Conclusion: A New Era for Blockchain Group

As Blockchain Group embarks on this ambitious capital-raising journey, the potential for growth is palpable. With TOBAM’s involvement and a clear commitment to transparency, investors are watching closely. Will this strategy solidify Blockchain Group’s position in the market? The future holds promise as the company seeks to lead the charge for Bitcoin adoption in Europe. What do you think about this shift in institutional investment toward Bitcoin? Share your thoughts and engage in the conversation below!